2025 Houston Real Estate Trends: 7 Key Predictions You Can’t Miss

With a 72% Accuracy Rate: Explore Our Expert Houston Real Estate Predictions for 2025

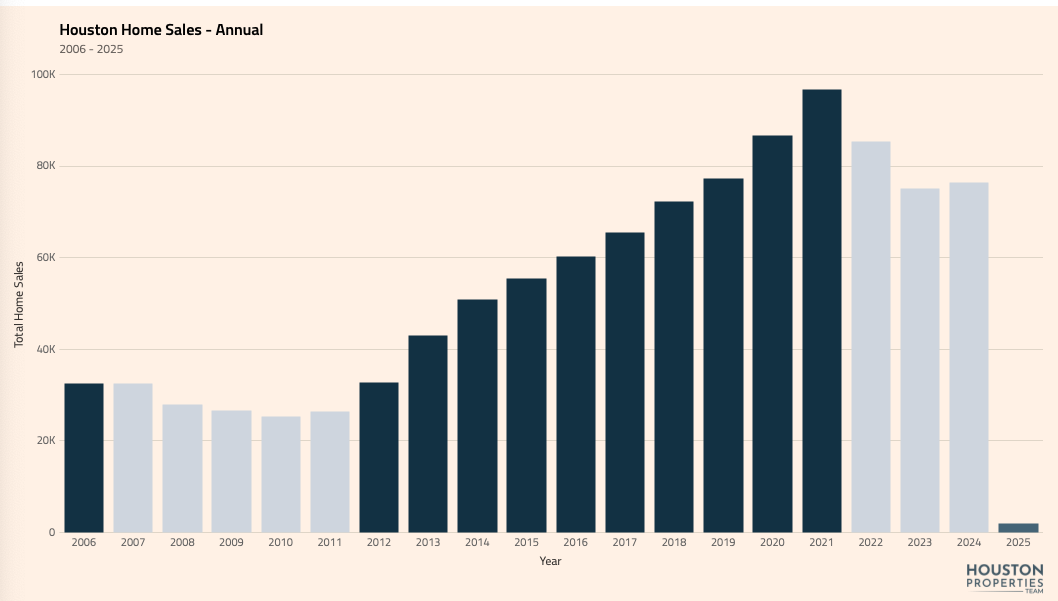

In 2024, Houston's real estate market showed resilience, with home sales rising 1.3% despite challenges like summer storms and the presidential election.

Median home prices increased by about 1.5%, keeping pace with inflation. However, performance varied widely across neighborhoods. Among the 134 neighborhoods we track, nearly a third saw price declines, while 16% experienced impressive gains of over 10%.

Looking ahead to 2025, Houston’s market offers a mix of opportunities and challenges for buyers and sellers. This article explores expert insights and key trends shaping the city's real estate landscape in the year ahead.

Table of Contents

- Houston Will End 2025 as the 4th or 5th Best Real Estate Market in History

- Houston's Economic Growth and Job Creation Will Fuel Housing Demand

- Elevated Mortgage Rates and Washington Uncertainty Will Test Buyer Confidence

- Luxury Real Estate: Houston’s High-End Market Continues to Thrive

- Suburban Appeal Will Continue to Dominate Buyer Preferences

- Investors Will Focus on Rental Market Stability and Opportunities

- Housing Inventory Will Increase To The Highest Level In 8 Years

- Take the Next Step

- Disclaimers, Sources & Methodology

Houston Will End 2025 as the 4th or 5th Best Real Estate Market in History

After closing 2024 as the 5th best real estate market in its history, we believe Houston's housing market will deliver another similar performance in 2025.

Our forecast predicts a slight uptick in sales volume as the market adjusts to a non-presidential election year and steady economic growth.

Key Trends Shaping 2025:

- Elevated Mortgage Rates: Uncertainty in Washington D.C. is likely to keep mortgage rates elevated, limiting activity among first-time homebuyers. With the median age of first-time buyers now at a record high of 38 years, affordability challenges continue to delay entry into the housing market.

- Interest Rate Lock-In Effect: Over 65% of U.S. homeowners with mortgages hold rates below 5%, creating a significant "lock-in" effect. This keeps many homeowners rooted, with moves largely motivated by life events rather than market conditions.

- "Vitamin Moves": Driven by positive life changes like a new baby, marriage, or a promotion.

- "Aspirin Moves": Triggered by difficult life events like divorce, death, or downsizing.

Houston’s Unique Position:

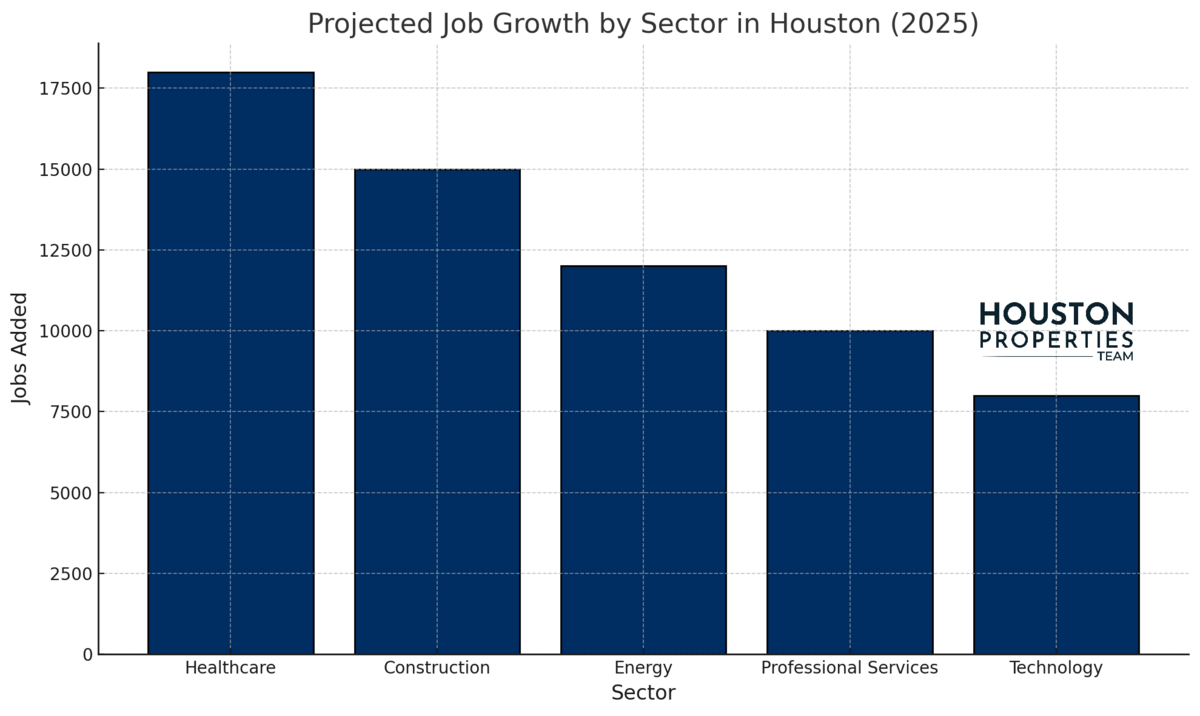

Houston's market is supported by its strong economy and projected addition of over 75,000 new jobs in 2025. This population growth is expected to sustain housing demand, particularly in areas with proximity to major employment hubs and top schools.

While elevated rates and affordability remain challenges, Houston’s combination of economic momentum and life-driven moves will keep the market competitive and dynamic.

Click here for Real Time Houston Market Data.

Houston's Economic Growth and Job Creation Will Fuel Housing Demand

Houston’s economy is projected to add over 75,000 new jobs in 2025, cementing its status as one of the fastest-growing metropolitan areas in the U.S. With industries like energy, healthcare, and technology driving expansion, the influx of employment opportunities will attract more residents to the city, supporting continued housing demand. [#1]

Key Sectors Driving Growth:

- Healthcare: Expansion in medical facilities and services will increase demand for housing near the Texas Medical Center.

- Construction: Ongoing infrastructure projects will boost employment, attracting workers seeking nearby accommodations.

- Professional and Technical Services: Growth in these sectors will draw professionals looking for housing with convenient commutes.

Implications for the Housing Market:

- Increased Demand: The influx of new residents will heighten demand for both single-family homes and multifamily units.

- Neighborhood Development: Areas near employment hubs may see increased real estate activity.

- Price Appreciation: Sustained demand could lead to moderate home price increases, benefiting homeowners and investors.

Houston’s strong economic outlook for 2025 suggests a vibrant real estate market, with job creation serving as a catalyst for housing demand.

Elevated Mortgage Rates and Washington Uncertainty Will Test Buyer Confidence

As of January 2025, the national average 30-year fixed mortgage rate stands at 7.23%. Throughout 2024, mortgage rates fluctuated between 6.1% and 7.45%.

While inflation decreased, uncertainty from Washington D.C. is likely to keep rates elevated throughout the year. [#3]

Key Impacts of Elevated Rates:

- Challenged Affordability: Higher monthly payments continue to price out many buyers reliant on financing.

- Increased Role of Cash Buyers: With over 30% of transactions in Houston being cash purchases, cash buyers are positioned to gain leverage in the market, as their offers remain unaffected by rate hikes.

- Shift in Buyer Behavior: Cash buyers may target discounted properties, such as those in need of renovations or homes in neighborhoods experiencing price declines, to maximize their investment potential.

Opportunities Despite the Challenges:

- For Cash Buyers: Elevated rates create less competition from financed buyers, enabling cash buyers to negotiate better deals.

- For Sellers: Sellers in high-demand neighborhoods or those willing to price competitively can still attract cash offers, reducing the risks associated with buyer financing contingencies.

Persistent uncertainty from Washington D.C., coupled with inflation pressures, is unlikely to bring rates down significantly in 2025. As cash buyers continue to account for a significant portion of the market, their ability to adapt quickly will shape Houston’s real estate landscape this year.

Luxury Real Estate: Houston’s High-End Market Continues to Thrive

Closing out 2024, sales of homes priced at $1 million and above experienced a remarkable 65% increase in December compared to the same month in 2023, highlighting the robust demand for luxury properties.

In 2025, we believe Houston’s real estate market is expected to favor wealthier neighborhoods, particularly those zoned to top-ranked schools. This shift is driven by the growing influence of cash buyers and well-qualified purchasers who are less affected by elevated mortgage rates.

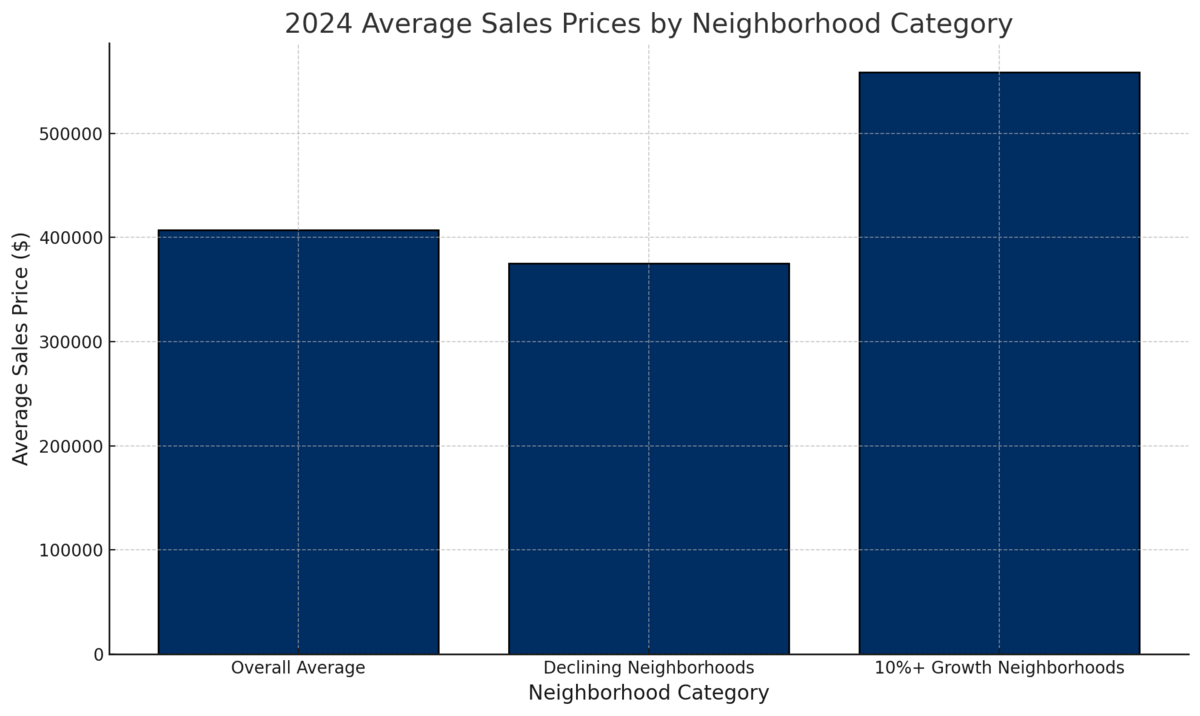

Key Observations from 2024 Data:

- We track daily price movements on 134 Houston area neighborhoods.

- 108 of these neighborhoods had 100+ sales during 2024.

- The overall average sales price across all neighborhoods with 100+ sales was $407,284.

- Neighborhoods with price declines had an average sales price of $375,358, indicating weaker demand in lower-priced markets.

- Neighborhoods with 10% or more growth recorded an average sales price of $558,778, reflecting stronger activity in affluent areas.

Expectations for 2025:

- Resilience in Wealthier Areas: Higher-priced markets will continue to see steady demand as cash buyers and well-qualified borrowers dominate.

- Demand for Top Schools: Homes in neighborhoods zoned to top-ranked schools will remain highly sought after.

- Opportunities for Cash Buyers: With fewer financing contingencies, cash buyers are expected to target wealthier areas for long-term value and investment potential.

We believe these trends underline the importance of tailoring strategies to neighborhood-specific conditions. Sellers in affluent markets should continue to see strong demand, while buyers in these areas may face increased competition.

Suburban Appeal Will Continue to Dominate Buyer Preferences

In 2025, suburban neighborhoods are expected to remain the top choice for many buyers, driven by affordability, larger homes, and access to quality schools. Areas like Katy, Cypress, The Woodlands, and Sugar Land continue to attract buyers seeking better value compared to inner-city locations.

Key Drivers of Suburban Growth:

- Affordability: With median home prices in suburban neighborhoods typically lower than those in the Inner Loop, buyers are able to get more space and amenities for their money.

- Quality of Life: Suburban areas often feature master-planned communities with parks, trails, & recreational facilities.

- Remote Work Flexibility: The shift toward hybrid and remote work arrangements allows buyers to prioritize space and lifestyle over commute times, making suburban living more viable.

Top Established Suburban Areas for 2025:

- Katy: Known for its excellent schools and amenities, Katy remains one of the most sought-after suburban markets.

- Cypress: With rapid development and proximity to job hubs, Cypress continues to attract buyers.

- Sugar Land: Featuring strong schools and a diverse housing market, Sugar Land is ideal for buyers seeking long-term value.

- The Woodlands The area has benefited from strong oil & gas job growth and relocation trends.

Predictions of Emerging Suburban Areas for 2025:

- Hockley/Waller: As Cypress continues to grow and develop, nearby Hockley and Waller are poised to benefit. These areas are experiencing transformation with new communities, schools, and infrastructure projects attracting buyers.

- Willis: Driven by job growth and The Woodlands’ relocation trends, Willis is emerging as a hotspot. Increasing demand suggests this area will see significant growth in 2025.

- Manvel / Iowa City. With limited new large development availability in Pearland, Manvel and Iowa Colony are stepping into the spotlight. These areas are seeing a surge in new construction, retail expansion, and improved connectivity via Hwy 288, making them attractive options for buyers.

Challenges in the Suburbs:

- Inventory Constraints: Many suburban areas face limited housing inventory, which could drive up prices and create competition among buyers.

- Infrastructure Needs: Rapid growth in some suburban markets has put pressure on infrastructure, such as roads and schools, which could affect long-term livability.

Houston’s suburban markets will remain a key driver of the region’s housing demand in 2025. Buyers looking for affordability, space, and strong communities are likely to find excellent opportunities in these areas. Sellers in the suburbs should also benefit from continued demand, particularly in neighborhoods with strong schools and amenities.

Investors Will Focus on Rental Market Stability and Opportunities

Houston’s rental market is expected to remain a key focus for investors in 2025, driven by steady population growth and elevated mortgage rates that continue to price out many potential buyers. With rental demand stable and multifamily occupancy rates forecasted to stay around 90.5%, the city offers attractive opportunities for both new and seasoned investors. [#4]

Key Drivers for Investor Activity:

- Elevated Rental Demand: Higher mortgage rates are pushing more households into the rental market, increasing demand for single-family homes and multifamily units.

- Rising Rents: With limited inventory in some neighborhoods, landlords are benefiting from rising rental prices, particularly in high-demand areas like the Inner Loop and Energy Corridor.

- Affordability Gaps: Investors are targeting neighborhoods with strong rental yields and lower property acquisition costs to maximize returns.

Opportunities for Investors:

- Multifamily Investments: With stable occupancy rates, multifamily properties remain a reliable option for long-term income generation.

- Single-Family Rentals: Suburban areas with high livability and good schools are becoming increasingly attractive for single-family rental investors.

- Emerging Markets: Investors willing to explore less saturated neighborhoods can find properties with higher rental yield potential, especially in areas experiencing population growth.

Challenges to Consider:

- Higher Financing Costs: Elevated mortgage rates will impact leveraged investors, requiring careful evaluation of cash flow and return projections.

- Zoning and Regulation: Investors must remain aware of changing zoning laws and local regulations that could affect short-term rental operations or multifamily developments.

Houston’s rental market continues to offer promising opportunities for investors seeking stable returns. By focusing on areas with strong rental demand and potential for price appreciation, investors can capitalize on the city’s growing population and resilient economy.

Housing Inventory Will Increase To The Highest Level In 8 Years

After several years of tight inventory, we believe 2025 is expected to see an increase in housing supply across the Houston market. Rising construction activity, combined with slower buyer activity due to elevated mortgage rates, is creating more balance between buyers and sellers.

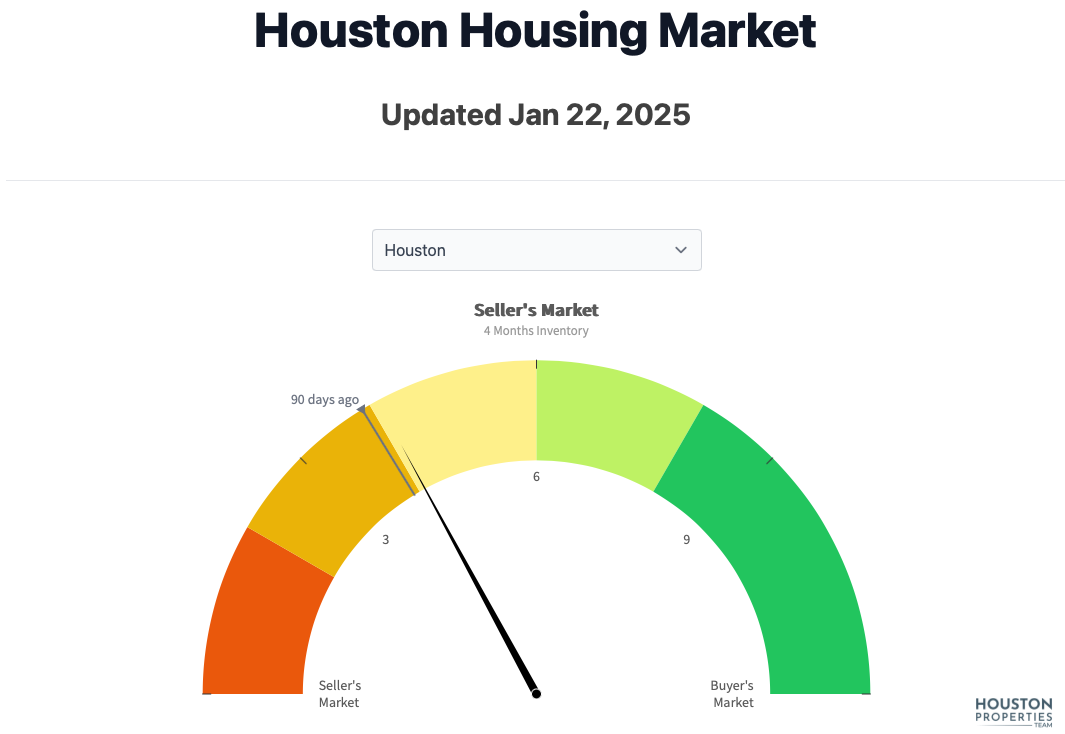

Months of inventory expanded from a 3.3-months supply in December 2023 to 4.0 months in December 2024.. Specifically, we believe Houston will have the highest inventory levels of any point in the last 8 years, with the peak surpassing 4.5 months of inventory.

Key Drivers of Increased Inventory:

- New Construction: Builders are completing projects initiated during the housing boom, particularly in suburban markets like Cypress, Katy, and Richmond, adding much-needed supply.

- Lingering Listings: Elevated rates have slowed buyer activity, leading to longer days on market for some properties and increased overall inventory levels.

- Market Adjustments: Sellers are becoming more realistic about pricing, which is helping to clear out previously stagnant listings.

What a Balanced Market Means for Buyers and Sellers:

- For Buyers: More inventory means greater choice and less competition in many neighborhoods, providing opportunities to negotiate on price or terms.

- For Sellers: A balanced market requires strategic pricing and preparation to stand out. Homes in high-demand areas or with desirable features, like proximity to top schools, will still perform well.

Caveats to Balance:

- While inventory is rising, it’s important to note that some areas will remain competitive, particularly in wealthier neighborhoods and those zoned to top-ranked schools.

- Affordability challenges due to high mortgage rates may still prevent some buyers from entering the market, limiting the pace of inventory absorption.

The gradual shift toward a balanced market is a positive development for Houston real estate, providing more stability after years of extreme conditions. Buyers and sellers alike should adjust their strategies to take advantage of this more normalized environment in 2025.

Take the Next Step

Understanding Houston’s dynamic real estate market is essential for making informed decisions, whether you're buying, selling, or investing in 2025. With trends like elevated mortgage rates, neighborhood-specific performance, and a growing reliance on cash buyers, having the right guidance can make all the difference.

Our free resources, including Free Houston Real Estate Guides, pricing analysis, and market trend guides, are designed to empower you with the insights you need.

If you’re looking for personalized advice tailored to your goals, connect with the best Houston realtor to help you navigate the market with confidence. Our award-winning team specializes in ensuring your next move is strategic, stress-free, and rewarding.

Take advantage of the resources available to you and make 2025 the year you achieve your real estate goals. Contact us today to get started!

Disclaimers, Sources & Methodology

We don’t have a crystal ball. All predictions are our educated guesses.

All Houston home value information was sourced from the HAR MLS database.

Data is deemed accurate but is not guaranteed. Information is provided for informational purposes only.

Our market data is from https://www.houstonproperties.com/housing-market

The data is for Houston (Data from the HAR MLS for purchases of single family homes over $125,000, not at lot value, in MLS Areas 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 28, 29, 30, 31, 32, 33, 34, 35, 36, 37, 38, 39, 40, 55 & 57).

The average days on market is calculated using the average of the trailing 4 weeks of data from the Days on Market graph.

The median sale price is from the most recent month on the Home Prices - Monthly graph, comparing the value to the same month one year ago.

The number of homes sold is from the most recent month on the Home Sales - Monthly graph, comparing the value to the same month one year ago.

Pending sales values are calculated by summing the number of new “Pending” listings from the trailing four weeks for the past two years and then expressing the differences in a percentage value.

Number of properties with price reductions are calculated by summing the number of new properties with a price change and comparing it with same time periods over the last two years.

Pending Sales graph displays the weekly count of new “Pending” listings in the HAR MLS. It does not include “Option Pending” or “Pending Continuing To Show” status fields so contracts are not double or triple counted.

The Days on Market graph displays the average of the Cumulative Days on Market field for sold properties from the HAR MLS field for the past 13 weeks, as compared to the same data over the past three years.

This product uses the FRED® API but is not endorsed or certified by the Federal Reserve Bank of St. Louis.

1) https://communityimpact.com/houston/bay-area/business/2024/12/13/houston-forecasted-for-record-breaking-job-growth-in-2025/

2) https://www.macrotrends.net/global-metrics/cities/23014/houston/population

3) https://www.marketwatch.com/guides/mortgages/30-year-mortgage-rates/

4) https://mmgrea.com/2025-houston-forecast