Houston Real Estate Market: Coronavirus

Impact of the Coronavirus on the Houston housing market.

Quick Summary:

Here’s a useful tip about life: Coronavirus or not, there’s always something people panic over.

Sometimes, it’s personal. Sometimes it’s local. Sometimes it’s global.

Houston residents can still protect what is likely their single largest asset (their home) by making smart, rational decisions.

It’s time to panic!

That’s what the stock markets were told in late February.

The 2020 stock market crash is now the 3rd largest daily percentage loss in history.

For many investors, the US stock market sell-off was one of the worst weeks of their investing careers.

** March 16 saw market volatility spike to a new record high, taking out the 2008 crisis peak.**

Before that, professionals in their early 40s may have experienced the crash post 9/11 (-11.6%).

Before that, the previous worst week was the October 1987 sell-off (-12.2%).

COVID-19, AKA the Coronavirus, was out and about. We now have over 10,000 confirmed cases.

The market had only one conclusion . . .

It was time to panic!

In this article, we outline the likely impact of the coronavirus on the Houston real estate market. We also list our suggestions if you're looking to buy or sell a home in Houston.

If you're looking for a personal recommendation on your situation (buying or selling a home in Houston) and how it could impact your goals, please contact Paige Martin at [email protected].

Table of Contents

- Lessons From The Last Viral Outbreak

- Parallels: Coronavirus & The 1918 Spanish Flu?

- Coronavirus In Houston Today

- Long-Term Success Themes

- Is It A Good Time To Buy A House In Houston?

- Is It A Good Time To Sell A House In Houston?

- Potential Winners & Losers

- Coronavirus in Houston: Tips To Protect You and Your Family

- Practical Tips To Prepare Your Home For An Emergency

- The Best Houston Realtor to Sell Your Home

Lessons From The Last Viral Outbreak

Lessons from the last viral outbreak and how it can apply to Coronavirus in Houston today.

When we reflect back on the last decade, there have been a huge number of bogeymen (war with Iran, terrorist attacks, war with North Korea, new laws coming out of Washington DC . . . ) lurking around the corner.

While there are always precautions we can take, it's not healthy to obsess over every potential negative outcome.

However, we can learn from history and apply it to today.

For example, do you remember the Ebola virus? Remember how panicked everyone was about that epidemic?

WorldAtlas.com wrote: “The world’s most widespread Ebola virus disease outbreak happened in West Africa in 2013 and lasted until 2016. Major loss of life and socioeconomic losses were suffered during this epidemic . . . After a peak in October 2014. Things started getting under control as international efforts started bearing fruit. Finally, on March 29, 2016, WHO (the World Health Organization) terminated the status of the epidemic as an emergency of international concern.”

There were 11,323 deaths during that time frame.

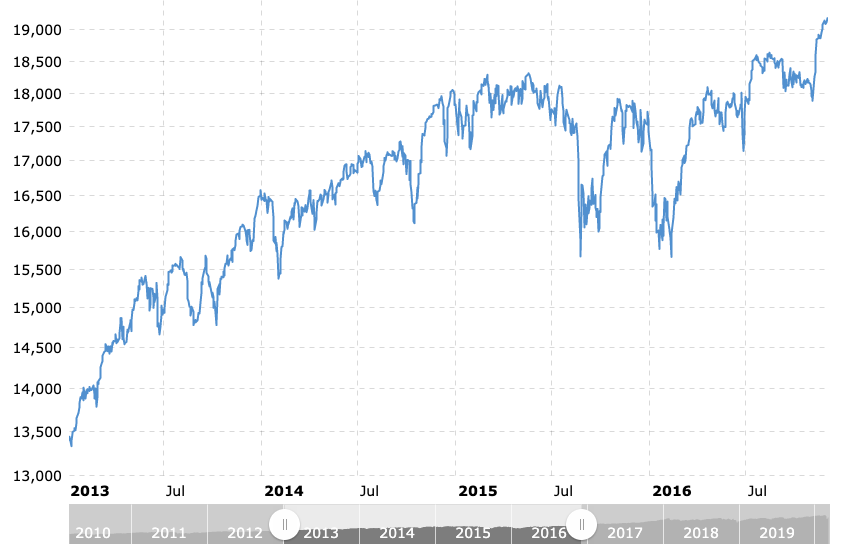

Here's what happened to the US stock market (Dow Jones Index):

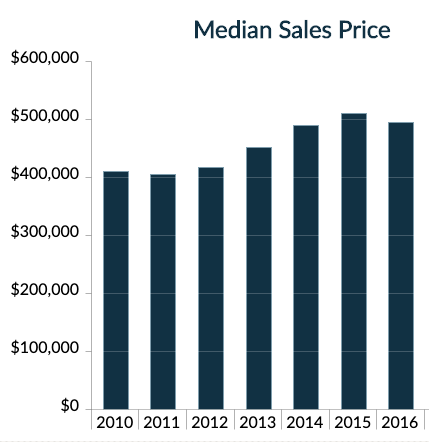

And here's what happened to Houston Inner Loop Real Estate Prices:

As a note, the ~3% drop in median home prices in 2016 from 2015 in Inner Loop Houston real estate was correlated to the drop in energy prices. About 1/3 of Houston's jobs are tied to the oil & gas markets.

Parallels: Coronavirus & The 1918 Spanish Flu?

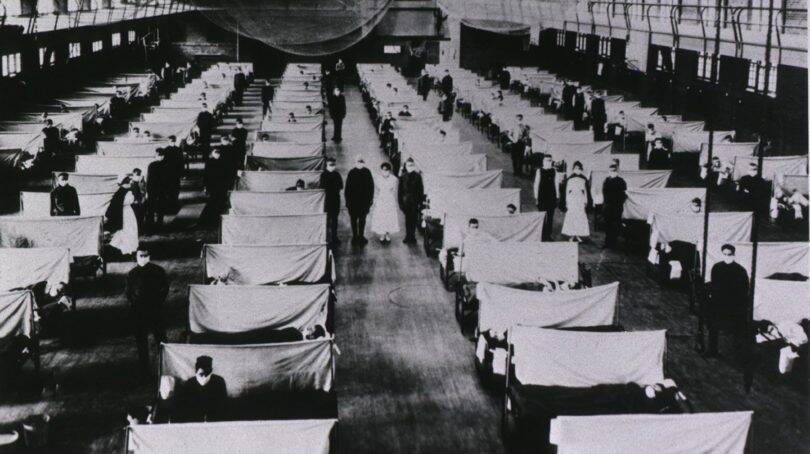

What happened to the market the last time we had a wide-spread, historical, global viral pandemic (the Spanish Flu from 1918)?

Stock markets (and most people) have trouble dealing with events outside normal probabilities.

Even current epidemiologists struggle to frame the potential range of outcomes for a virus like this.

However, by looking at historical pandemics, we may get some insights into how the world has reacted in the past; and track how the market will respond if COVID-19 reaches a panic of epic proportions.

If you exclude the Black Plague from the mid-14th century, the Spanish Flu from 1918 is likely the most deadly viral outbreak in modern history.

The influenza pandemic infected approximately 500 million people worldwide (more than 1/4 of the global population).

In the United States, it caused about 675,000 deaths.

Since there's not much publicly available Houston real estate data from 1918, the baseline we're using here is the US stock market.

Framing the current viral outbreak versus historic pandemics may provide some measure of insight.

In 1918, the Spanish Flu took out roughly 0.6% of the total population, and the stock market had a decent year. The Dow Jones Industrial Average (DIA) delivered a 10.5% return (around the long-term average).

There was an immediate crash, but long-term investors still benefited from it.

This broader perspective can remind investors that the US has navigated difficult scenarios well in the past.

We don't know exactly how the Coronavirus will impact the Houston real estate market, the global economy, or the stock markets.

However, we do know that the world is in a much better place today than it was in 1918 when disease and war ravaged the planet.

American businesses have continued to create jobs and shown incredible resilience in even more difficult situations than we're seeing today.

As you think about your home and other investments and wonder how the coronavirus will affect the Houston real estate market, remember that the long-term fundamentals have stood the test of time.

Coronavirus In Houston Today

Let's put the Coronavirus in context against historical viral outbreaks, based on the data.

Compare that to COVID-19 or the Coronavirus.

As of June 7, the World Health Organization (WHO) was saying there have been:

- 6,322,094 deaths

- 5,226 in China

- 1,033,830 in the United States.

Outside of COVID-19’s country of origin, the WHO reports a 1.46% death rate for those who have contracted it.

This compares to a 0.1% death rate for the common flu.

According to the CDC, the main reason that COVID-19 is of higher concern is the pace at which it's spreading:

"The virus that causes COVID-19 seems to be spreading easily and sustainably in the community (“community spread”) in some affected geographic areas. Community spread means people have been infected with the virus in an area, including some who are not sure how or where they became infected."

And, incidentally, on a global level, 99.9886% of the world’s population has not been affected so far.

Still, it’s time to panic, as evidenced by how the stock markets behaved last week. But you can rely on major success themes so you can still make a good investment.

Long-Term Success Themes

Based on the last two decades, every major crisis that has come to Houston (e.g. 2008 stock crash, 2015 oil crash, Hurricane Harvey) has taken about 18 months to materially show up in the real estate market.

Unsurprisingly, the questions have begun to flood in; people are grasping for any Houston real estate market forecast to plan their next move. You may be wondering if investing in Houston real estate right now is a good idea given everything, so let’s break the situation down to the basics . . .

You can only do so much to avoid getting the Coronavirus. In addition, no one can predict whether the markets will be fear- or greed-fueled.

But that doesn’t mean you need to make emotion-fueled decisions with what is likely your single largest asset - your home.

From our studies of over 500,00 Houston home sales, here are the major success themes to make a good investment:

Located in quality neighborhoods that have good proximity to major job centers;

Large lots (the primary value is the land value);

Not located on a busy thoroughfare, near a highway, or near a railroad;

A street location with some kind of premier feature (by a cul-de-sac, on the street with a tree-filled median, etc.);

With a home that is liveable and can be rented. Typically, new construction homes come with a higher purchase premium, and “true fixer-uppers” require too much investment.

To read the studies:

Is It A Good Time To Buy A House In Houston?

Real estate is hyper local - for personal recommendations on a buying strategy, please contact [email protected]

One of the questions we've gotten a lot recently is, "I'm considering buying a home in Houston; what impact do you think the Coronavirus will have on me?"

So how is the real estate market in Houston, Texas, faring amid the coronavirus outbreak?

While we don't have a crystal ball, below are our thoughts based on our research, experience, and what we've seen from past market shocks:

Currently, the majority of buyers we are working with aren't changing their home buying strategy (at all) based on Coronavirus fears.

In parts of the city, we're still seeing multiple offers and homes going under contract within the first few days. As far as Houston real estate market predictions go, buyer activity is unlikely to change any time soon.

Both based on Coronavirus fears and the upcoming presidential election (where the news media is filled with fear, uncertainty, and doubt), we expect 5-10% of buyers to "sit on the sidelines" for much of 2020.

Since the typical real estate purchase process takes about 4-6 months (including being under contract for ~30-45 days), any data showing any market impact won't begin to show up for at least 3 months.

Historically, it has taken 18 months before there is a material impact on the real estate market (e.g., after the 2008 crash, average home prices still increased for ~12 months).

So, to those wondering, “Is it a good time to buy a house in Houston?”: Evidence suggests that Houston's real estate market conditions may remain largely unchanged in the immediate future.

So, by all means, continue to search for the best neighborhoods to invest in Houston.

Historically, these buyers who sit on the sidelines are concentrated in "discretionary" parts of the market:

Investor markets (either the multi-family home market or the lowest price end of the market with higher than average investors' purchases)

2nd home markets (e.g., Galveston, lake houses, certain condos)

Luxury home market (typically luxury buyers have more discretion on when they move)

Is It A Good Time To Sell A House In Houston?

Real estate is hyper local - for personal recommendations on a selling strategy, please contact [email protected]

Another question we've gotten recently is, "I'm considering selling my home in Houston. What impact do you think the Coronavirus will have on me?" In other words, is it a good time to sell a house in Houston?

While we don't have a crystal ball, below are our thoughts based on our research, experience, and what we've seen from past market shocks:

Buyers typically give more weight to potential risks faster than sellers (e.g., "I'm concerned about Coronavirus, and I don't want to overpay, so I want to offer less.")

Sellers typically discount future market concerns (e.g., "I don't think Coronavirus will be that bad, so I don't want to give my house away.")

When it comes to Houston housing prices, this has historically created larger mismatches between the price a buyer is willing to pay and the price the seller is willing to approve.

In past Houston real estate market trends, the result of this is that houses tend to sit on the market longer, and the volume of deals decreased.

- Historically, in Houston, for the first 3-6 months of any downturn, Houston home prices usually rise.

The reason for this is that the deals that do get done are from motivated buyers (and the sellers don't feel the pain yet of "having to sell.")

Again, usually, a downturn in median home prices doesn't appear for about 18 months after a major crash.

So until then, there are likely still some interested buyers looking to invest in up-and-coming neighborhoods in Houston.

Potential Winners & Losers

The real data of “getting a good deal” only comes up when you go to resell. It’s just like buying a stock, you don’t know how much money you make or lose until you sell it.

One other question we've received is, "There were some deals to be had after the 2015 crash and Hurricane Harvey. Where do you think they may appear now?"

Ray Dalio recently wrote one of the best pieces I've seen with his thoughts on the overall investing market.

I encourage you to read the full summary, but I've highlighted a few of his comments below:

The world is now leveraged long with a lot of cash still on the sidelines—i.e., most investors are long equities and other risky assets, and the amount of leverage that has taken place to support these positions has been large because low-interest rates relative to expected returns on equities and the need to leverage up low returns to make them larger have led to this.

The actions taken to curtail business activities will certainly cut revenues until the virus and business activity reverse, which will lead to a rebound in revenue. That should (but won’t certainly) lead to V- or U-shaped financials for most companies.

However, during the drop, the market impact on leveraged companies in the most severely affected economies will probably be significant.

Additionally, it seems to me that this is one of those once in 100 years catastrophic events that annihilate those who provide insurance against it and those who don’t take insurance to protect themselves against it because they treat it as the exposed bet that they can take because it virtually never happens.

In Houston, here's how this has historically translated in the past Houston housing market trends:

Nearly 100% of buyers will "want a deal."

Only 3-5% of buyers will end up "actually getting a good deal."

The real data of “getting a good deal” only comes up when you go to resell. It’s just like buying a stock. You don’t know how much money you will make or lose until you sell it.

After Hurricane Harvey, a lot of investors thought that they "got a good deal" because they paid less than the asking price. However, for inexperienced investors, many of them ended up losing a lot of money on their purchases.

Here are the best tips for how to get "a good deal" in the 2020 Houston housing market

1) Don't buy a bad house.

This seems obvious and simple, right?

You'd be surprised how hard this actually is.

9 Kisses of Death For Resale. What to Avoid When Buying A Home

2) Buy homes that fit the main long-term investment themes.

Here's what has made a good long-term real estate investment in Houston.

Homes like this only represent about 20-30% of the total market.

Historically, it's been far better to buy quality than attempt to "get a discount to list price."

3) Historically, the "best deals" only come after making an offer.

We ran a study of the homes that sold for the lowest price per square foot.

After digging further into the data, most of these deals came not from a listed "deal price" but were negotiated only after the buyer had made an offer.

Said another way, these deals were not published - they were created.

Contact us for tips and recommendations on how to get the best deals for you.

Coronavirus in Houston: Tips To Protect You and Your Family

The outbreak of the Coronavirus Disease (COVID-19) has brought about widespread stress and fear. But you don’t have to feel helpless amid this stressful time. By being proactive, you can increase your safety and decrease your chances of getting affected by the outbreak.

Here are some simple health and safety tips to protect yourself and your family from the Coronavirus.

Everyday steps to avoid the spread of the coronavirus:

Constantly wash your hands with soap and water for at least 20 seconds.

Washing your hands is an easy yet effective way to prevent the spread of germs. A trick is to hum the “Happy Birthday” song twice to ensure you wash your hands for ample time.If you don’t have immediate access to soap and water, apply an alcohol-based hand sanitizer with at least 60% alcohol.

Avoid leaving the house when you’re sick. If you absolutely have to leave, wear a facemask to help prevent the spread of disease in the community.

Cough or sneeze into the inside of your elbow, not your hands, if you don’t have a tissue.

Avoid close contact with people who are sick.

Constantly disinfect surfaces in your workplace and home.

Commonly touched surfaces like doorknob handles, computers, tables, switches, toilets, bathroom sinks, counters, and toys are breeding grounds for germs. Make sure to constantly disinfect these areas.Remember: Cleaning is different from disinfecting. Cleaning merely removes germs, while disinfecting kills germs. For good measure, first, clean a surface with soap (or detergent) and water. Afterward, you’ll have to use chemicals to kill the germs and lower the risk of infection.

Stay healthy.

Get plenty of sleep, physical activity, fluids, and nutritious food to strengthen your immune system.

Practical Tips To Prepare Your Home For An Emergency

We’re facing a lot of uncertainty on the impact of the Coronavirus in the U.S. But one thing’s for sure: you and your family have to be prepared in case the situation gets worse.

In case the situation calls for your family to stay home, preparation will ensure your family’s comfort and safety.

Stock up on these food staples and household supplies to prepare your home:

Bathroom items - toothpaste, toilet paper, feminine supplies

Laundry detergent

Disinfectant

Canned foods - These food items will last longer than fresh produce

Special food for babies, family members with specific diets, and pets

Bottled water - Make sure to have a lot on hand to keep your family hydrated

First-aid kit

14-day supply of prescription medications

You can do your part in preventing the spread of the disease. Call your doctor if you’re experiencing respiratory illness, and recently visited a country with widespread COVID-19 cases, or been in close contact with someone with the disease.

The Best Houston Realtor to Sell Your Home

The Houston Properties Team has a well-defined structure based on the individual strengths of each member. Each member is a specialist in their role – which is why our homes sell faster and for more money than average.

Paige Martin, Broker Associate with Keller Williams Realty, and the Houston Properties Team are ranked among the top residential Realtors in the world.

They have been featured on TV and in dozens of publications, including The Wall Street Journal, Fortune Magazine, Reuters, Fox News in the Morning, Money Magazine, Houston Business Journal, Houstonia, and Houston Chronicle.

Paige Martin was just ranked as the #5 agent in the world with Keller Williams, completing over $1 Billion in Houston residential real estate sales.

Recent awards include:

- 2022: #1 Residential Real Estate Team by Sales Volume, Houston Business Journal

- 2021: Best Real Estate Teams in America, RealTrends.com

- 2021: Top 100 Women Leaders in Real Estate of 2021

- 2021: America’s Top 100 Real Estate Agents

- 2021: Top Real Estate Team (Houston Properties Team), Houston Business Journal

- 2021: Best Houston Real Estate Team, Best of Reader’s Choice

- 2021: Top Real Estate Team (Houston Properties Team), Houston Business Journal

- 2021: #1 Real Estate Team, Keller Williams Memorial

- 2020: America’s Best Real Estate Teams, Best of America Trends

- 2020: Best Houston Real Estate Team, Best of Reader’s Choice

- 2020: Top Real Estate Team (Houston Properties Team), Houston Business Journal

- 2020: #6 Individual Agent, Keller Williams, Worldwide

- 2020: #1 Individual Agent, Keller Williams, Texas (Top Keller Williams Realtor)

- 2020: #1 Real Estate Team, Keller Williams Memorial

- 2019: Top Residential Realtors in Houston, Houston Business Journal

- 2019: America’s Best Real Estate Agents, RealTrends.com

- 2019: #5 Individual Agent, KW Worldwide

- 2019: #1 Individual Agent, KW Texas

- 2018: #5 Individual Agent, Keller Williams, Worldwide

- 2018: #1 Individual Agent, Keller Williams, Texas

- 2018: #1 Individual Agent, Keller Williams, Houston

- 2018: America’s Best Real Estate Agents, RealTrends.com

- 2018: Top 25 Residential Realtors in Houston, Houston Business Journal

- 2018: Texas’ Most Influential Realtors

- 2017: #1 Individual Agent, Keller Williams, Texas

- 2017: #1 Individual Agent, Keller Williams, Houston

- 2017: #10 Individual Agent, Keller Williams, Worldwide

- 2017: America’s Best Real Estate Agents, RealTrends.com

- 2017: Top 25 Residential Realtors in Houston, Houston Business Journal

- 2017: Texas’ Most Influential Realtors

- 2016: #1 Individual Agent, Keller Williams, Texas

- 2016: #1 Individual Agent, Keller Williams, Houston

- 2016: #20 Individual Agent, Keller Williams, Worldwide

- 2016: Texas’ Most Influential Realtors

- 2016: Top 25 Residential Realtors in Houston, HBJ

- 2016: Five Star Realtor, Featured in Texas Monthly

- 2016: America’s Best Real Estate Agents, RealTrends.com

- 2015: #9 Individual Agent, Keller Williams, United States

- 2015: #1 Individual Agent, Keller Williams, Texas

- 2015: #1 Individual Agent, Keller Williams, Houston

- 2015: America’s Best Real Estate Agents, RealTrends.com

- 2015: Top 25 Residential Realtors in Houston, HBJ

- 2015: Five Star Realtor, Texas Monthly Magazine

- 2014: America’s Best Real Estate Agents, RealTrends.com

- 2014: #1 Individual Agent, Keller Williams Memorial

...in addition to over 318 additional awards.

Paige also serves a variety of non-profits and civic and community boards. She was appointed by the mayor of Houston to be on the downtown TIRZ board.

Benefits Of Working With The Houston Properties Team

Our team, composed of distinguished and competent Houston luxury realtors, has a well-defined structure based on the individual strengths of each member.

We find the team approach as the most effective way to sell homes. We have dedicated people doing staging, marketing, social media, open houses, and showings. Each Houston Properties Team member is a specialist in their role—which is why our homes sell faster and for more money than average.

The benefits of working with a team include:

- the ability to be in two or three places at one time; a member can handle showings while another answer calls

- collective time and experience of members

- targeted advice and marketing of agent experts in your area

- competitive advantage by simply having more resources, more ideas, and more perspectives

- a “checks and balances” system; selling and buying a home in Houston is an intensely complex process

- more people addressing field calls and questions from buyers and agents to facilitate a faster, successful sale

- efficient multi-tasking; one agent takes care of inspections and repair work, while another agent focuses on administrative details

- multiple marketing channels using members’ networks

- constant attention: guaranteed focus on your home and your transaction

- lower risk for mistakes. Multiple moving parts increase oversights. A team approach handles these “parts” separately

- flexibility in negotiation and marketing

- better management of document flow

- increased foot traffic through more timely and effective showing schedule coordination; and

- increased sphere of influence and exposure to more potential buyers.

To meet all the award-winning members of the Houston Properties Team, please go here.