Houston Housing Market Update: Current Data & 2020 Market Predictions

Concerned about a housing market crash? Review current Houston real estate data & lessons from past hurricanes & oil price shocks.

UPDATE: We have just released our Houston Real Estate Forecast For 2022. While you will find that most of our predictions last year were accurate, you’ll be more intrigued to read about our projections about the housing market this year.

SUMMARY:

Coming off a record year, the Houston real estate market started 2020 in a seller's market.

Because real estate was deemed "an essential service" in Houston during the quarantine, the housing market held up much better than other cities across the nation.

See how showings, new listings & sales trended day by day during the lock down.

The #1 predictor of real estate prices is job growth.

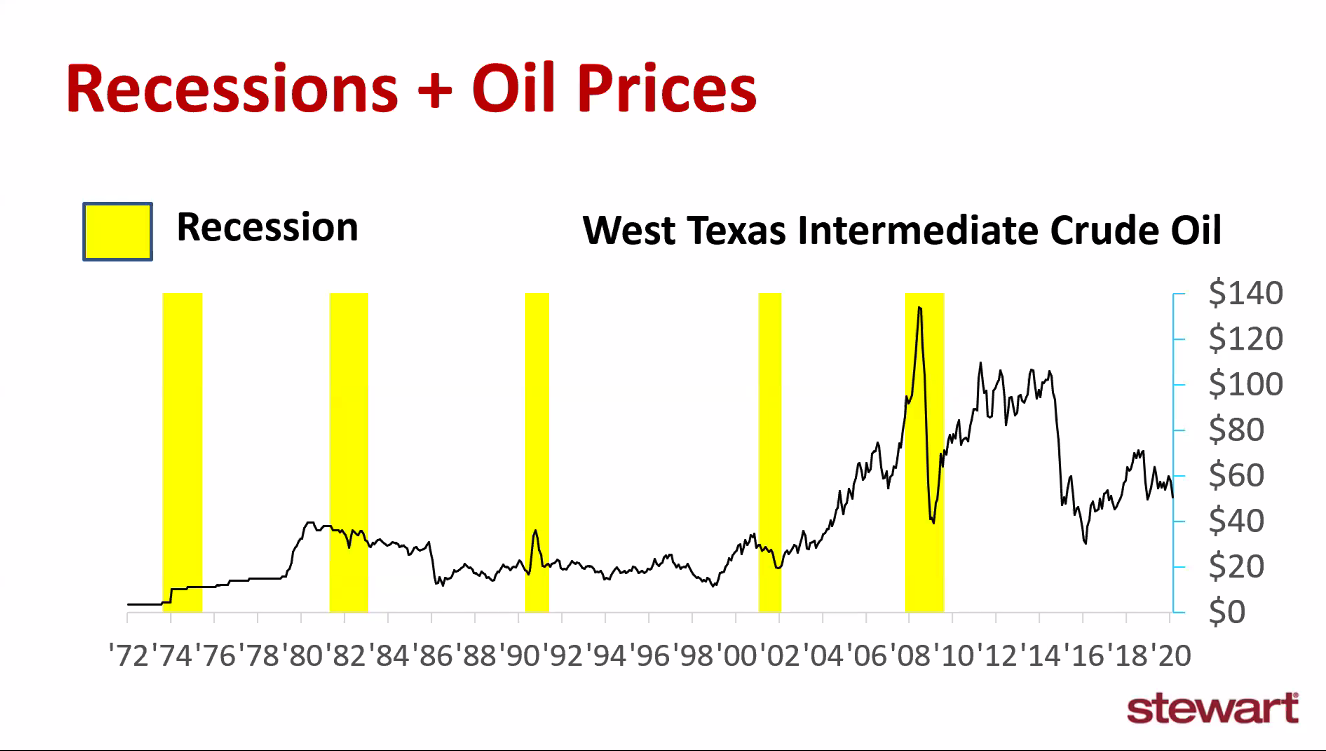

Our main concern is the impact of the oil price crash on Houston jobs (since about 1/3 of Houston's jobs are tied to the energy industry).

In this analysis, we show you current data along with key lessons from both the 2015 oil price crash and 2008 great recession.

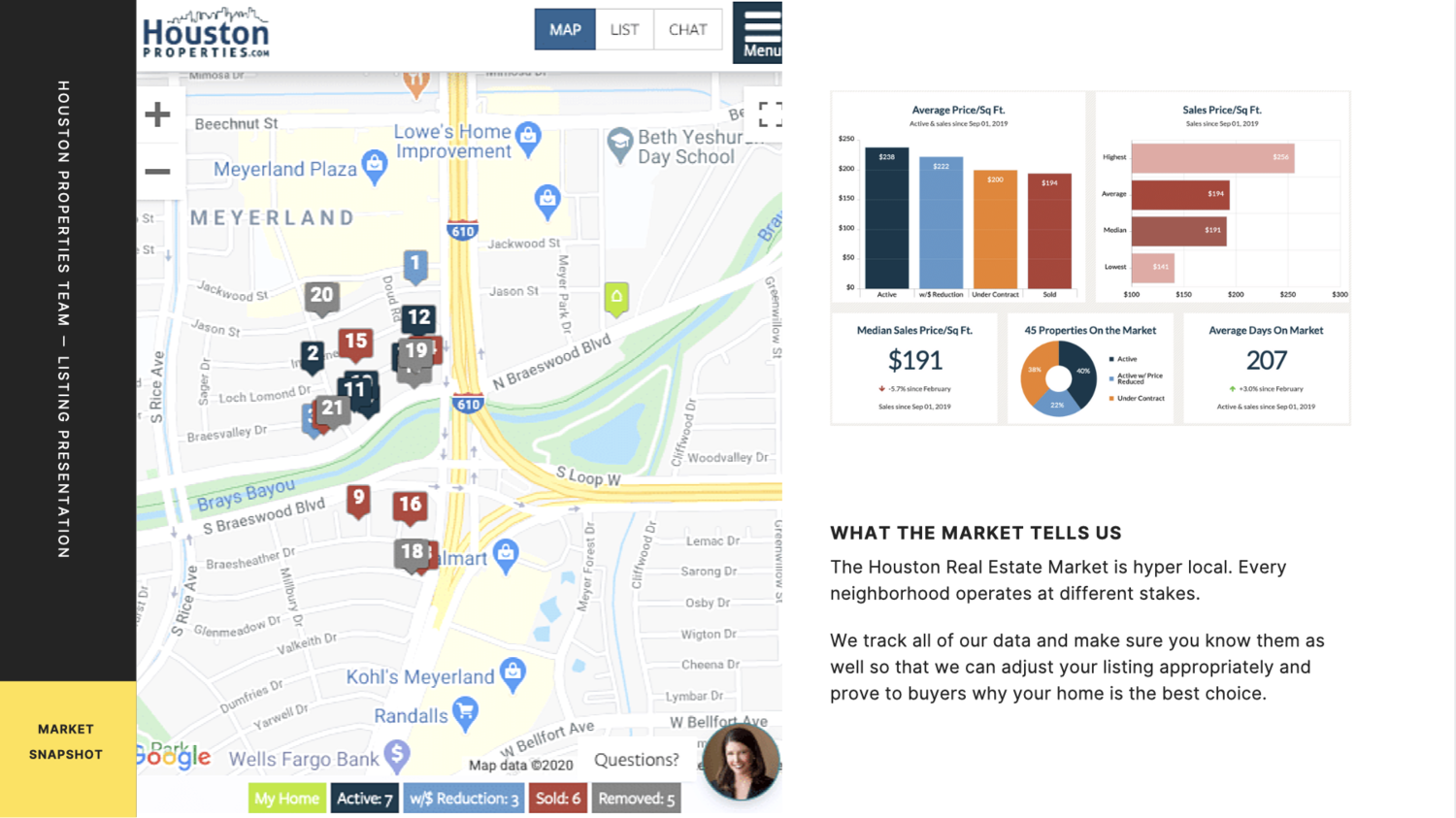

Remember: real estate is hyper-local! The data below covers the "average Houston home." Many neighborhoods are trending differently.

Get a free home valuation for your house and trends on your neighborhood.

If you're considering buying or selling, our advice for you will depend on your neighborhood, price point, and personal goals.

KEY RESOURCES:

Study Of How Previous Pandemics Affected The Real Estate Market.

Support Local: How The Houston Properties Team Is Helping Out Small Businesses.

If you're looking for a personal recommendation on your situation (buying or selling a home in Houston) and how it could impact your goals, please contact Paige Martin at [email protected]. Paige Martin is the #1 Individual Agent with Keller Williams in the State of Texas and team lead of The Houston Properties Team.

Table of Contents

- How Is My Neighborhood Doing?

- What To Do As A Homeowner?

- I Am Still A Buyer. Should I Be Worried?

- I May Need To Sell. How Does This Affect Me?

- The Houston Real Estate Market Pre-COVID-19 & Oil Price Crash

- Coronavirus In Houston Today

- Job Losses In Houston: Areas And Industries At Risk

- Is Oil & Gas Potentially More Concerning Than COVID-19?

- 8 Questions About The 2020 Houston Real Estate Market

- Sources, Methodology & Disclosures

- Meet Paige Martin & Our Top Ranked Houston Agents

How Is My Neighborhood Doing?

High-quality homes sell in nearly every market. Disadvantaged homes sell more slowly or at larger discounts. The Houston real estate market is hyper-local — contact The Houston Properties Team for tips on how to navigate it.

"Which Houston neighborhoods are hit hard by COVID-19 and oil price crash?"

"Which areas in The Bayou City are doing well despite the pandemic and economic downturn?"

"How is my neighborhood doing? Should we expect sales to go up or down this year?"

These are just some of the many questions we get about the Houston real estate market each day.

Houston real estate is hyper-local, some areas are doing better than others. Our response to these questions will be on a case-to-case basis.

Properties are still going under contract. We are still seeing listings receive multiple markets.

Based on the graph above, the number of homes that have gone under contract is still consistent with figures prior to the coronavirus and the oil price crash.

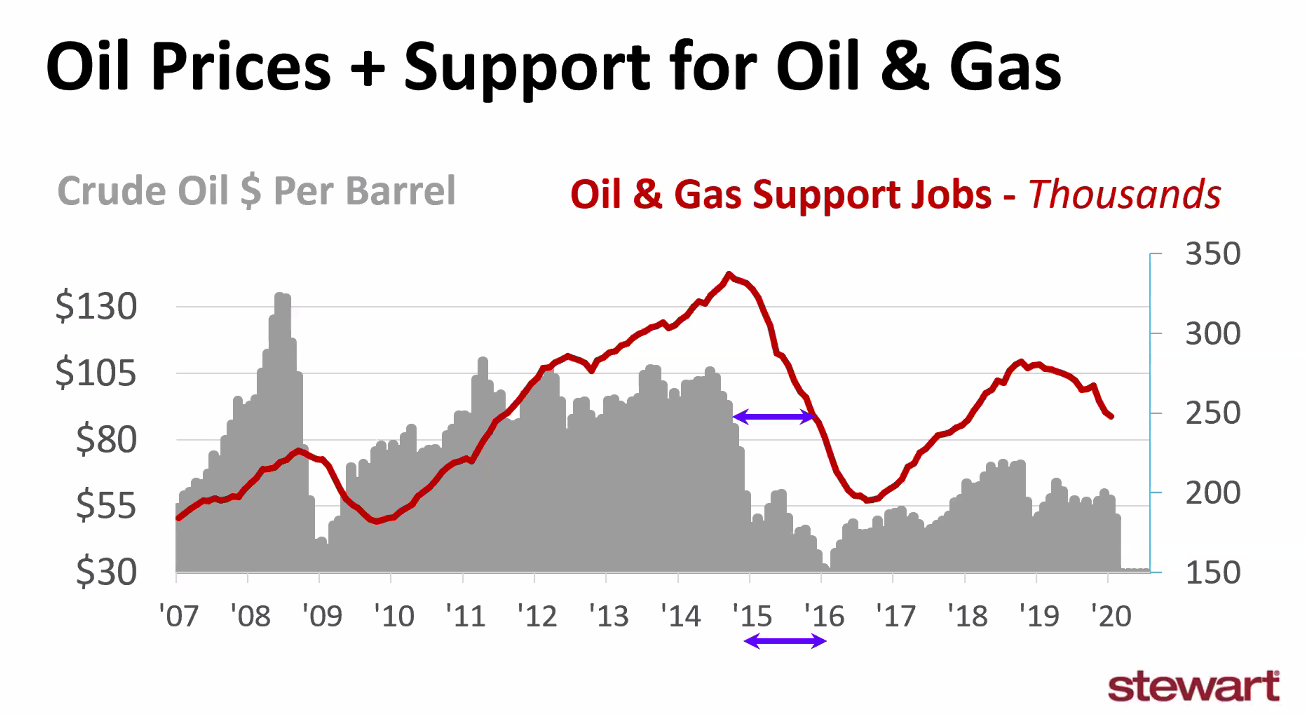

With that, regions tied heavily to oil and gas are areas of concern. Neighborhoods like Energy Corridor and The Woodlands still haven't recovered from 2015.

Oil prices have crashed to levels not seen in decades, meaning gas companies are operating at a loss and will need to make sizable personnel cuts.

We’re already having conversations with our clients in the industry. Given the volatility of the situation, the urgency of the response is critical.

Regardless of the economic and political climate, our approach has been the same: Every situation is unique.

We use data to create custom solutions for our clients, present this to them, and have candid conversations on what they should do given the situation.

What To Do As A Homeowner?

Whether you buy or sell first depends on the current market and your unique situation. Our experience taught us to make the proper assessment out of the overall scenario every homeowner is in. Contact us to help you make the most viable decision.

The Houston housing market is facing a lot of uncertainties. A lot of current homeowners have been reaching out and seeking advice.

What we tell them: Unless you absolutely need to sell, you have to strap in and hold on.

We expect a nationwide drop in home values.

Historically, the housing market has been able to bounce back strong from economic downturns (see graph below). As long as you don’t have to sell in a short time you should be able to ride this out.

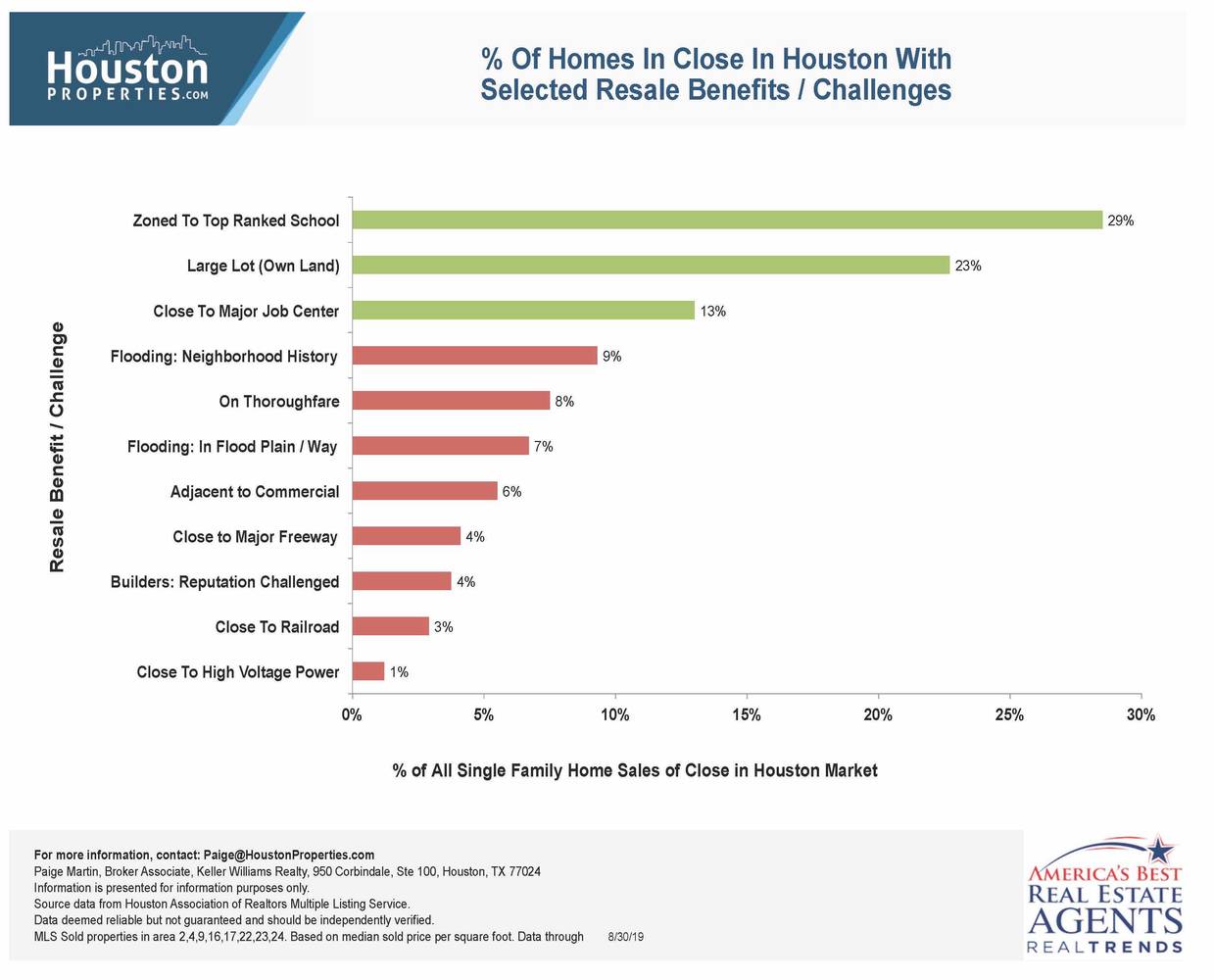

As with any downturn, there's a flight to quality. Quality homes should rebound strong:

- Located in quality neighborhoods that have good proximity to major job centers;

- Large lots (the primary value is the land value);

- Not located on a busy thoroughfare, near a highway or near a railroad;

- A street location with some kind of premier feature (by a cul-de-sac, on a street with a tree-filled median, etc.); With a home that is liveable and rentable. Typically, new construction homes come with a higher purchase premium, and repair and maintenance require too much investment.

I Am Still A Buyer. Should I Be Worried?

With over $500 Million Houston residential home sales, the Houston Properties team can help you find the best property for you and your family. Contact us for a custom report on the Houston real estate outlook for this year.

Buyers are in a good position to get amazing deals.

If you’re looking to buy, our expectation is that in the next 3-6 months you’re going to be in a position to get a great deal.

Buyers have two big advantages:

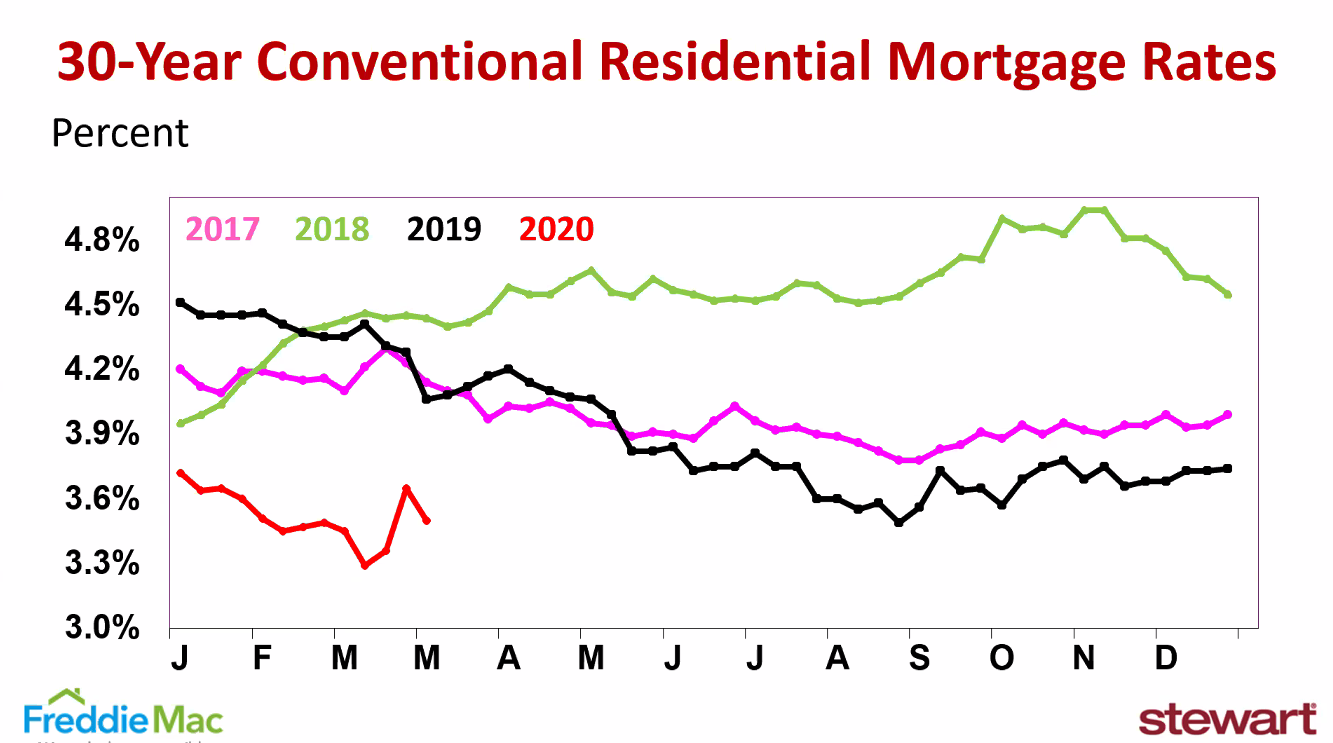

- Interest rates are at an all-time low

- You're going to start seeing great deals in good locations in the next 3-6 months

However, we also expect to see a lot of fake deals. There will be plenty of buyers who will think they got a good deal, only to find out it's a disaster later.

The market will see an influx of price drops. Properties that have been sitting on the market for a while even BEFORE coronavirus and the current energy crisis will be slashing prices left and right.

Buyers should be wary of "seemingly good deals on paper". We typically guide our clients to watch out for the 9 Kisses Of Death For Resale when shopping for a home.

I May Need To Sell. How Does This Affect Me?

The Houston Properties Team ran a study of past shocks (Hurricane Harvey, 2008 Crash, 2015 Oil Crash) and how it reshaped the market. For a copy of this research plus current trends in your neighborhood, email [email protected].

Candidly, we do not have a lot of good news for sellers.

We expect the market to slow down considerably. It could last more than two years depending on how oil, gas, and retail do in the next few months.

What we see from past experiences is that people who sell in the short term, while they may not make as much as they want, do much better than those who sell in 18-24 months down the road.

This is because people who got on the market first, reset the comps lower.

The typical real estate purchase process takes about 4-6 months (including being under contract for ~30-45 days). Any data showing any market impact won’t begin to show up for at least 3 months.

Historically, it has taken 18 months before there is a material impact on the real estate market (e.g. after the 2008 crash, average home prices still increased for ~12 months).

This means home sellers who can get on the market early has a distinct advantage over those who will opt to wait. Homeowners who absolutely need to sell, NEED TO GET OUT EARLY.

The Houston Real Estate Market Pre-COVID-19 & Oil Price Crash

More than 30 million companies are listed on LinkedIn. Connect with the Houston Properties Team for a more comprehensive action plan on getting the job you want.

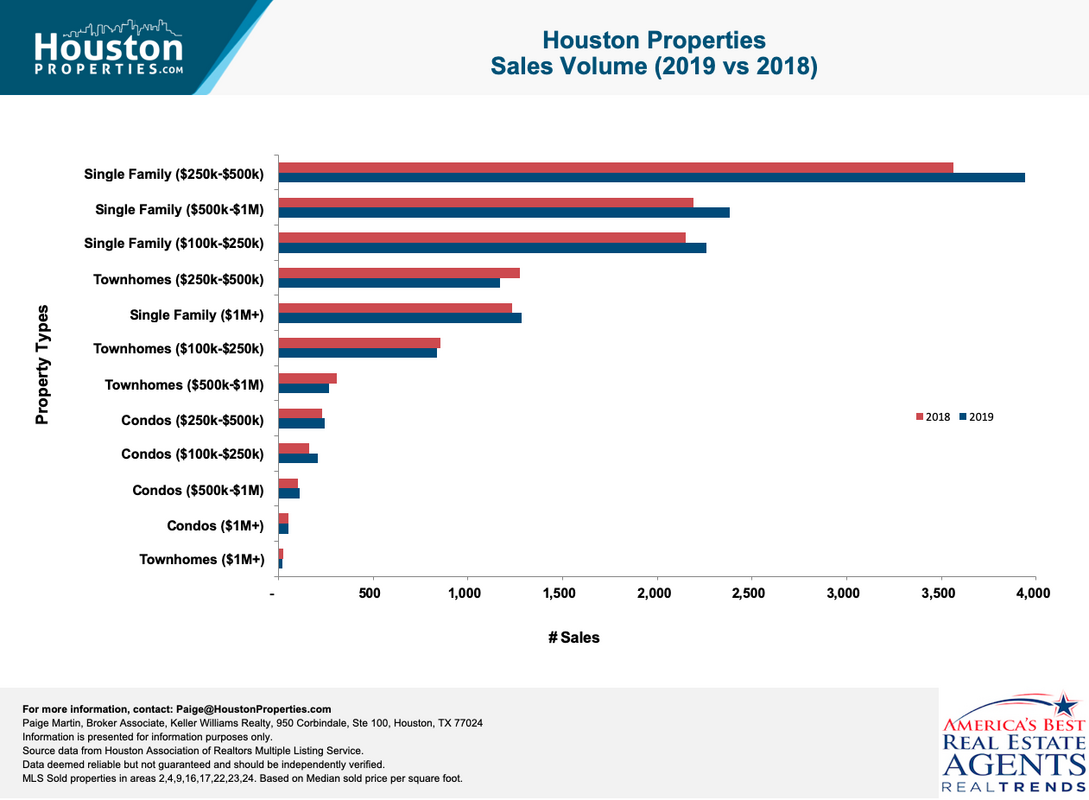

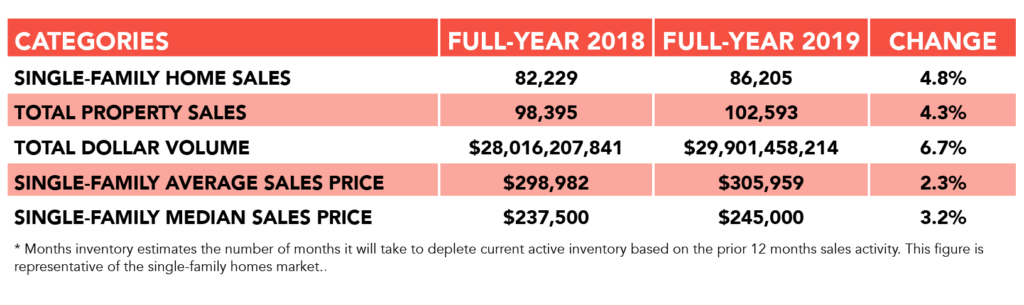

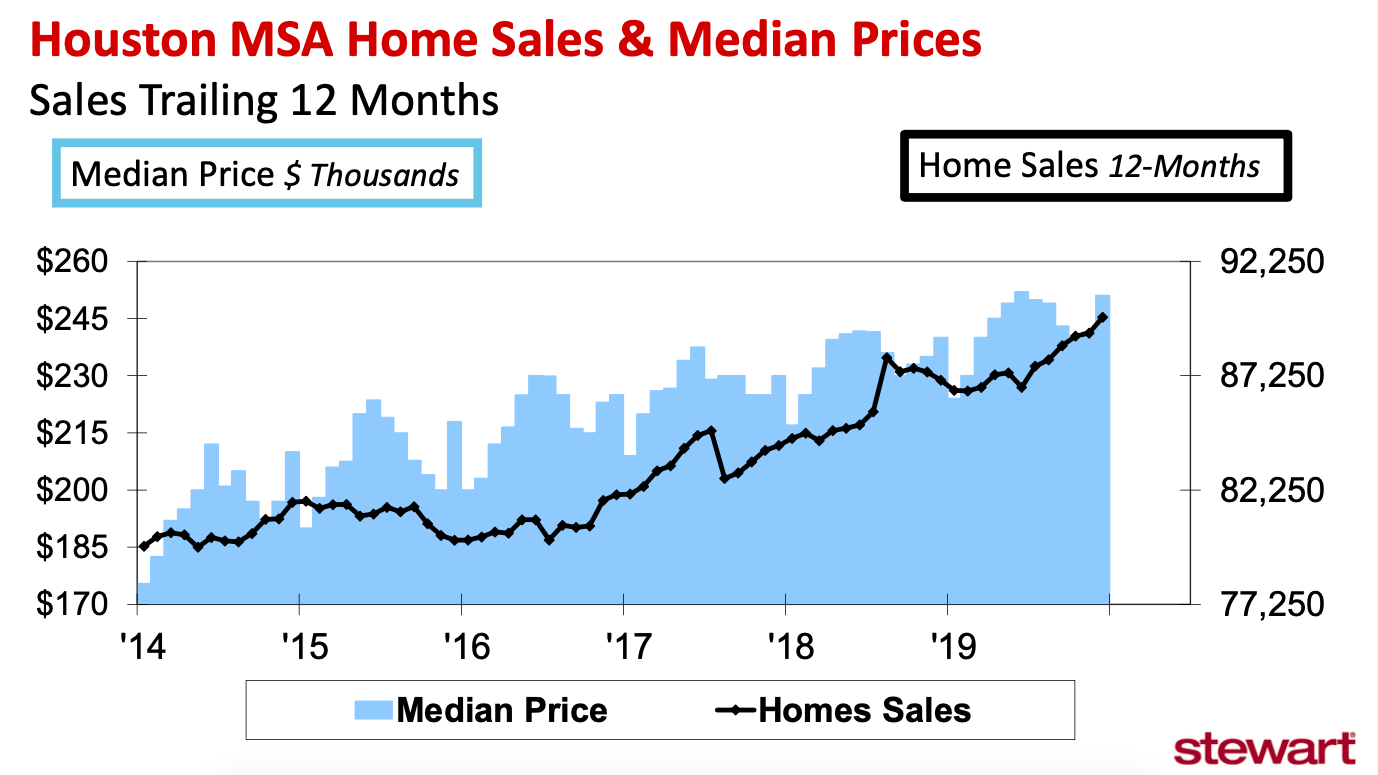

The Houston housing market entered 2020 off of a momentous record-breaking run the previous year.

2019's single-family home sales surpassed the previous year's record volume by almost 5%. Main drivers include:

- low mortgage interest rates

- healthy employment growth

- stable supply of homes

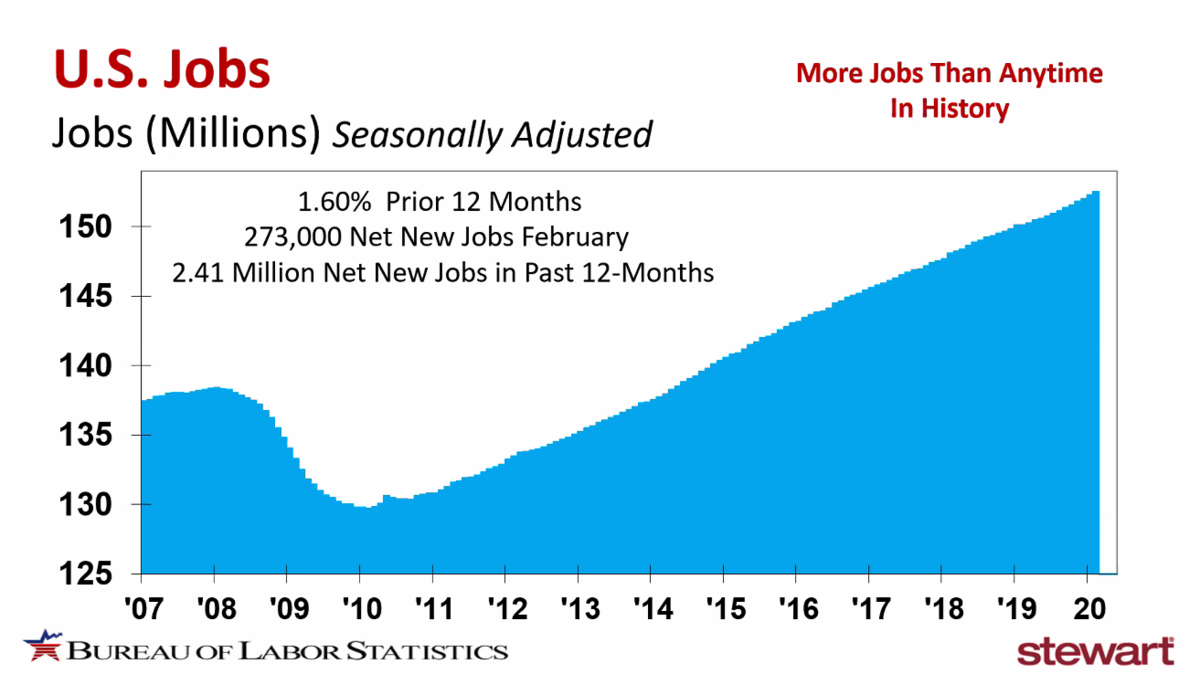

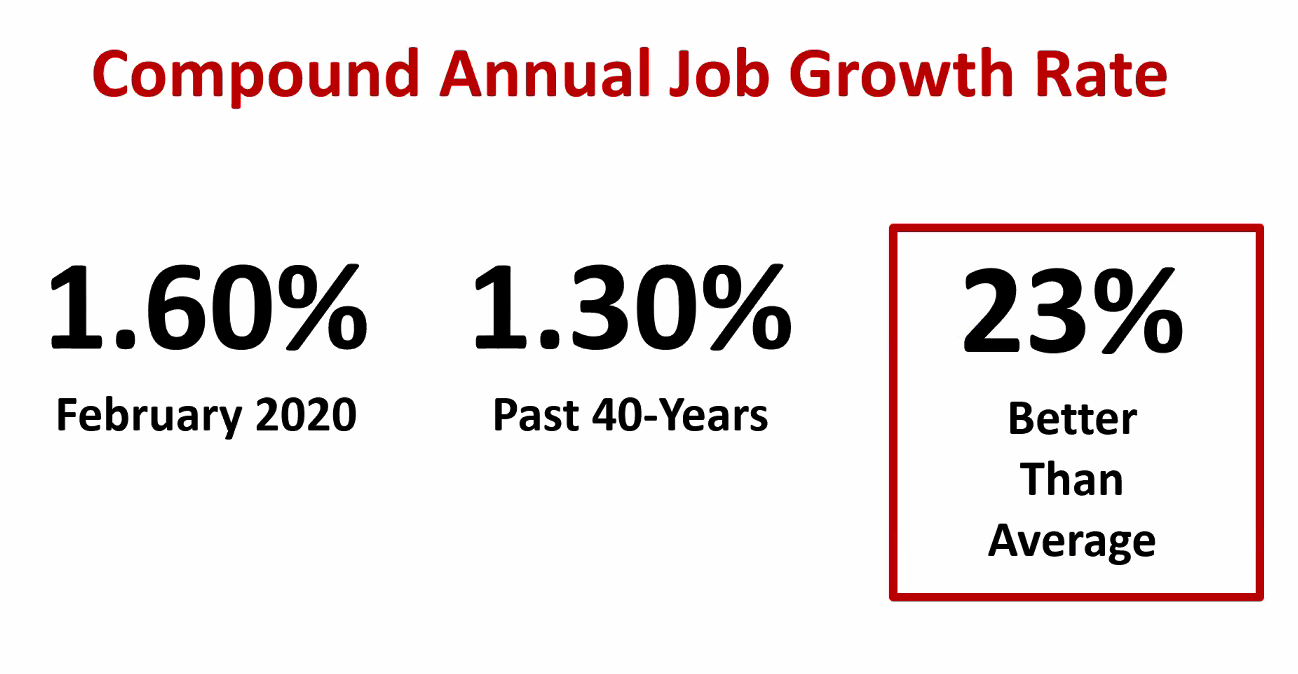

Job growth is the leading indicator of real estate stability. In 2019, over 92,000 people (about 250 each day) moved to Houston because:

- 1 in 3 manufacturers in Texas are located in Houston

- We’re ranked as the #1 seaport in North America

- Houston is home to over 500 tech companies

- Our city has the largest medical facility with over 360,000 healthcare professionals

- Houston has the 4th highest # of Fortune 500 companies

- 35% of publicly traded oil and gas companies are located in Houston

Before the start of the year, Houston was projected to gain 49,000 jobs this year.

Now, because of the oil price crash and COVID-19, The Bayou City is on pace to lose that many--or more.

Coronavirus In Houston Today

Lessons from the last viral outbreak and how it can apply to Coronavirus in Houston today.

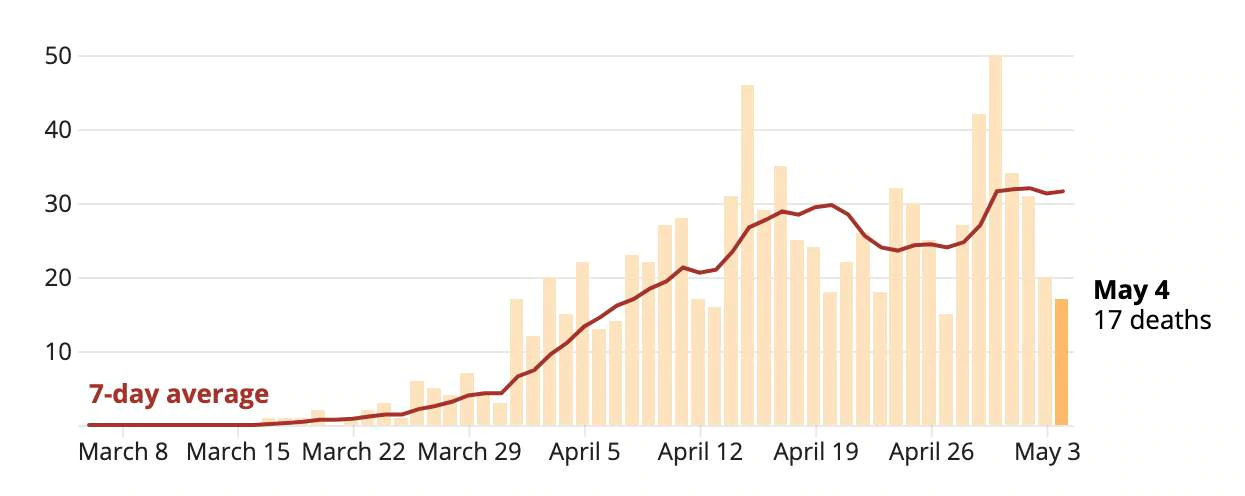

As of May 5, the World Health Organization (WHO) was saying there have been:

- 252,675 deaths worldwide.

- 69,925 in the United States.

- 847 in Texas.

- 75 in Houston(city).

- You can get the current statistics here

Outside of COVID-19’s country of origin, the WHO is reporting a 3.4% death rate for those who have contracted it.

According to the CDC, the main reason that COVID-19 is of higher concern is the pace at which it’s spreading:

“The virus that causes COVID-19 seems to be spreading easily and sustainably in the community (“community spread”) in some affected geographic areas. Community spread means people have been infected with the virus in an area, including some who are not sure how or where they became infected.”

- Active Listings

- New Listings

- New Homes Under Contract

- Price Reductions

- Total Showings

Based on initial trends, the pandemic and ensuing lockdown had a considerable impact on the real estate market. However, properties are STILL going under contract and new listings are still going active.

We can learn from history and apply it to today.

For example, do you remember the Ebola virus? Remember how panicked everyone was about that epidemic?

WorldAtlas.com wrote: “The world’s most widespread Ebola virus disease outbreak happened in West Africa in 2013 and lasted until 2016. Major loss of life and socioeconomic losses were suffered during this epidemic . . . After a peak in October 2014, things started getting under control as international efforts started bearing fruit. Finally, on March 29, 2016, WHO (the World Health Organization) terminated the status of the epidemic as an emergency of international concern.”

There were 11,323 deaths during that time frame.

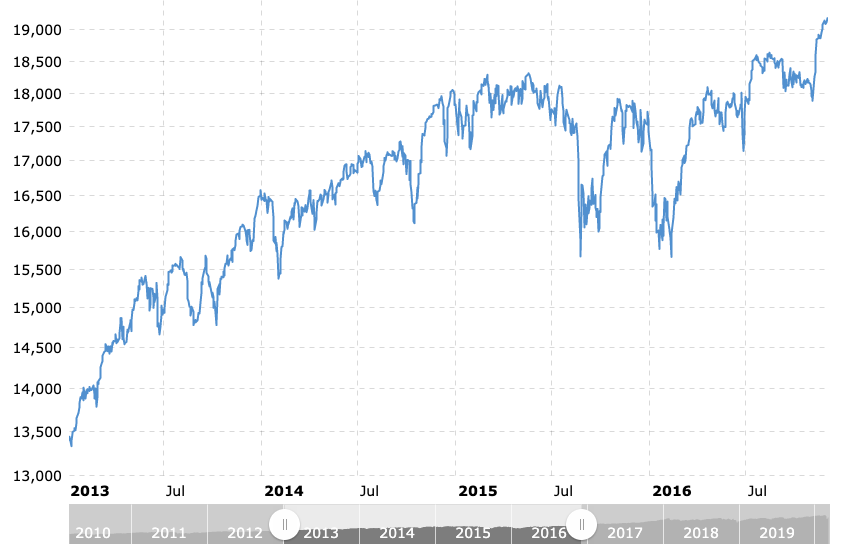

Here's what happened to the US stock market (Dow Jones Index):

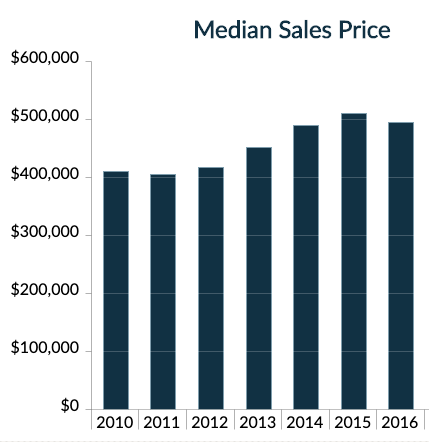

And here's what happened to Houston Inner Loop Real Estate Prices:

As a note the ~3% drop in median home prices in 2016 from 2015 in Inner Loop Houston real estate was correlated to the drop in energy prices. About 1/3 of Houston's jobs are tied to the oil & gas markets.

There's little doubt that the coronavirus has affected the Houston real estate market. However, the bigger impact appears to be coming from the oil price crash.

Job Losses In Houston: Areas And Industries At Risk

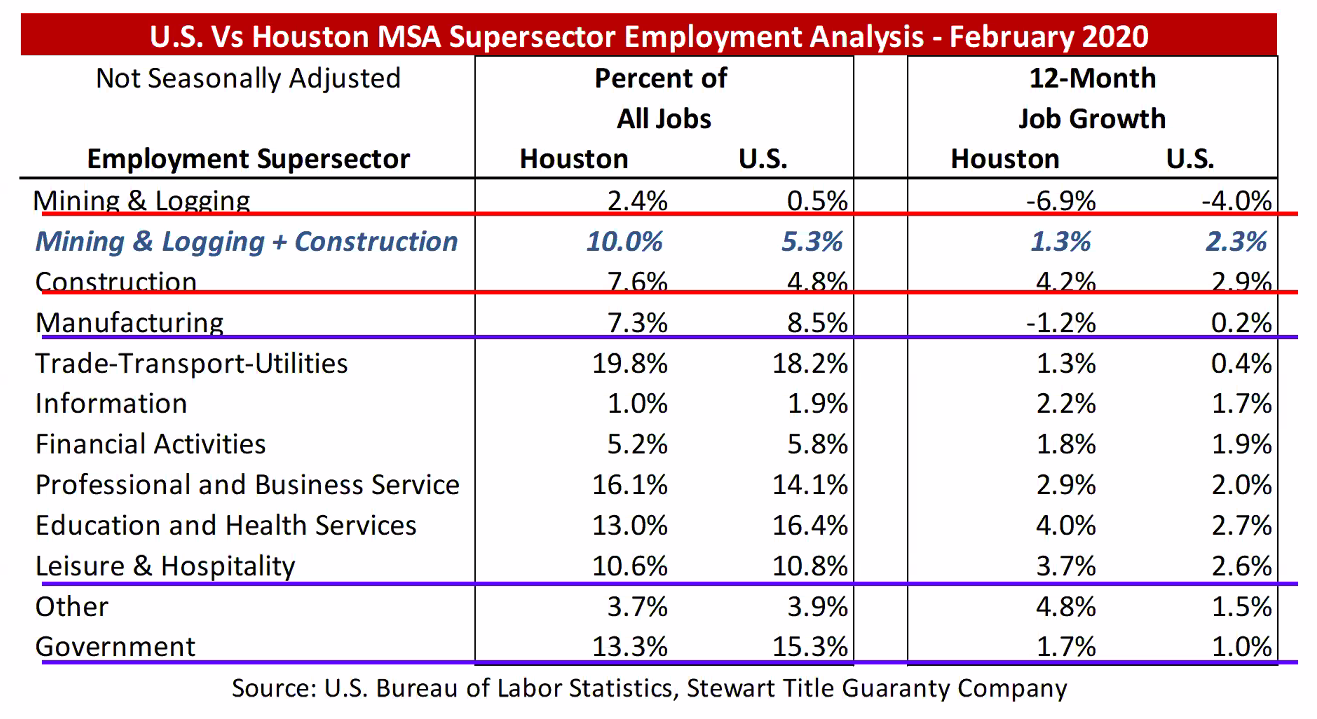

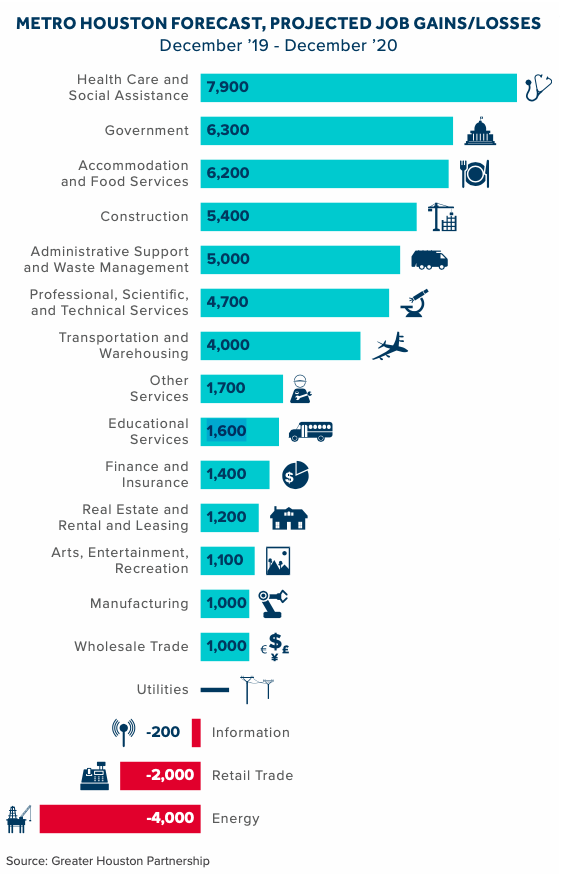

The #1 determining factor for the real estate market is job growth. In 2019, over 92,000 people moved to Houston last year due to our healthy employment growth. In the 2nd quarter of 2020, the coronavirus global pandemic and the oil price crash has significantly reshaped all industries all over the city.

Before the start of the year, The Bayou City projects moderate job growth in 2020 with over 42,000 net new jobs expected in the Greater Houston area.

Then COVID-19 and the oil price crash happened.

Some analysts predict Houston's job losses to reach as high as 200,000 by the end of the year. Those numbers are grim and could dictate how the housing market will perform this year.

In 2019, over 92,000 people moved to Houston last year. Employment was a main driver, and it shows Houston is now less dependent on the oil and gas industry:

- 1 in 3 manufacturers in Texas are located in Houston

- We’re ranked as the #1 seaport in North America

- Houston is home to over 500 tech companies

- Our city has the largest medical facility with over 360,000 healthcare professionals

- Houston has the 4th highest # of Fortune 500 companies

- 35% of publicly traded oil and gas companies are located in Houston

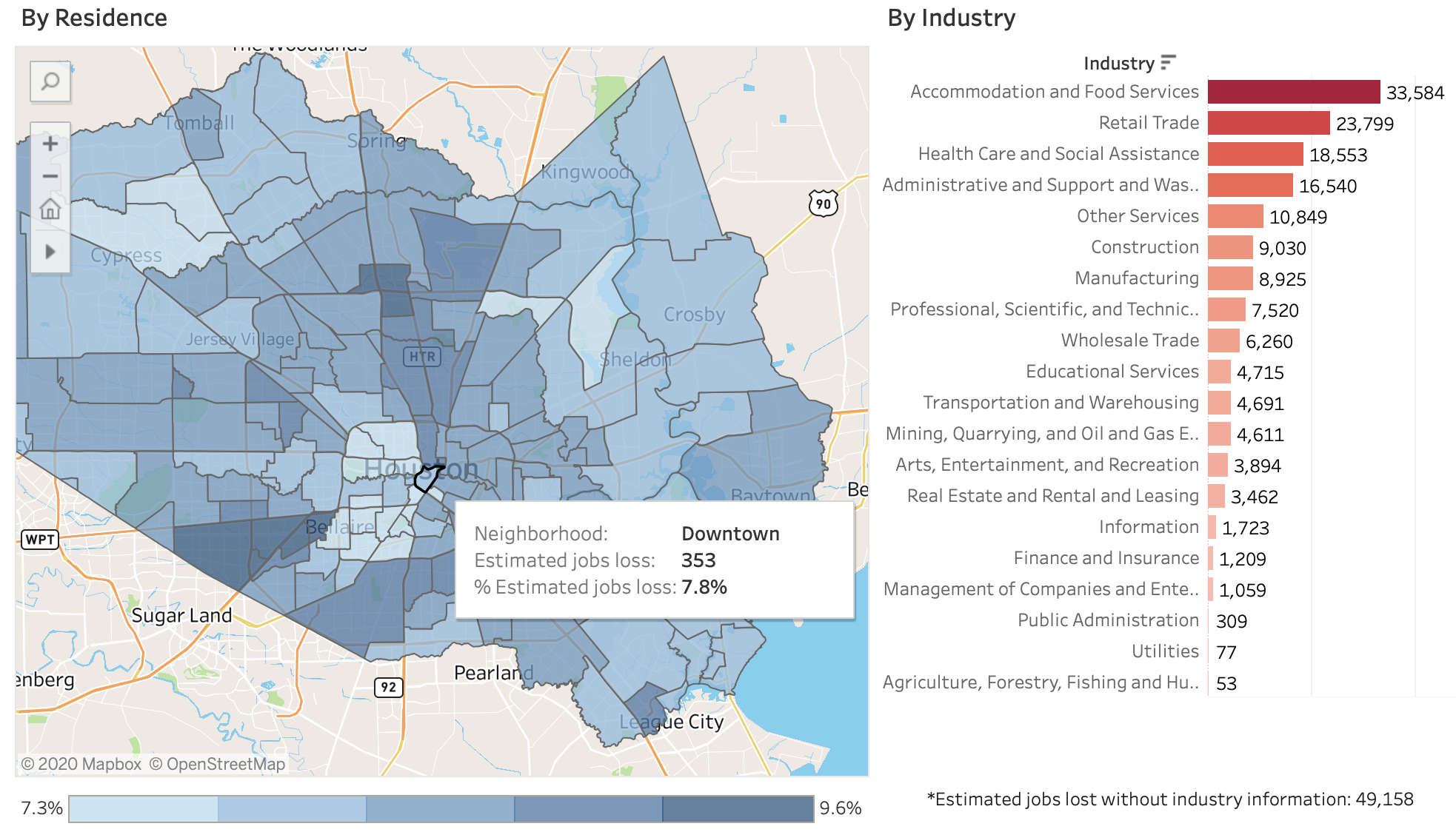

Kinder Institute's Houston Community Data Connections details the job-loss estimates across Harris County neighborhoods. Key takeaways include:

Estimated # of workers who lost jobs range between 7.3% to 9.6%

Accommodation and Food Services lost over 33,000 jobs; Retail dips by over 23,000

Areas (Sharpstown, Gulton, Greenspoint, etc) with a high number of people working in retail suffered significant job losses

Over 9,000 Construction workers lost jobs, many of them located in east Harris County

Job losses in retail are quite even all across Harris County, except the west side of the Interstate 610 loop

Low-income renters are among the most vulnerable populations. In some regions, more than 60% of renters allot over 30% of their income on rent

Is Oil & Gas Potentially More Concerning Than COVID-19?

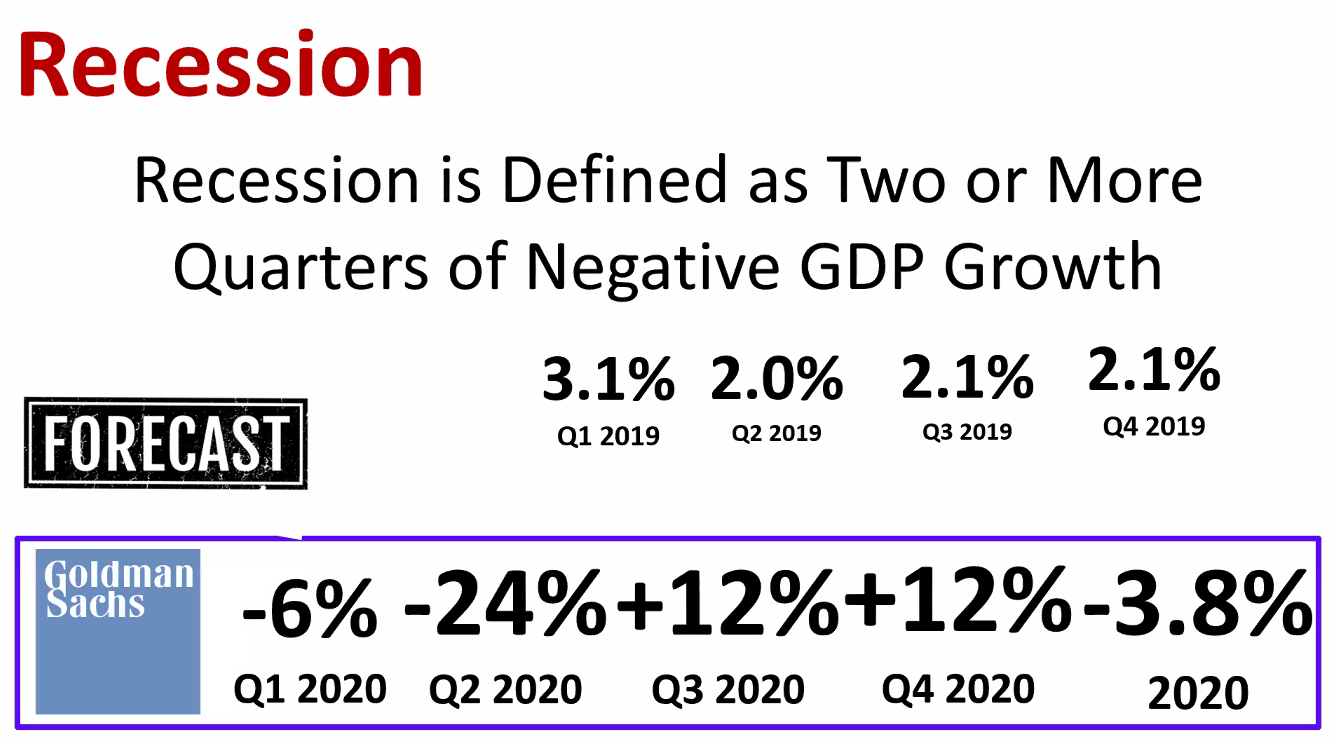

In a $20 oil environment over 500 US oil exploration and production companies will file for bankruptcy in two years. At $10, that number would more than double. That could fuel a recession.

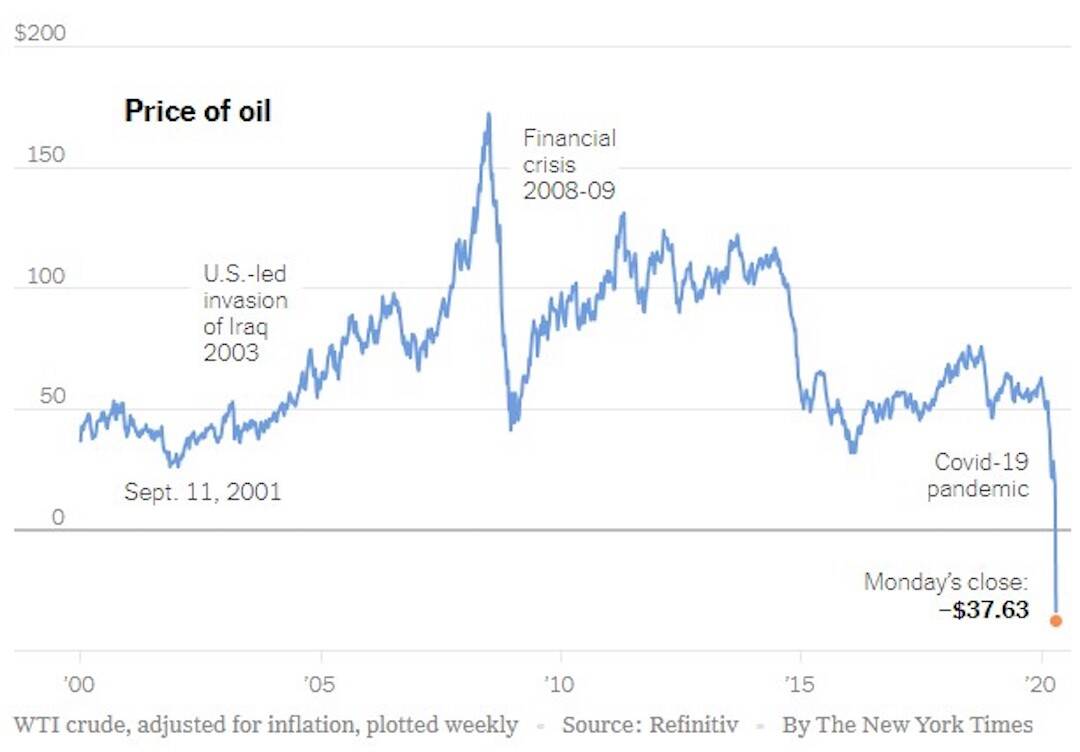

The coronavirus pandemic has hit the "pause" button on the global economy, pushing oil demand to drop - we're literally running out of room to store barrels. Russia and Saudi Arabia flooded the world with excess supply.

This double whammy has put the American oil industry in a difficult position.

US crude for May delivery turned negative a few weeks ago. This has never happened since NYMEX oil futures began trading in 1983.

The oil price crash is hitting Houston harder than most cities. While we are a lot less dependent on oil (compared to the '80s, about a third of the total jobs in Houston are tied to the industry.

Dirt-cheap oil could unleash a wave of bankruptcies, furloughs, and layoffs.

A good number of oil companies took on too much debt during the good times. Quite a few of them won't be able to survive this historic downturn.

According to analysts, in a $20 oil environment over 500 US oil exploration and production companies will file for bankruptcy in two years. At $10, that number would more than double. That could fuel a recession.

8 Questions About The 2020 Houston Real Estate Market

For a customized approach to your home buying or selling experience, contact Paige Martin, the #1 Individual Agent with Keller Williams in the State of Texas and team lead of The Houston Properties Team.

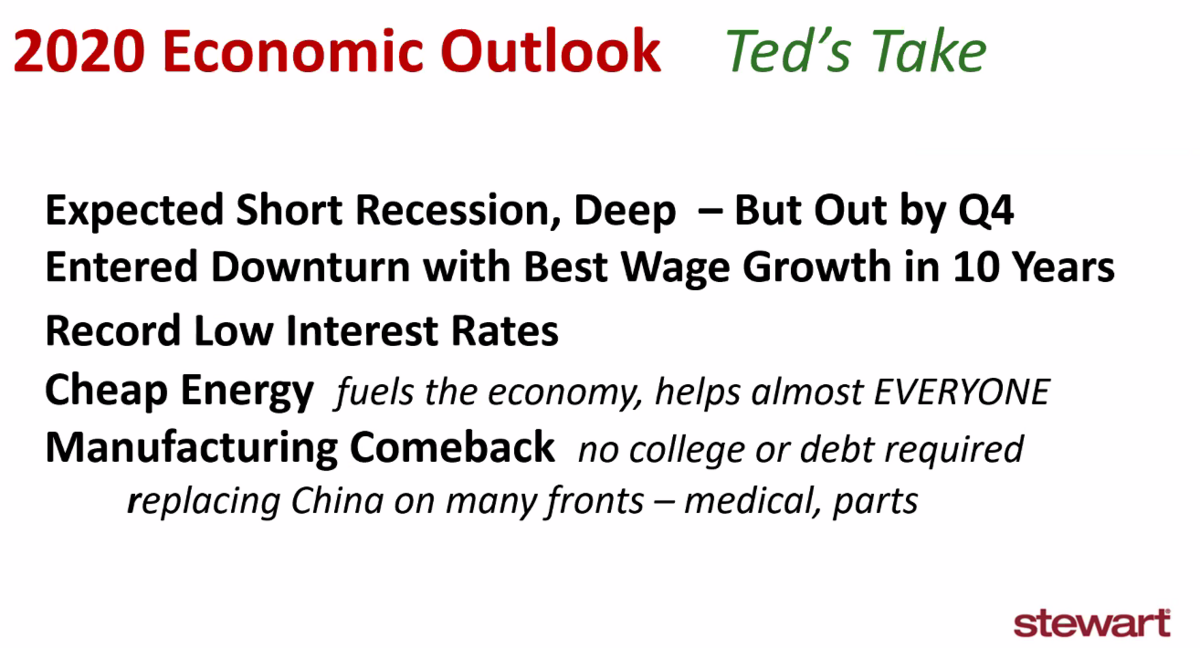

EDITORS NOTE: This section was written BEFORE 2020. We haven't taken into consideration the Coronavirus and the oil price war then. We have updated this article (please see above) noting the (current and potential) impact of the recent events.*

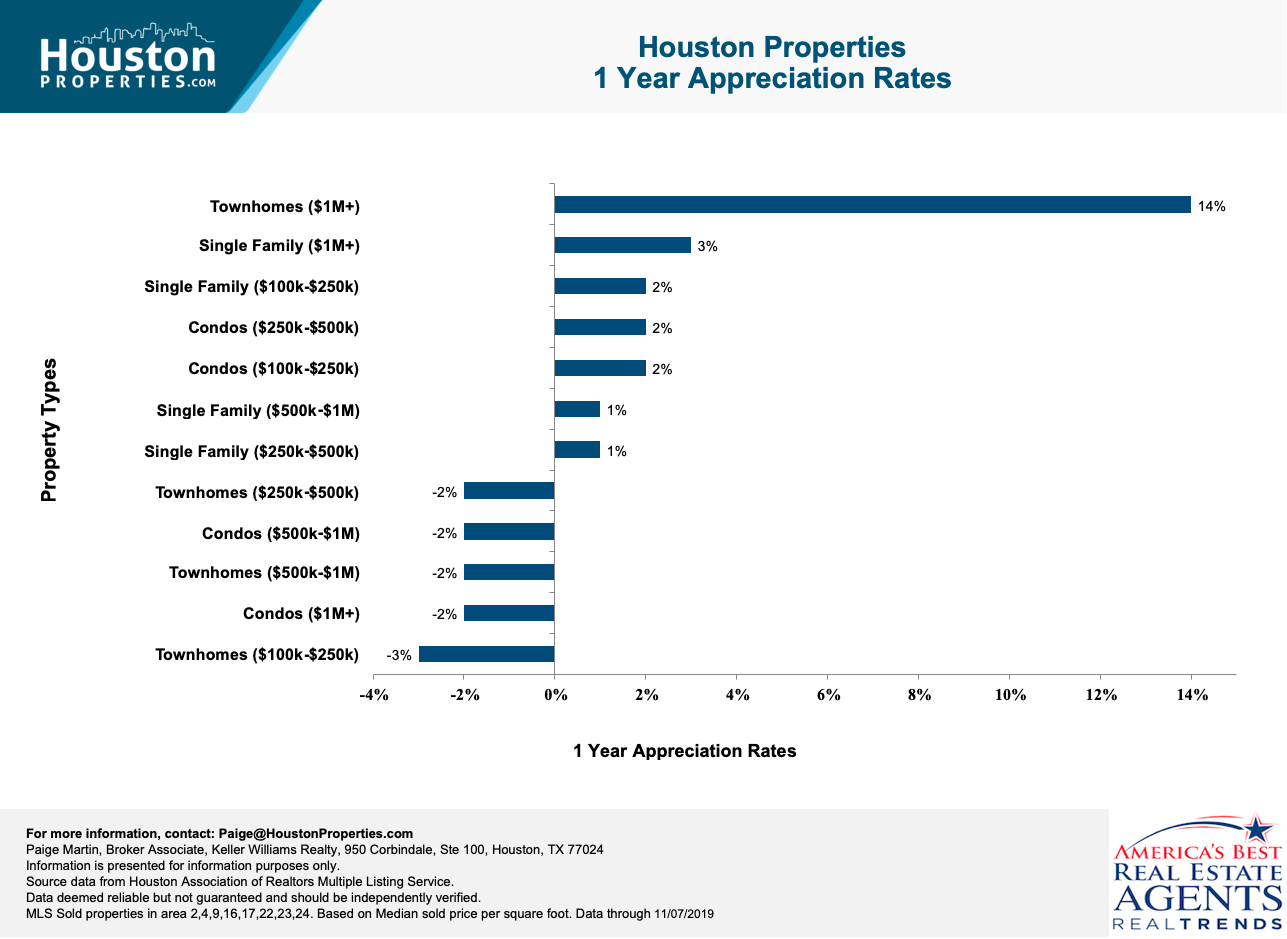

The 2019 Houston housing market last year had its ups and downs. We expect 2020 to follow the same trend.

The #1 determining factor for the real estate market is job growth. The Bayou City projects moderate job growth in 2020 with over 42,000 net new jobs expected in the Greater Houston area.

This is slightly below the high-marks set in the previous two years. We expect the housing market to mirror this growth throughout the year, albeit at a slower pace compared to the record-breaking numbers we've seen in the last two years.

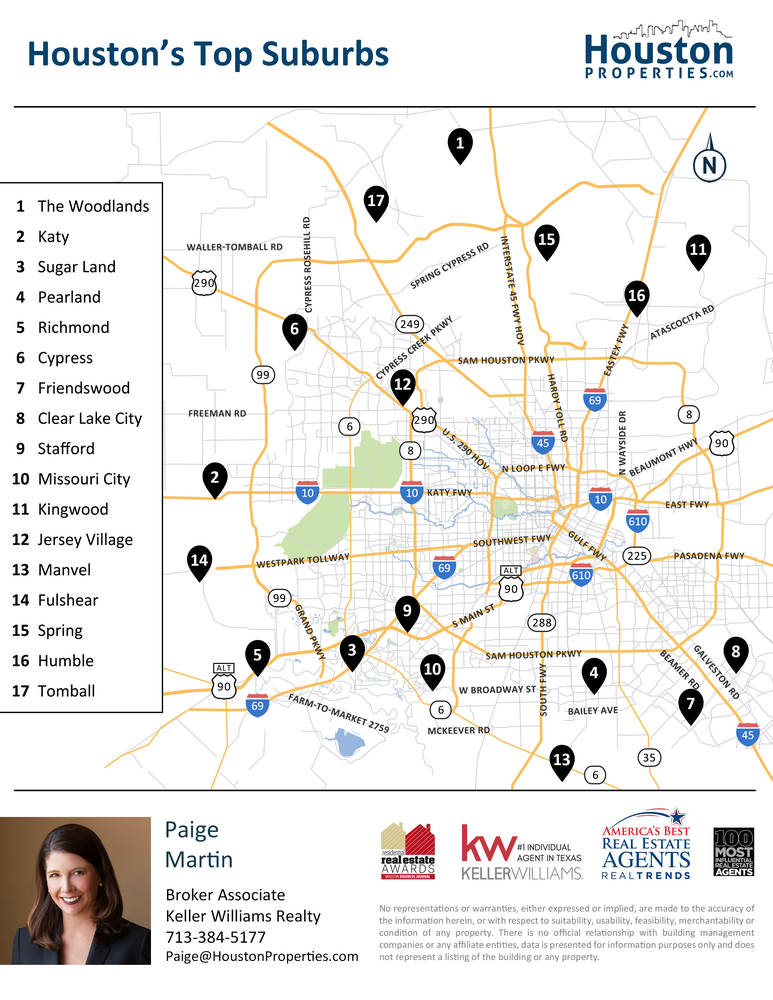

In times of fear, uncertainty, and doubt, we see a consistent flight to quality. The highest growth rate should be around the four major employment hubs: Downtown, Galleria, Texas Medical Center, and the Energy Corridor. We should see the same trend in:

- Houston's Top Suburbs

- Best Inner Loop Neighborhoods

- Most Expensive Areas

- Neighborhoods Zoned To Top-Ranked Schools

- Most Accessible Neighborhoods

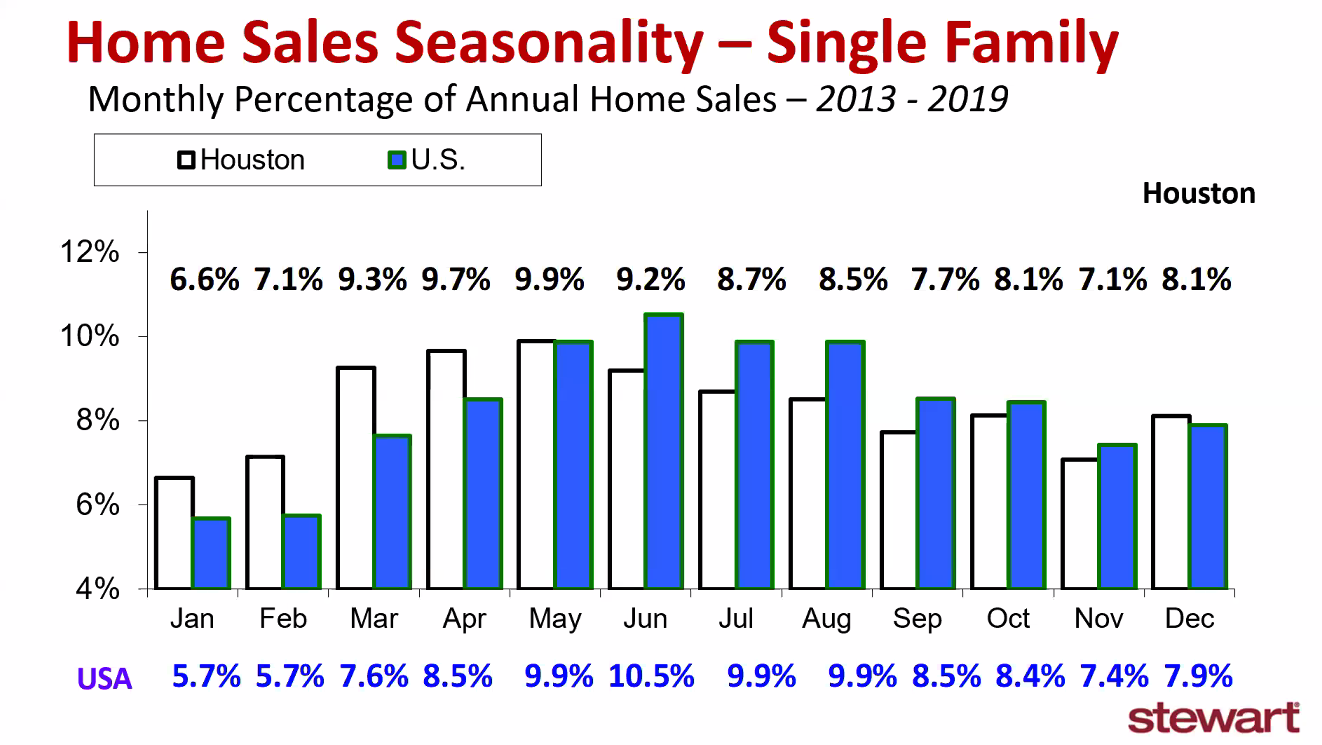

Looking at the Houston housing price trends from the 2016 elections, we anticipate seasonal slowdown this year. Expect the market to dip around September to November as campaign ads and electioneering pull buyers out of the market pool.

We have broken down Houston housing market predictions circling these core issues:

1. Is The Houston Real Estate Market Looking At A Downturn This year?

The local economy should continue to boost the housing market this year.

Houston created over 80,000 jobs (a 2.7% year-over-year increase) in the last 12 months. Even allowing for a 50% decrease due to the upcoming elections, stock market corrections, the trade war with China, etc., Houston is poised to add over 40,000 jobs in 2020.

Unlike in the past, Houston’s local economy is a lot more diverse and a lot less dependent on oil. Healthcare & Social Assistance, Government, Accommodation & Food Services industries are expected to make up for the bulk of the jobs this year vis-a-vis losses from the Energy, Retail, and Information sectors.

Over 92,000 people moved to Houston last year. We’re adding more than 250 new residents each day because:

- 1 in 3 manufacturers in Texas are located in Houston

- We’re ranked as the #1 seaport in North America

- Houston is home to over 500 tech companies

- Our city has the largest medical facility with over 360,000 healthcare professionals

- Houston has the 4th highest # of Fortune 500 companies

- 35% of publicly traded oil and gas companies are located in Houston

2. Houston Real Estate 2020 Forecast: Is This A Buyer’s Market?

For the majority of Houston, it will still be a seller’s market, but we’re seeing it less and less so each month.

For instance, Houston home inventory is at 4 months. A balanced market has around 5-6 months of home inventory. However, home inventory 5 years ago was only at 2.7 months. Already we’re seeing discrepancies between the Houston housing market outlook of sellers and buyers and it’s starting to create problems.

Again, with Houston real estate being hyper-local, the answer varies for each specific neighborhood.

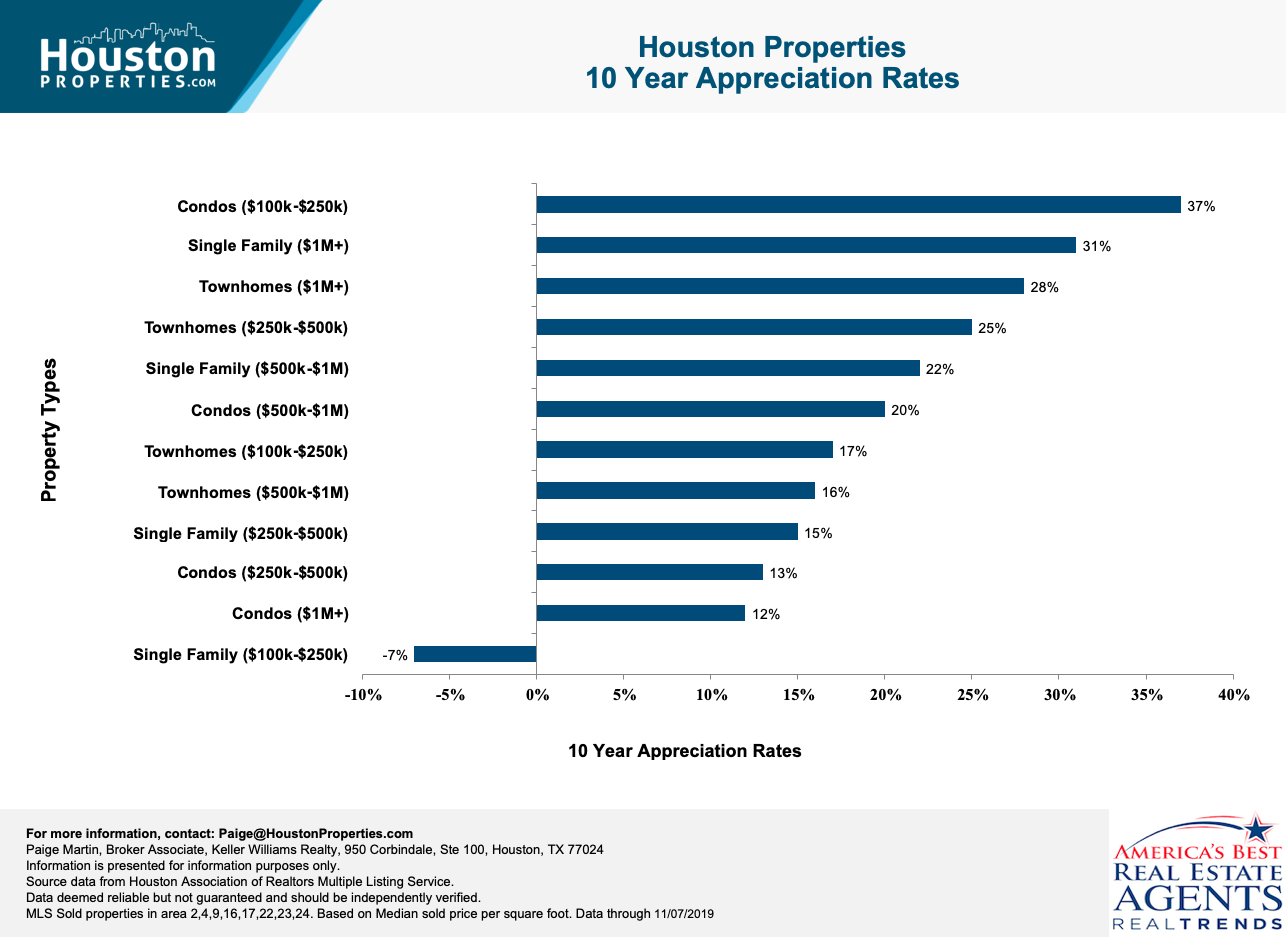

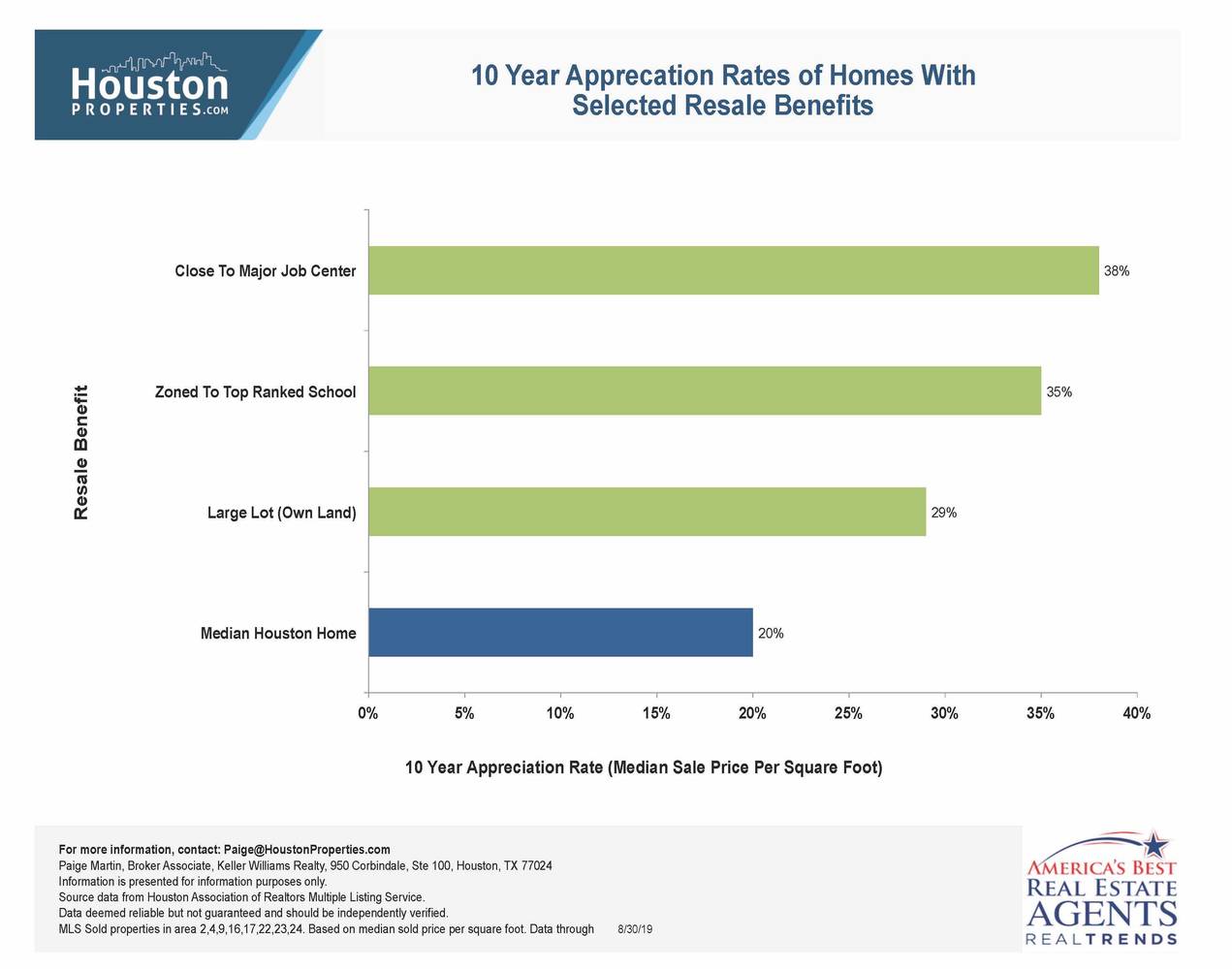

I expect home sales in quality locations to perform well. While there may be blips in certain neighborhoods, homes with land, zoned to top-ranked schools, located near major job centers have nearly doubled the overall market on a 10- and 20-year basis. Like we said above, whenever turbulence arises, we have a flight to quality.

I don’t think that we’ll see “screaming deals,” but I think we’ll have more willing sellers and there will be opportunities for buyers to pick up things “in a lull” before things heat back up.

The stock market, the trade war with China, and upcoming political theatre have created (and will continue to create) a lot of drama. I believe that those buyers who focus on the fundamentals (good locations, with land, zoned to top-ranked schools with quality layouts) can purchase attractive, long-term investment options.

3. What Trends Should Buyers & Sellers Look At In 2020?

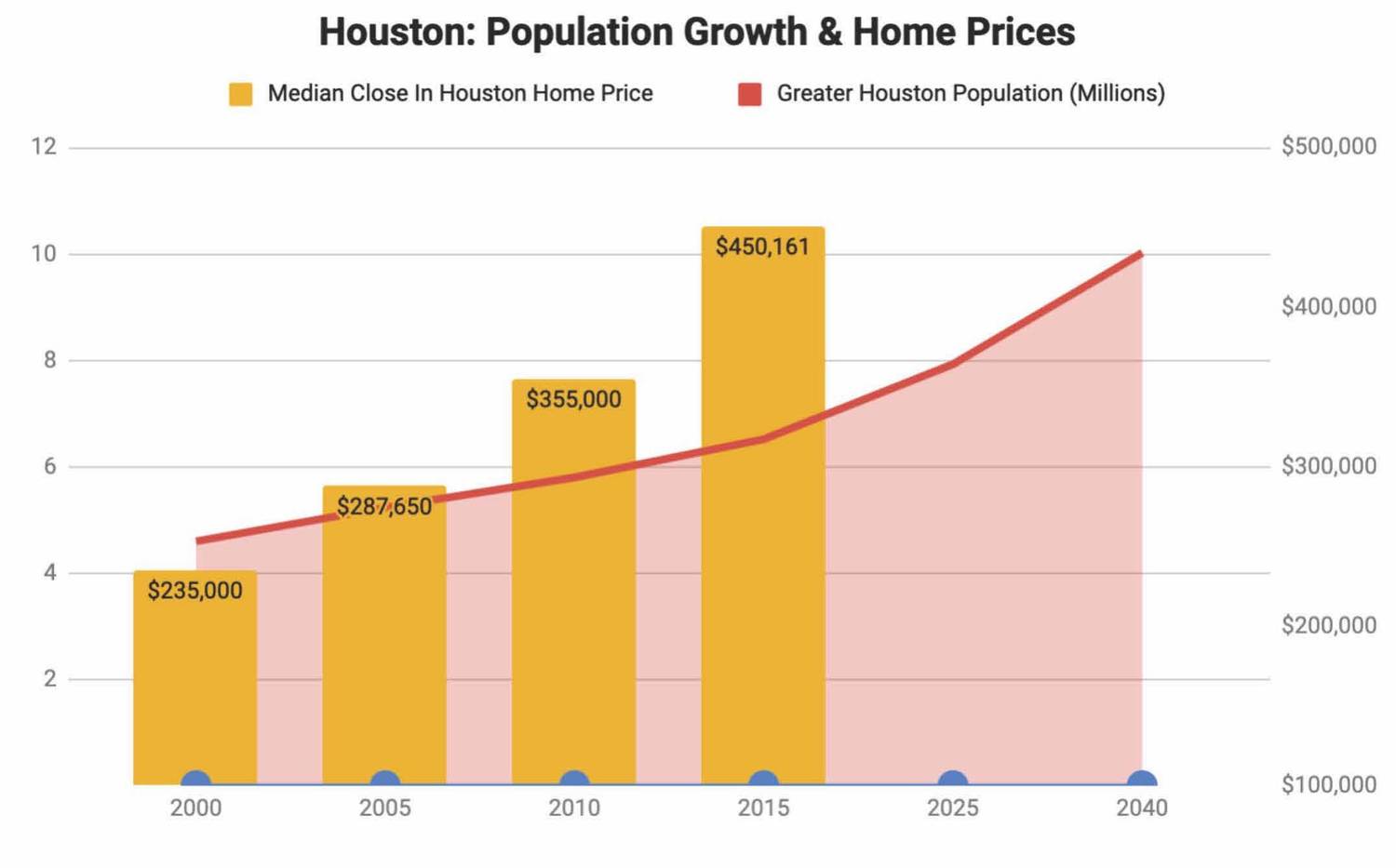

Correlating the growth of Houston population and home prices over the past two decades, I think 2020 will be a strong year for sellers, primarily because of the buying power of the average Houstonian.

Jobs. Cost Of Living. Location. These are the three most important factors driving the real estate market, and the reasons I’m bullish on Houston this year.

Houston’s economy should add around 50,000 net new jobs this year. Cost of living in Houston ranks third lowest among the nation’s top 20 most populous US metropolitan areas.

The best opportunities for both buyers and sellers will be properties with these characteristics:

- Located in quality neighborhoods that have good proximity to major job centers;

- Large lots (the primary value is the land value);

- Not located on a busy thoroughfare, near a highway or near a railroad;

- A street location with some kind of premier feature (by a cul-de-sac, on a street with a tree-filled median, etc.);

- With a home that is liveable and can be rented. Typically, new construction homes come with a higher purchase premium and “true fixer uppers” require too much investment.

If you are looking to buy a home:

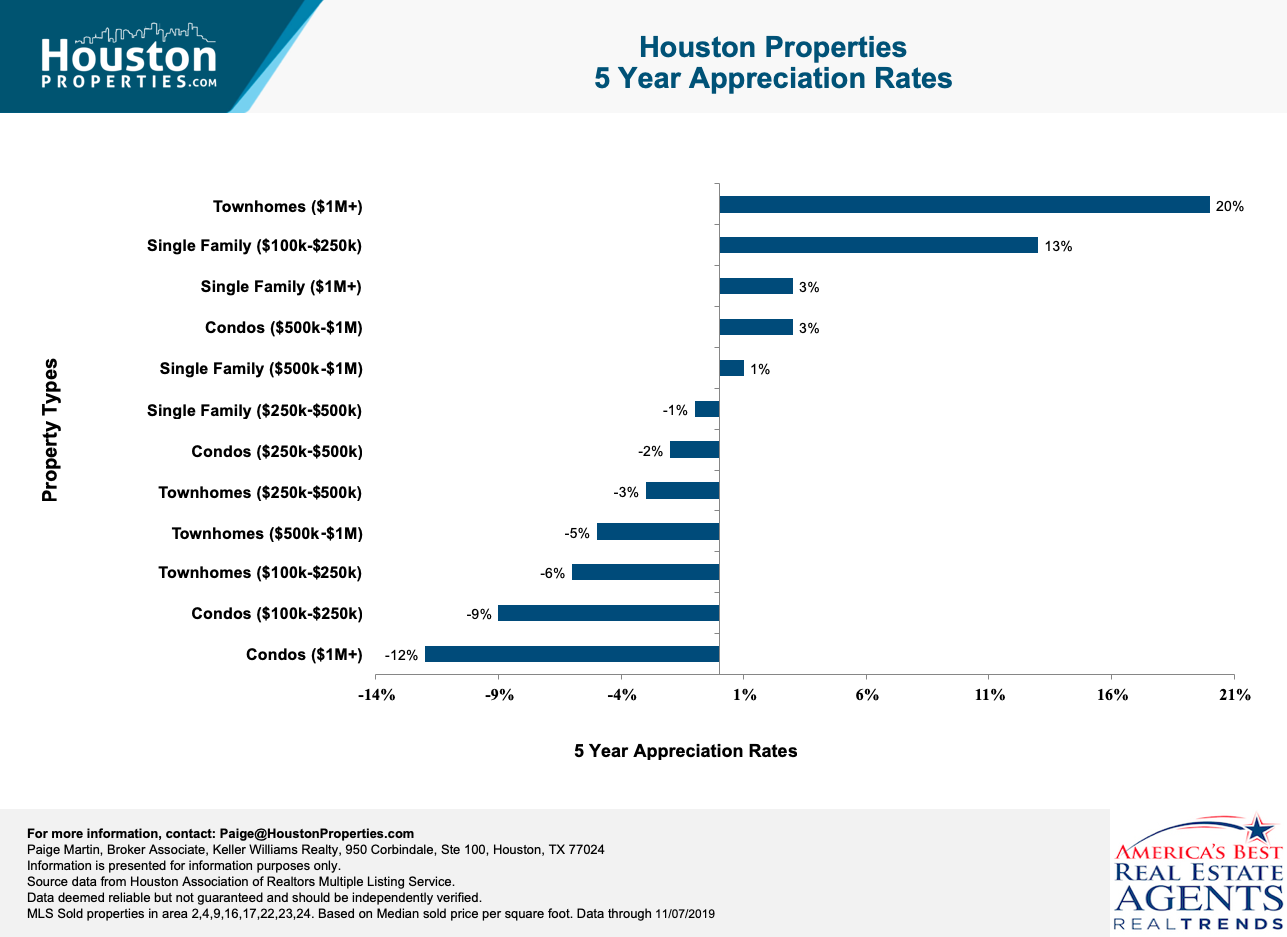

While the "average" Houston home has appreciated, there have been areas, neighborhoods & individual properties that have beaten the market by 500% or more.

As we guide our clients in both helping them generate long-term wealth from their investment and living their best life, we want to quantify the successes (and failures) from the housing market.

From analyzing 512,056 Houston home sales over two decades, we identified five home characteristics that have a systematic and statistically significant POSITIVE impact on a home's resale value. We will help you see what a good property investment in Houston really is.

We dubbed these the "5 Successful Investment Themes."

Properties with any of these factors on average:

- Resell for higher values than their peers.

- Benefitted from higher demand.

- Benefitted from having multiple types of bidding (residents, builders, investors).

- Sell faster.

- Sell for closer to list price.

If you are looking to sell your home:

- Read the Top Nine Home Selling Mistakes To Avoid

- Get a Free Home Valuation Guide

- Review the Best Houston Property Market Program

- Read the Houston iBuyer Review Guide

- See Our "Best Houston Realtor" Experience

4. How Will The 2020 Election Affect The Houston Housing Market?

Houston real estate is hyper-local and if we go by the trends of the previous election (2016), there shouldn’t be any significant impact.

Back in 2015 (probably the closest we've come to a Houston housing bubble), economists also predicted a slowdown due to falling oil prices and resulting energy industry layoffs, and the then-upcoming election. However, the Houston housing market held steady throughout 2016 and had a record-breaking year in home sales.

Full-year 2016 sales for Houston single-family homes had a 3% increase from 2015 and is 1.3% above the record of homes sold in 2014. Total dollar volume for properties sold in 2016 rose 4.2% to $24.5 billion.

We expect the 2020 election to have a minimal impact on home sales next year.

5. Which Areas Are Going To Trend Well This Year?

Houston real estate is hyper-local. As we consistently tell our clients, one of the few reliable Houston market trends is that there will always be a flight to quality.

Homes in good locations (close to major job centers, zoned to top-ranked schools, outside primary flood zones, not adjacent to railroads or major roadways) have proven to perform well (and will continue to do well).

By contrast, we believe homes in disadvantaged locations will struggle as builders keep adding inventory to awkward lots, and as the continued development of the city make Houston more prone to flooding and traffic congestion.

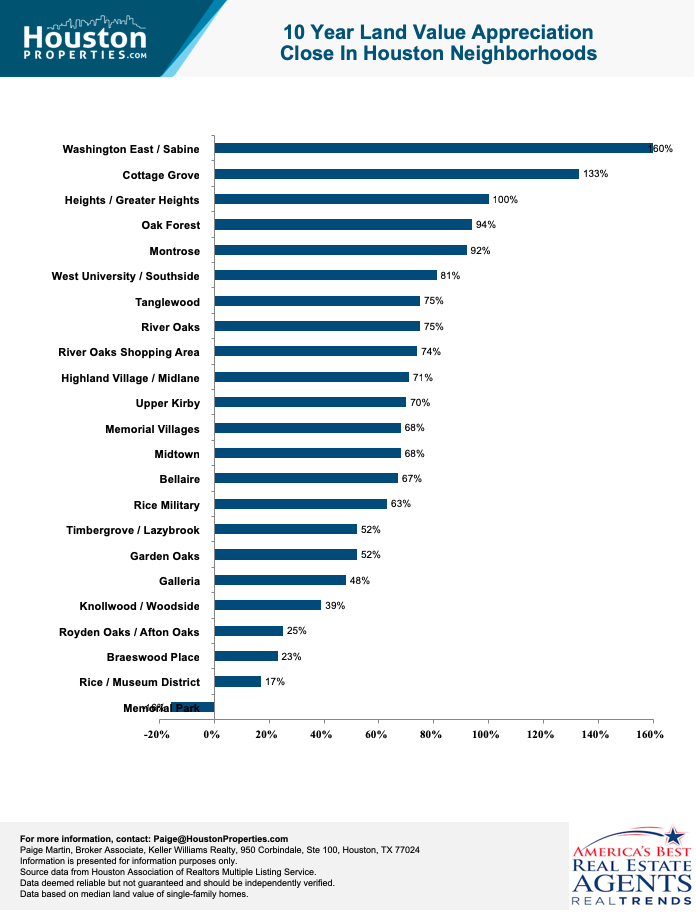

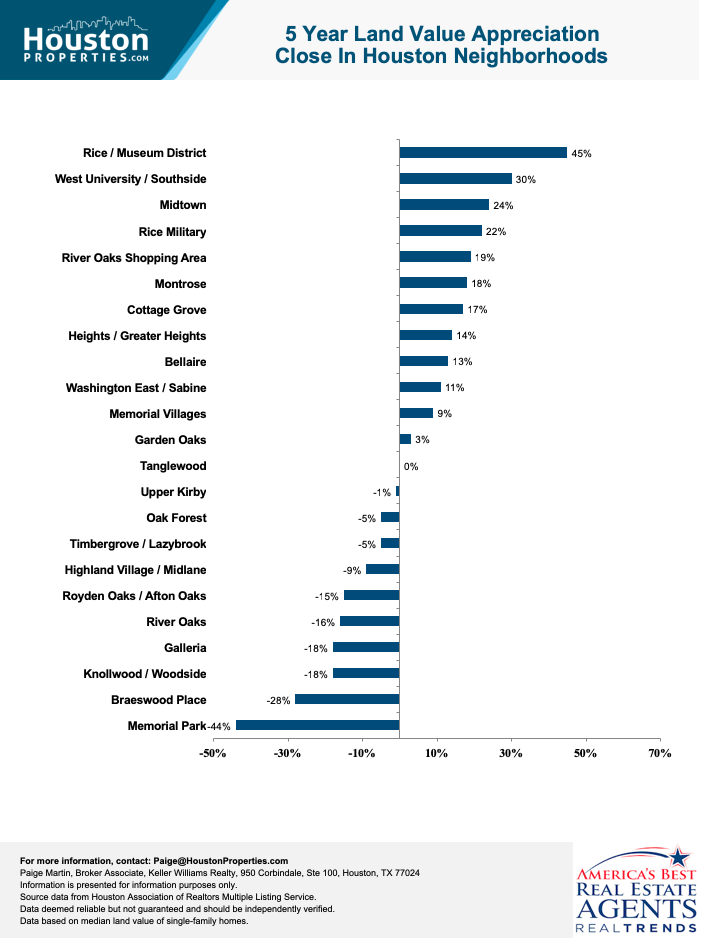

Close-In Houston neighborhoods with strong appreciation rates the past 10 years will continue to perform well. Smart buyers and investors will always be drawn to areas with a strong track record.

We also expect top neighborhoods near Texas Medical Center (or with good MetroRail access to TMC) to post very strong growth numbers in the next 10 years.

Around $5B worth of health-care related projects are currently underway in the area, and health care jobs are projected to double within the next decade. TMC is already the world’s largest medical complex with more than 60 institutions, 106,000 employees, and 10 million patients each year.

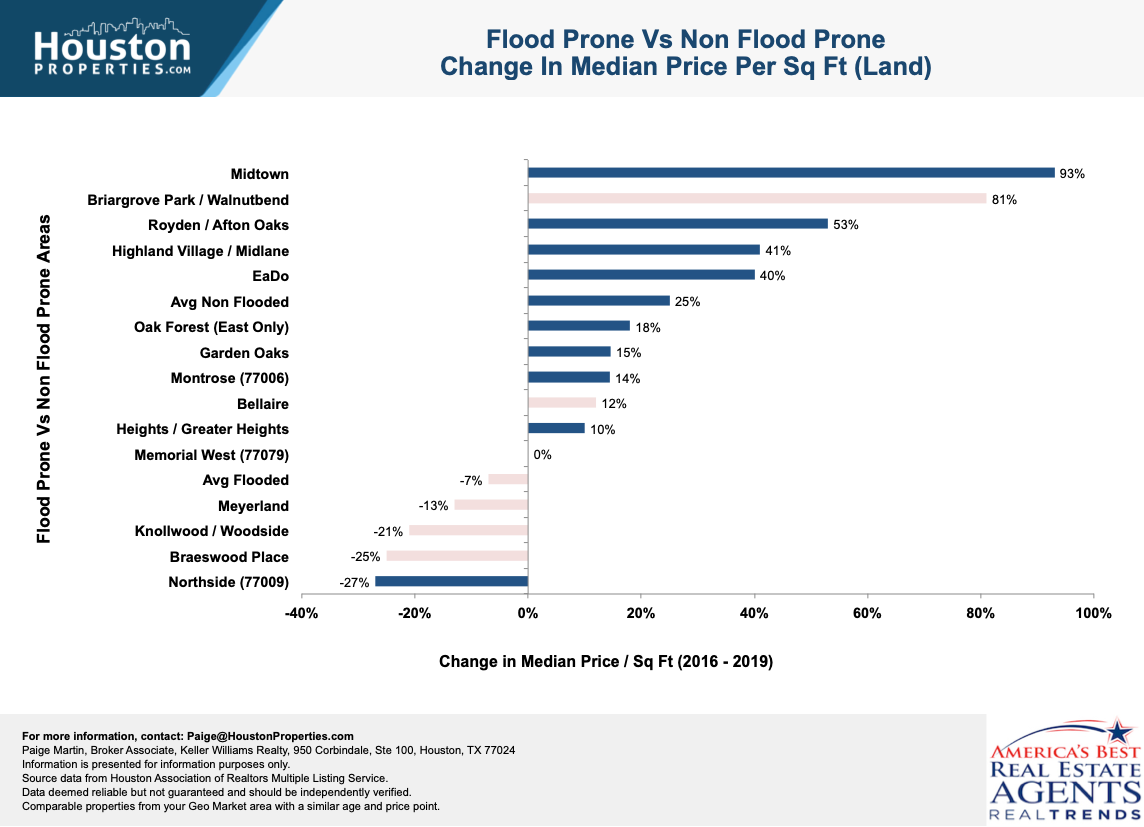

Lastly, well-developed suburbs should continue to appreciate well. Areas like Katy, Missouri City, Pearland, Sugar Land, and Spring posted very strong land value appreciation rates last year. These suburbs have grown large enough where buyers were willing to pay more for certain lots in prime, non-flooded locations, zoned to top-ranked schools.

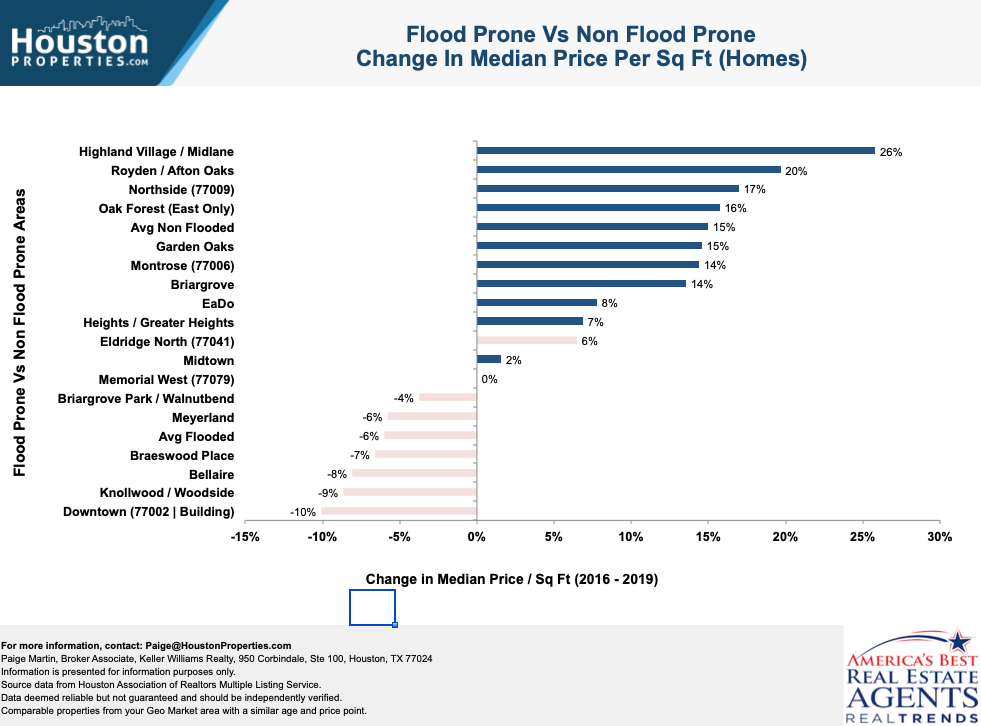

6. Which Areas Are Going To Trend Poorly This Year?

I believe the areas that flooded multiple times will continue to struggle.

These areas suffered in 2018. Last year, we saw the same trend due to two main reasons:

First, Houston’s city council passed onerous regulations for any new permits in flood prone areas.

Many builders and major remodelers I’ve talked with expect their costs to increase by 15-25% in these areas.

The second issue is when Harvey-flooded-and-then-renovated homes started hitting the market.

Some were done by reputable builders, but many didn't have remediation certificates, quality construction, or strong warranties.

This made determining fair value difficult between non-flooded homes, flooded-and-well renovated and flooded-and-poorly renovated homes.

In addition, many builders in these areas have set their list pricing based on their cost plus the “amount of money they need to make.”

As an example, new construction homes between $1M-$1.5M in Bellaire are on the market for an average of 285 days now as sales have declined by 30%.

While builders are currently holding strong to their list price, I believe that many will be forced to sell at material discounts, creating more downward pressure on prices.

I’m also concerned about the resale of several new construction condo projects.

In some cases, developer pricing has been 30-50% above the average price per square foot of Houston’s top-ranked condo buildings. While there have been limited resales, at least one original buyer experienced a $1M+ loss already.

7. Will iBuyers Reshape The Real Estate Market This Year?

As we have seen in other markets, the iBuying industry should have a significant impact on the real estate industry. The business is shifting.

iBuying is an excellent tool and should be a primary option for a good percentage of buyers and sellers. The operative word there is “tool”.

Buyers and sellers will continue to seek good agents who have 1) strong market knowledge, 2) mastery of the nuances of the Houston market, and 3) strong systems in place for contract and admin management. Clients will be on the lookout for agents who can harness iBuying as a tool (like Keller Offers for KW agents).

As we’re seeing in other locations with active iBuying operations in place, real estate professionals who can provide expert-level advice with a customized approach built on strong personal relationships will remain on top.

We're already seeing this with “Keller Offers” - the new Instant Buyer Platform from Keller Williams that has just rolled out in Houston. It allows clients the best of both worlds: the convenience of a “one easy button” approach and the expert advice and insight of a real estate professional.

In the Houston Properties Team, we also have proprietary market research tools and home value calculators. This platform allows us to easily pull data and comparisons for any location, property type, housing segment, etc.

We have an in-house admin team that uses a compliance and documentation process with over 100 steps to maintain accuracy. Our clients don’t have to deal with the usual stress and problems that usually come with real estate transactions.

As recent as 5-10 years ago, the first step home buyers take is to call an agent. Today 93% of buyers say websites are their primary source of information during their home search. 50% of buyers say they found the home they purchased online first. We recognize this trend and have been incorporating tech in every single facet of the business.

8. What Design Trends Are Driving Home Buyers in 2020?

We saw this last year, and we expect to continue seeing this trend in 2020.

Many buyers have been influenced by HGTV. They either want something “new and pretty” or they want to be compensated for doing the work themselves.

Popular design trends include the use of mixed metals, transitional styling, and more contemporary lines. Many buyers are also asking for homes that are “light and bright” with open floor plans.

We’re seeing a decrease in demand in very stylistic homes (e.g. French, Mediterranean, Spanish homes) and many sellers are better off making cosmetic changes before putting them on the market.

Sources, Methodology & Disclosures

Houston real estate is hyper-local. For advice on the 2020 Houston housing market forecast, contact Paige Martin, the #1 Keller Williams Realtor in Houston and #1 Realtor in the state of Texas.

- All Houston home value information was sourced by the HAR MLS database.

- National Association of Houston Realtors Research Group: 2019 Home Buyers and Sellers Generational Trends Report

- Stewart Title: and the beat goes on An Economic Outlook on What Changes, What Stays the Same, and What's to Come by Ted C. Jones, PhD

- Greater Houston Partnership

- Data is deemed accurate but is not guaranteed. Information is provided for informational purposes only.

- We don’t have a crystal ball. All predictions are our educated guesses. Caveat emptor.

Meet Paige Martin & Our Top Ranked Houston Agents

The Houston Properties Team has a well-defined structure based on the individual strengths of each member. Each member is a specialist in their role – which is why our homes sell faster and for more money than average.

Paige Martin, Broker Associate with Keller Williams Realty, and the Houston Properties Team are ranked amongst the top residential Realtors in the world.

They have been featured on TV and in dozens of publications including: The Wall Street Journal, Fortune Magazine, Reuters, Fox News in the Morning, Money Magazine, Houston Business Journal, Houstonia, and Houston Chronicle.

Paige Martin was just ranked as the #5 agent in the world with Keller Williams, and has completed over $500,000,000 in Houston residential real estate sales.

Recent awards include:

- 2019: Top 25 Residential Realtor in Houston, Houston Business Journal

- 2018: #5 Individual Agent, Keller Williams, Worldwide

- 2018: #1 Individual Agent, Keller Williams, Texas

- 2018: #1 Individual Agent, Keller Williams, Houston

- 2018: America’s Best Real Estate Agents, RealTrends.com

- 2018: Top 25 Residential Realtor in Houston, Houston Business Journal

- 2018: Texas’ Most Influential Realtors

- 2017: #1 Individual Agent, Keller Williams, Texas

- 2017: #1 Individual Agent, Keller Williams, Houston

- 2017: #10 Individual Agent, Keller Williams, Worldwide

- 2017: America’s Best Real Estate Agents, RealTrends.com

- 2017: Top 25 Residential Realtor in Houston, Houston Business Journal

- 2017: Texas’ Most Influential Realtors

- 2016: #1 Individual Agent, Keller Williams, Texas

- 2016: #1 Individual Agent, Keller Williams, Houston

- 2016: #20 Individual Agent, Keller Williams, Worldwide

- 2016: Texas’ Most Influential Realtors

- 2016: Top 25 Residential Realtor in Houston, HBJ

- 2016: Five Star Realtor, Featured in Texas Monthly

- 2016: America’s Best Real Estate Agents, RealTrends.com

- 2015: #9 Individual Agent, Keller Williams, United States

- 2015: #1 Individual Agent, Keller Williams, Texas

- 2015: #1 Individual Agent, Keller Williams, Houston

- 2015: America’s Best Real Estate Agents, RealTrends.com

- 2015: Top 25 Residential Realtor in Houston, HBJ

- 2015: Five Star Realtor, Texas Monthly Magazine

- 2014: America’s Best Real Estate Agents, RealTrends.com

- 2014: #1 Individual Agent, Keller Williams Memorial

. . . in addition to over 318 additional awards.

Paige also serves a variety of non-profits, civic and community boards and was appointed by Houston’s Mayor to be on the downtown TIRZ board.

Benefits Of Working With The Houston Properties Team

Our Team, composed of distinguished and competent Houston luxury realtors, has a well-defined structure based on the individual strengths of each member.

We find team approach as the most effective way to sell homes. We have dedicated people doing staging, marketing, social media, open houses and showings. Each Houston Properties Team member is a specialist in their role – which is why our homes sell faster and for more money than average.

The benefits of working with a team include:

- ability to be in two or three places at one time: a member can handle showings, while another answers calls

- collective time and experience of members

- targeted advise and marketing of agent expert in your area

- competitive advantage by simply having more resources, ideas, and more perspectives

- a “Checks and Balances” system. Selling and buying a home in Houston is an intensely complex process

- more people addressing field calls and questions from buyers and agents to facilitate a faster successful sale

- efficient multi-tasking: One agent takes care of inspections and/or repair work, while another agent is focused on administrative details

- multiple marketing channels using members’ networks

- constant attention: guaranteed focus on your home and your transaction

- lower risk for mistakes. Multiple moving parts increase oversights. A team approach handles these “parts” separately

- flexibility in negotiation and marketing

- better management of document flow

- increased foot traffic through more timely and effective showing schedule coordination; and

- increased Sphere of Influence and exposure to more potential buyers.

To meet all the award-winning members of The Houston Properties Team, please go here.