Houston Real Estate Market Forecast: Current Data & 2022 Predictions

Concerned about a housing market crash? Review current Houston real estate data & lessons from past hurricanes and trends.

SUMMARY:

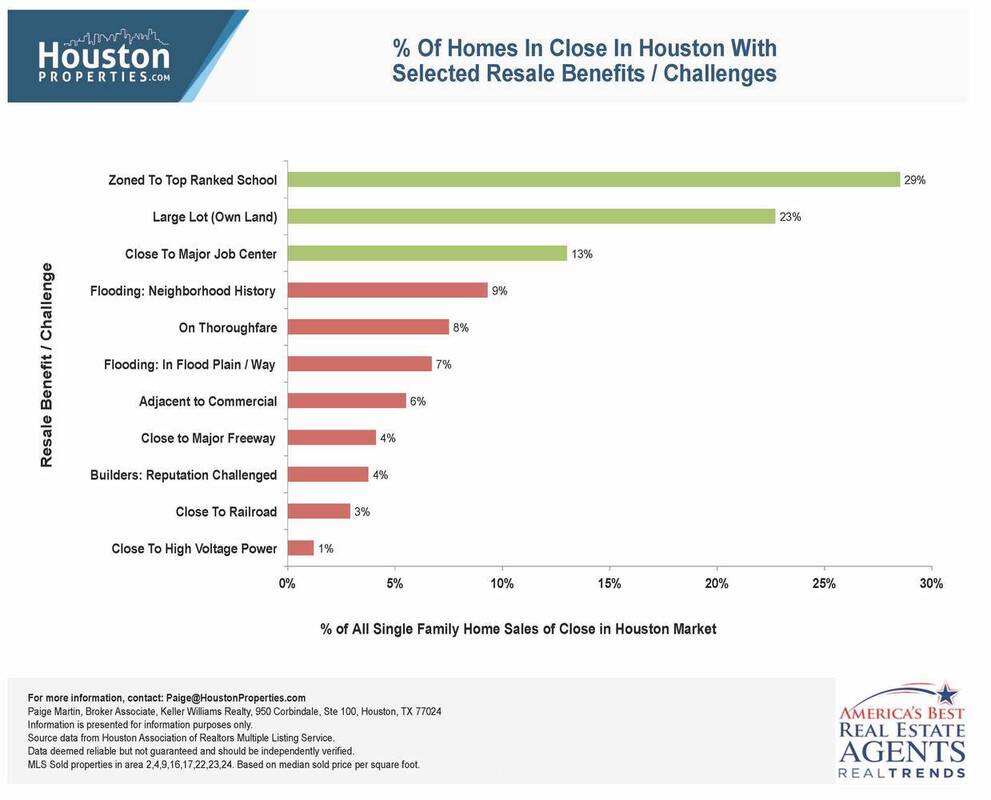

Our greatest concern is that last year’s euphoria (home sales are up 13% and total dollar volume is up 28%) led to some really risky deals that violated the 9 Kisses of Death - the 20-year research study of what NOT to buy in Houston.

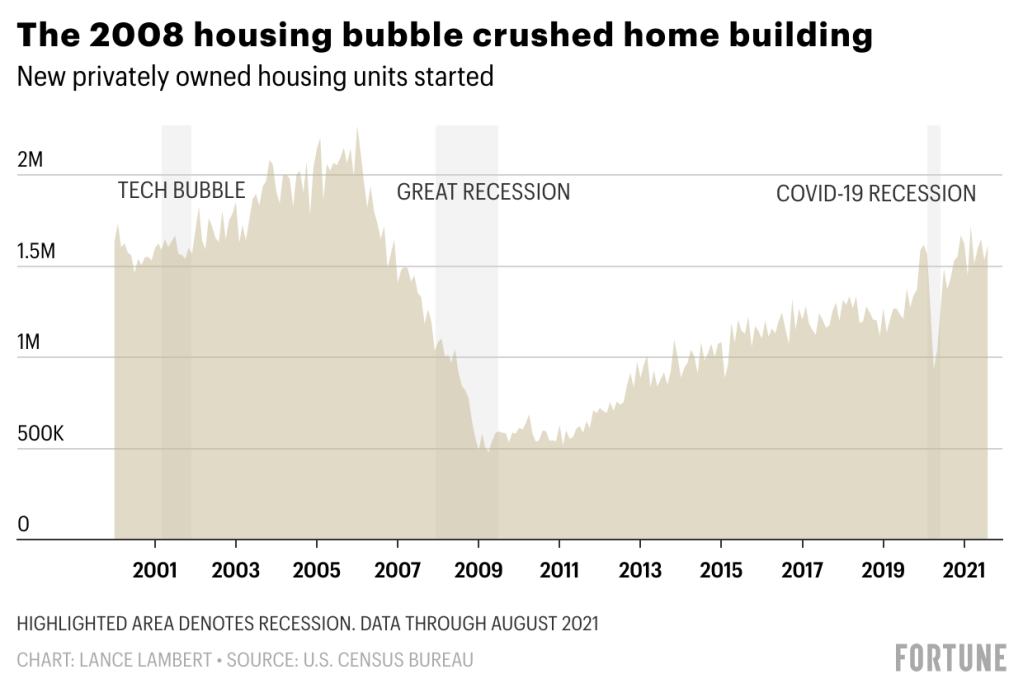

While no one ever thinks they’ll be forced to sell in a down market, very few people predicted 9/11 (2001), Great Recession (2008), the collapse of oil prices (2014), or Hurricane Harvey (2017).

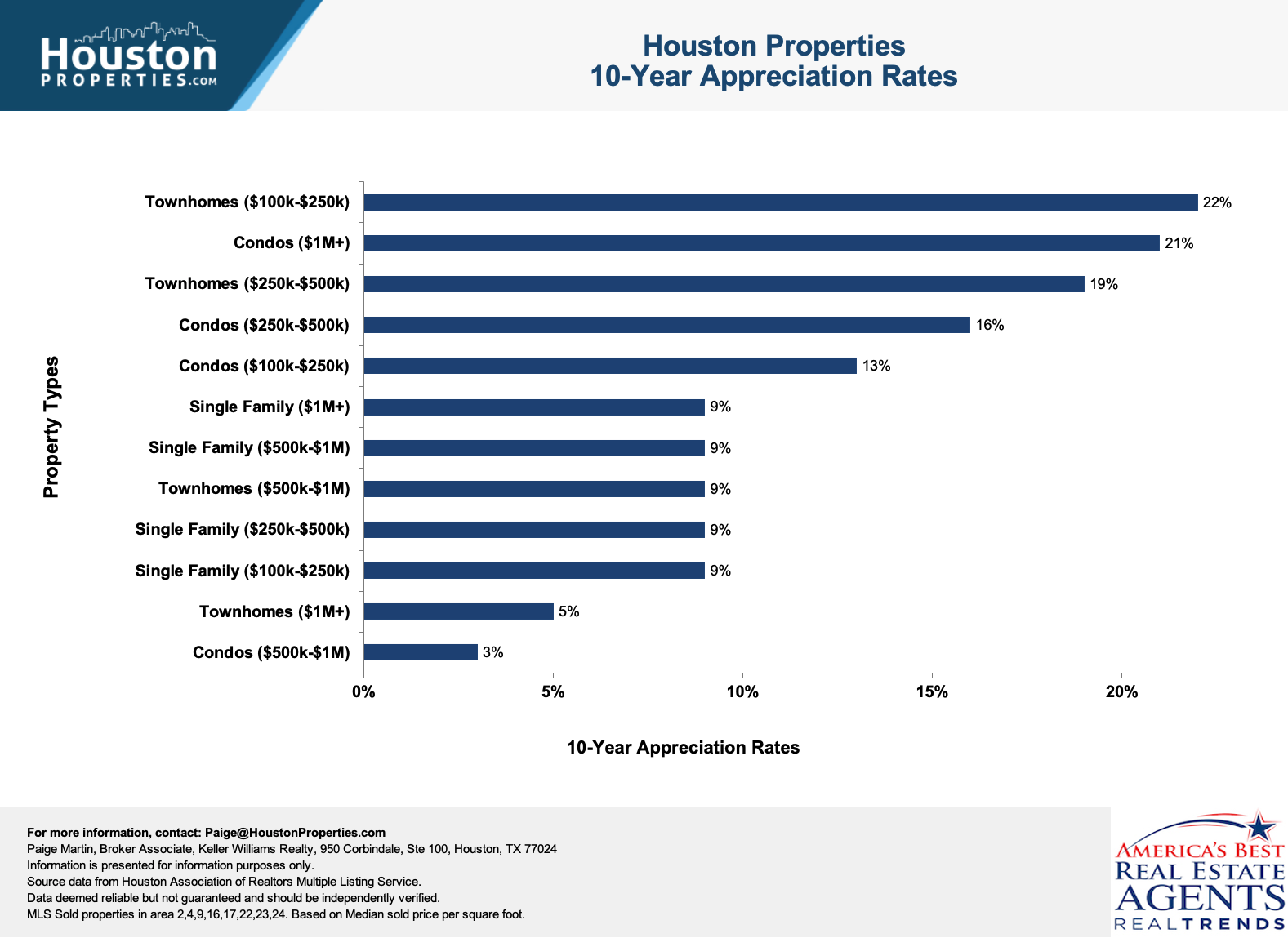

A study of 400,000+ Houston home sales over two decades shows five major investment themes that have worked very well for homeowners (even if they paid “high prices” at the time).

This is more concerning now that 71% of Houston Realtors have sold less than 5 homes in their entire career. It can be difficult to get knowledgeable representation.

For the broad Houston real estate market, all major indicators point to growth during the year.

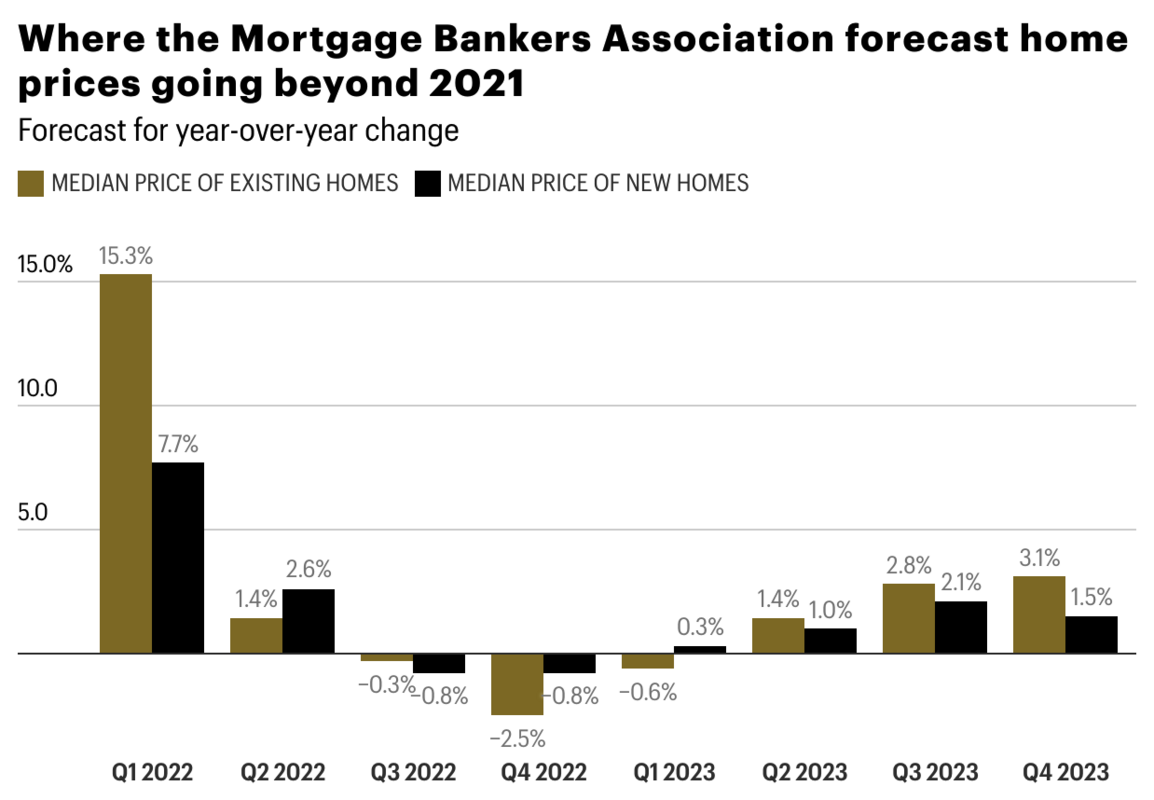

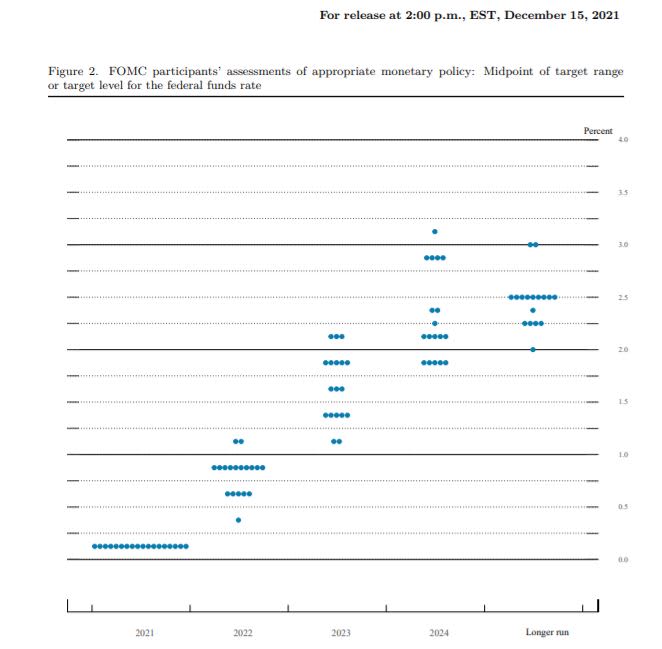

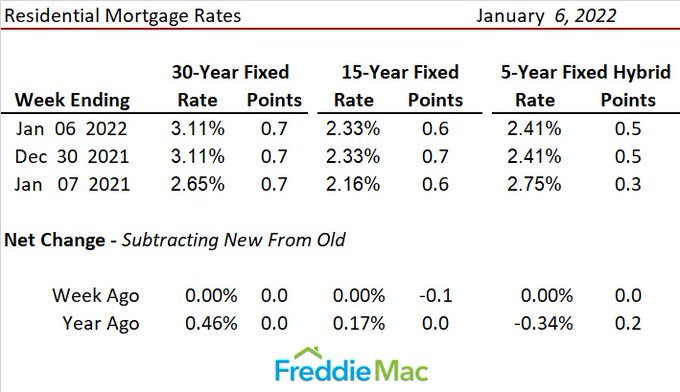

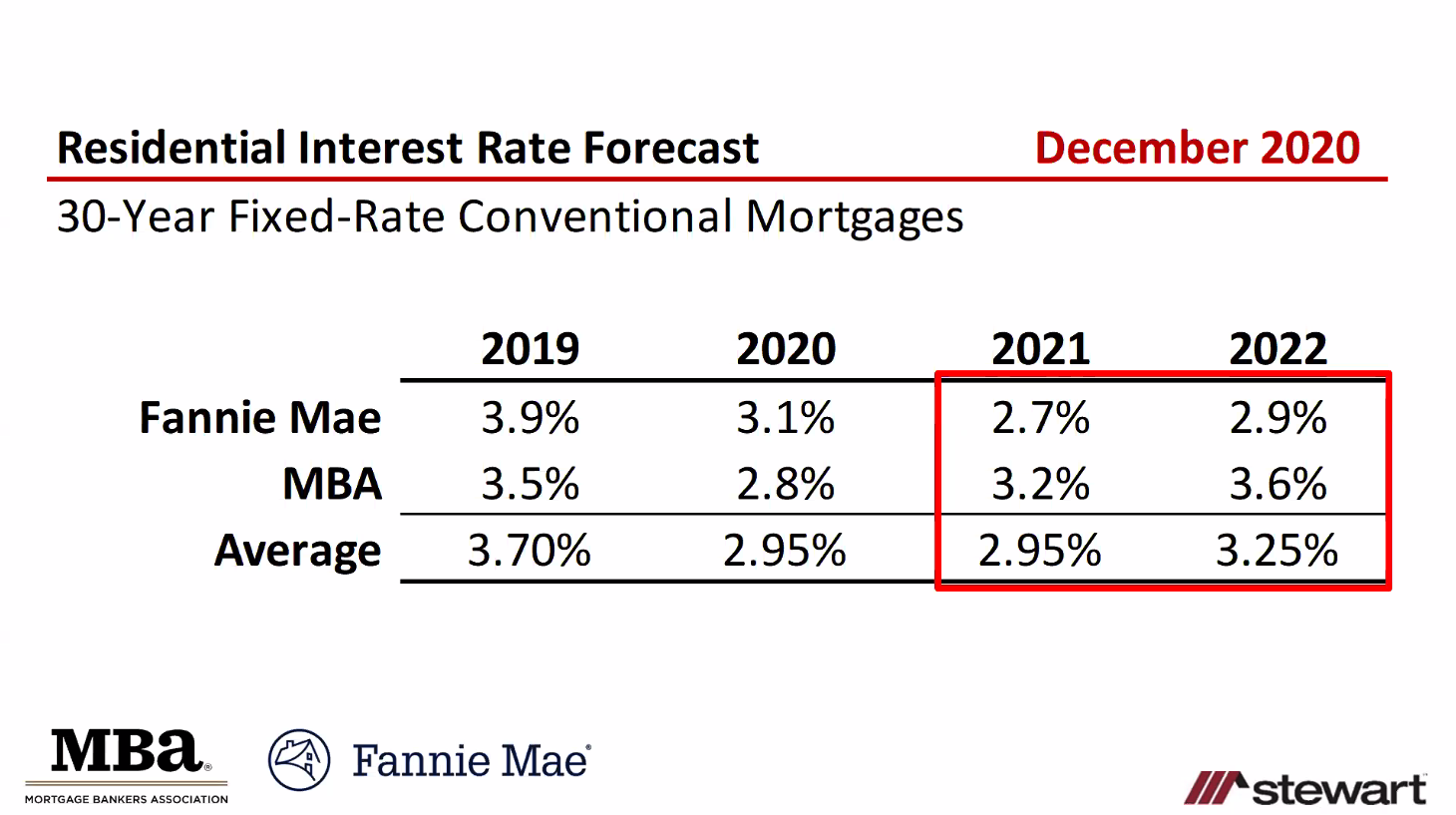

The biggest wildcard is the Federal Reserve and its plan to raise interest rates multiple times during the year to combat inflation. We offer tips and resources below.

Get a free home valuation for your house and trends in your neighborhood.

If you're looking for a personal recommendation on your situation (buying or selling a home in Houston) and how it could impact your goals, please contact Paige Martin at [email protected]. Paige Martin is the #1 Individual Agent with Keller Williams in the State of Texas and team lead of The Houston Properties Team.

Table of Contents

- Why We're Fearful: Buyer & Seller Mistakes

- Why We’re Hopeful: Jobs, Cost Of Living, & Inflation

- How Is My Neighborhood Doing?

- I’m A Buyer. Should I Panic?

- I May Need To Sell. What Should I Do?

- Third Party Predictions

- Sources, Methodology & Disclosures

- Best Houston Realtors: Paige Martin & The Houston Properties Team

Why We're Fearful: Buyer & Seller Mistakes

"A good and experienced Realtor should protect their clients from making bad mistakes, specially when putting emotions over data. However, 71% of agents in Houston have sold less than 5 homes their entire career."

The following three case studies illustrate the problems with paying high for properties that violate the Nine Kisses of Death For Home Resale.

There are hundreds of examples throughout Houston, but we’ve highlighted three. We’ve removed the full address to protect the parties, but contact us for the MLS numbers and data.

The root causes of buyers overpaying are similar:

- Using an inexperienced agent (one with less than 6 transactions in total).

- Being so enamored with “a pretty home” that it overcomes the fundamentals.

- Getting caught up in bidding wars.

Case Study #1: Buying In A Floodplain / Buying a Home With A Flood History

In this case, buyer bought the property with flooding issue back in 2016. They sold it with an 82% loss just three years later.

Hurricane Harvey (2017), Tropical Storm Imelda (2019), and the other recent cases of flooding made buyers hyper-aware of the risks of buying properties in areas with flooding history.

The buying frenzy and low inventory we saw last year (and will continue to see for better parts of this year) may push buyers (specially if driven by bad advice from an unseasoned Realtor) to make bad decisions. This will cause problems down the line when they decide to resell.

Here's why this is such a big risk coming into 2022:

Some buyers of flooded homes know of the risks. However, far too many Houston home buyers didn’t do their correct due diligence before making a purchase.

If the property flooded, but the structure didn’t, the listing agent too often markets the property in big bold letters “DID NOT FLOOD.”

However, while this is technically true, it is not accurate . . . and it happens all the time.

Furthermore, the listing agent also often doesn’t make it easy for Houston homebuyers to get the survey, details and any prior inspection reports so you know really know what you’re buying.

That’s why you need an expert on your side to help you navigate the pitfalls of buying in or around Houston flood prone areas. Read More To Learn How To Avoid Buying Homes With Flooding History

Case Study #2: Buying “Pretty” New Construction, Overlooking Limited Land & Freeway Proximity

This is the classic case of a buyer putting emotions over data. One that caused the buyer more than $200k in losses, instead of making a profit in their investment.

A good real estate agent should protect buyers from this as it's a very common mistake specially among first-time homebuyers.

However, that's not always the case. About 71% of agents in Houston have sold less than 5 homes their entire career.

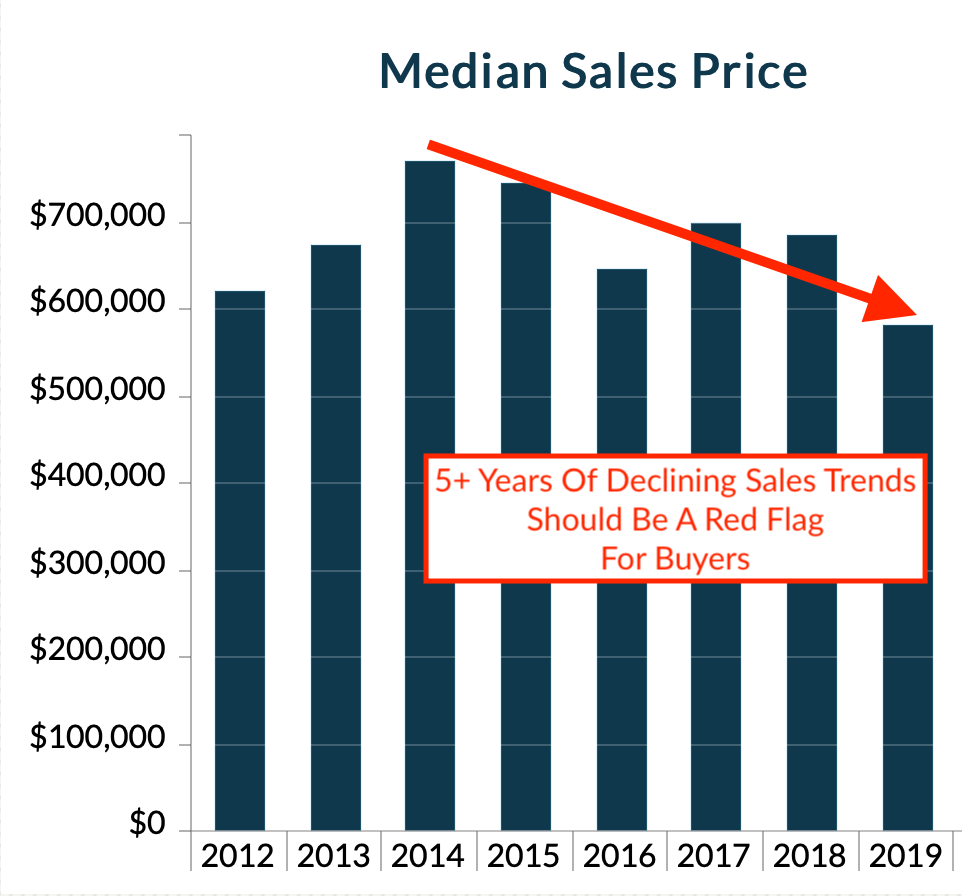

The property was first sold in 2016. A new construction, it sold for $760,000. After just 5 years, the then-owner re-sold it for almost 40% below what they originally paid for it. After reviewing the property, it's clear that it comes with multiple red flags (the builder has a bad reputation, it's very near the freeway, and it has a small lot and awkward floor plan).

Simply put: not all homes are created equal.

High-quality homes sell in nearly every Houston Texas real estate market. Disadvantaged homes sell more slowly or at larger discounts.

This is anecdotal data, but it supports the Houston real estate market trends we see above: In the aftermath of the 2007/2008 financial crisis, we saw a flight to quality in nearly every asset class.

Several of the key factors that influenced the price and speed that residential investment property Houston sold in the downturn include:

- Railways. Homes near railroads tend to sell at larger discounts.

- Highways. Homes near highways tend to sell at larger discounts.

- On major thoroughfares. Homes on a major thoroughfare tend to sell at larger discounts.

- Floor plan. Homes built with a bad or awkward floor plan tend to sell slower or at larger discounts.

- Quality of construction. While this can be subjective (or determined by a good inspector during the option period) homes built by “known problematic builders” sold at material discounts.

These are the same trends we’re seeing now, post-Hurricane Harvey. We see no reason for it to change in 2022.

Case Study #3: Buying In A Community With Declining Sales Trends (& Stucco Issues)

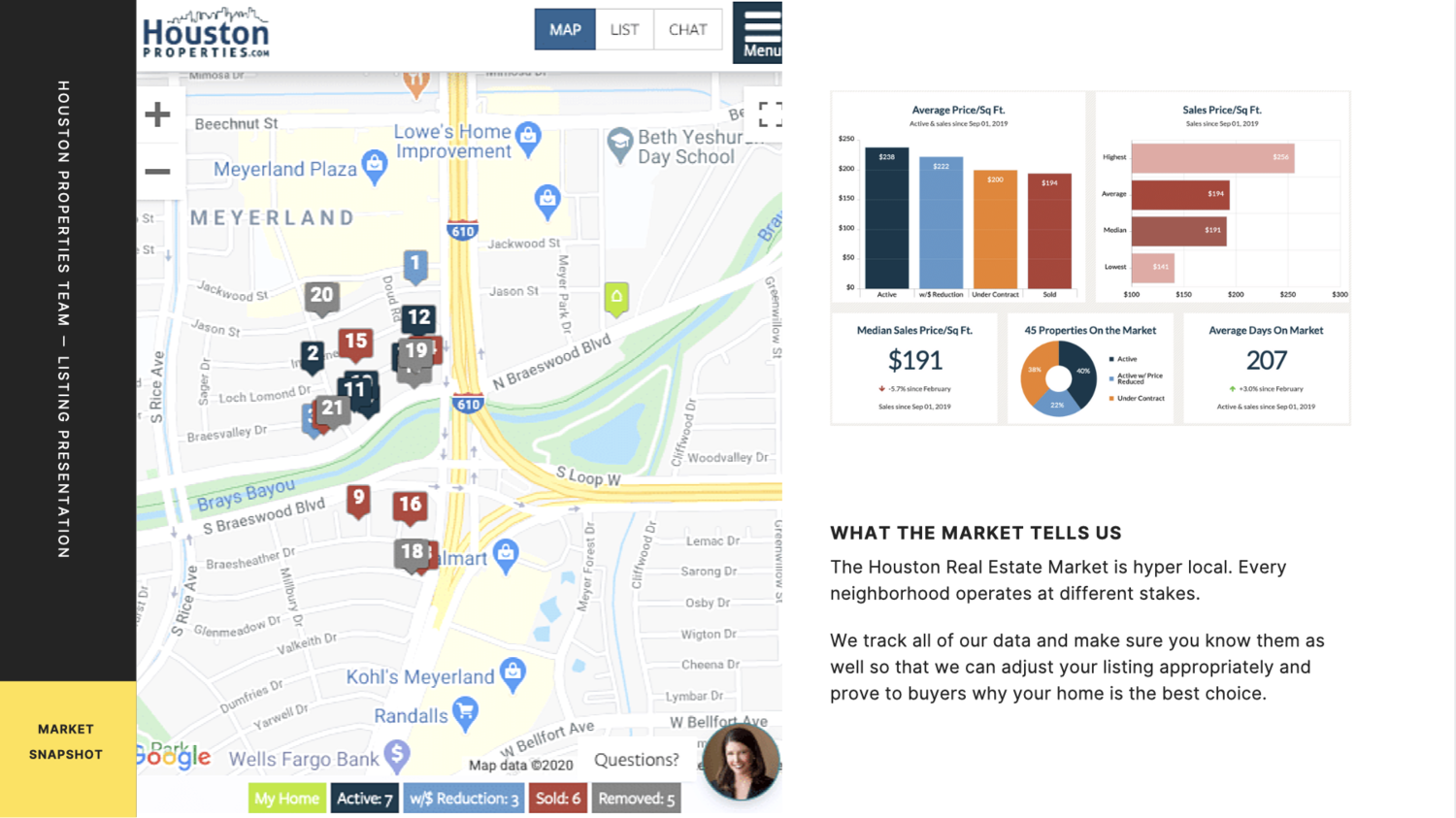

Numbers don't lie. This is specially important in a market as hyper-local as Houston. Typically, headline market statistics do not reflect what buyers and sellers are living in their respective areas/communities.

Overlooking historical data for a specific neighborhood and property type could be costly. A competent real estate agent is constantly providing their clients with area-specific data, market reports, and analysis.

This is not an absolute list, but we have completed a study of 400,000+ Houston home sales since 2000. The best investments tend to be single-family homes with the following characteristics:

- Located in quality neighborhoods that have good proximity to major job centers;

- Large lots (the primary value is the land value);

- Not located on a busy thoroughfare, near a highway or near a railroad;

- A street location with some kind of premier feature (by a cul-de-sac, on a street with a tree-filled median, etc.);

- With a home that is liveable and can be rented. Typically, new construction homes come with a higher purchase premium and “true fixer uppers” require too much investment.

Why We’re Hopeful: Jobs, Cost Of Living, & Inflation

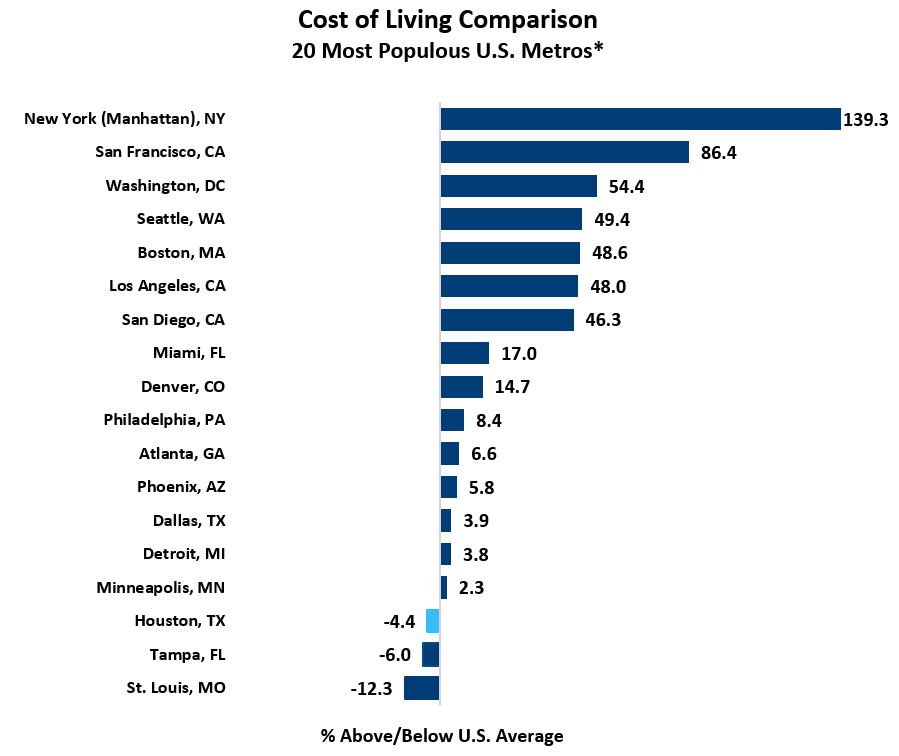

Houston has the 3rd lowest living costs among the most populous US metro areas. Texas has the 8th lowest tax rate in the US.

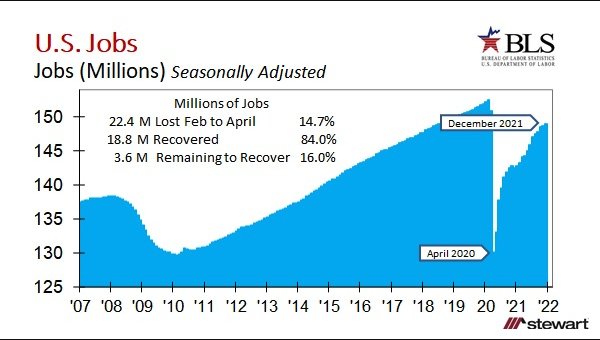

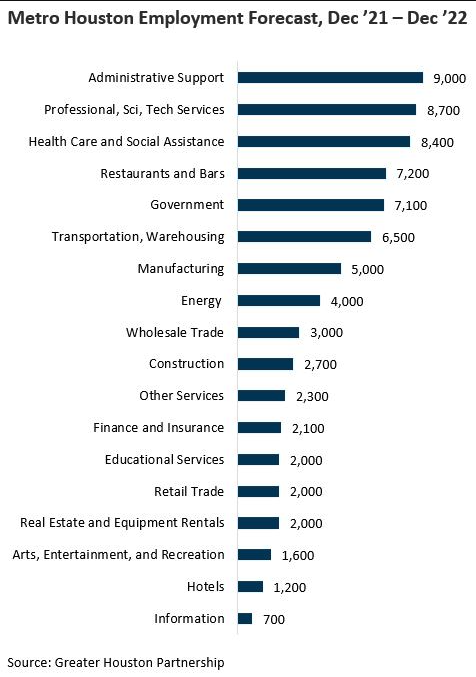

Houston Employment Outlook

Houston has recouped over 75% of the jobs lost during the early stages of the pandemic. Nine sectors have fully recovered their losses.

The latest economic forecasts predict that Houston will create nearly 80,000 jobs in 2022. The biggest gains are expected in administrative support, government, health care and social assistance, professional, scientific, and technical services, and restaurants and bars.

Houston Cost Of Living

Accounting for migration trends, Houston is still one of the top destinations for relocation. Texas has no state income tax. Employment is also one of the main drivers, and it shows Houston is now less dependent on the oil and gas industry:

- Texas has the 8th lowest tax rate in the US

- Houston is #3 in areas with the lowest living costs

- 1 in 3 manufacturers in Texas are located in Houston

- We’re ranked as the #1 seaport in North America

- Houston is home to over 500 tech companies

- Our city has the largest medical facility with over 360,000 healthcare professionals

- Houston has the 4th highest # of Fortune 500 companies

- 35% of publicly traded oil and gas companies are located in Houston

Houston also has the 3rd lowest living costs among the most populous U.S. metro areas. Houston’s living costs are 4.4% below the nationwide average and 26% below the average of the nation’s most populous metropolitan areas.

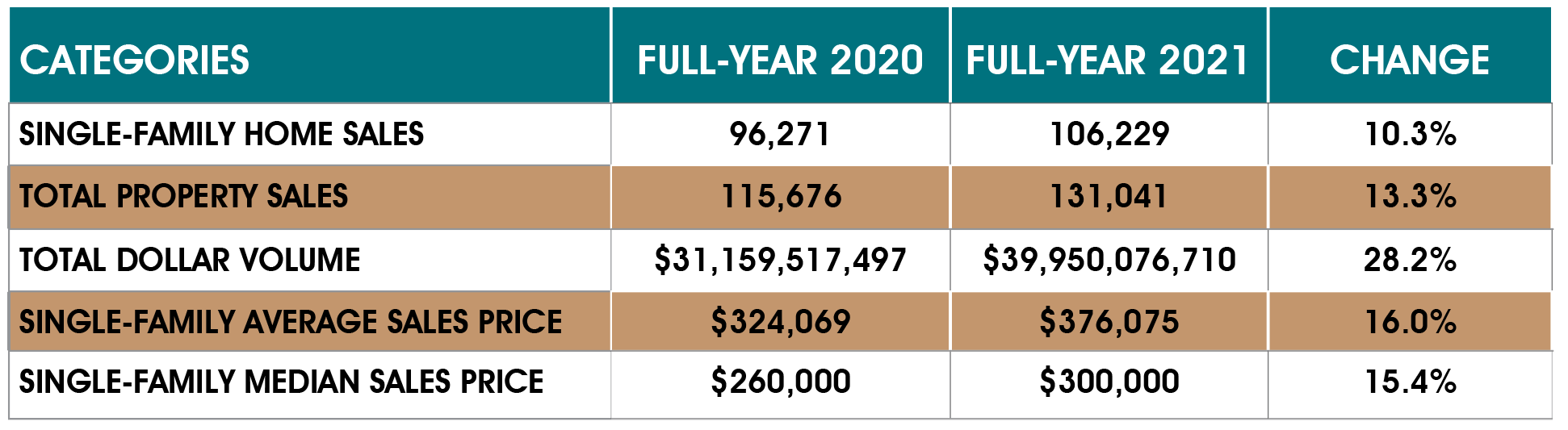

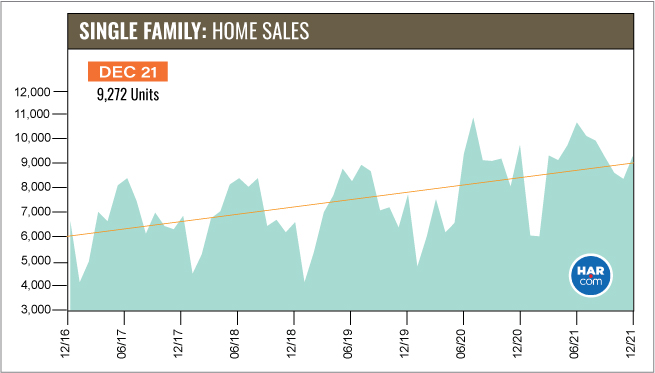

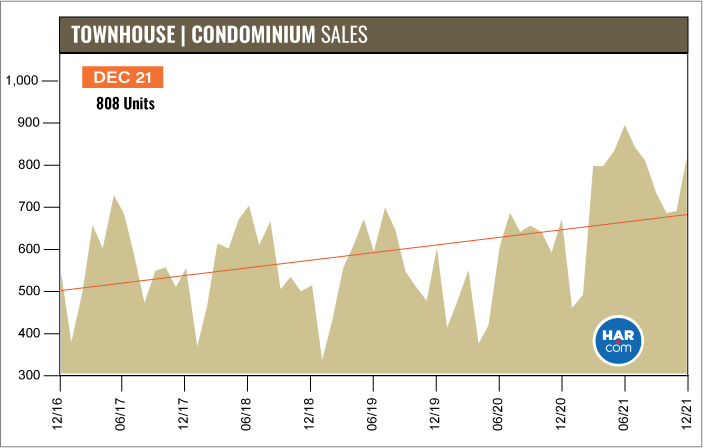

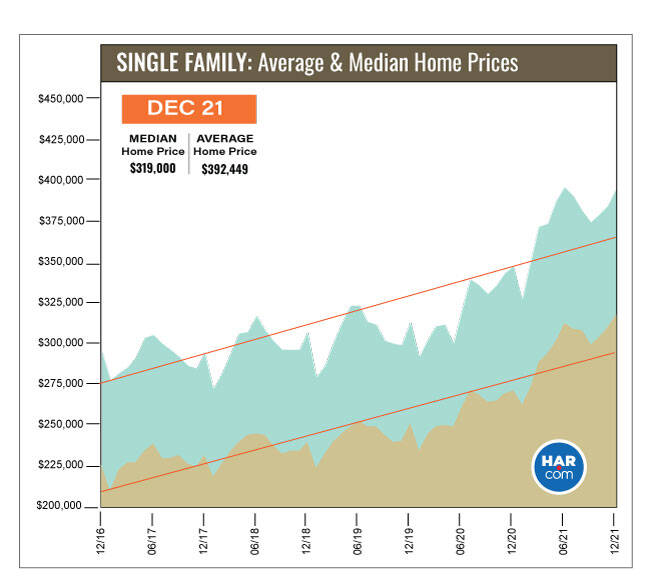

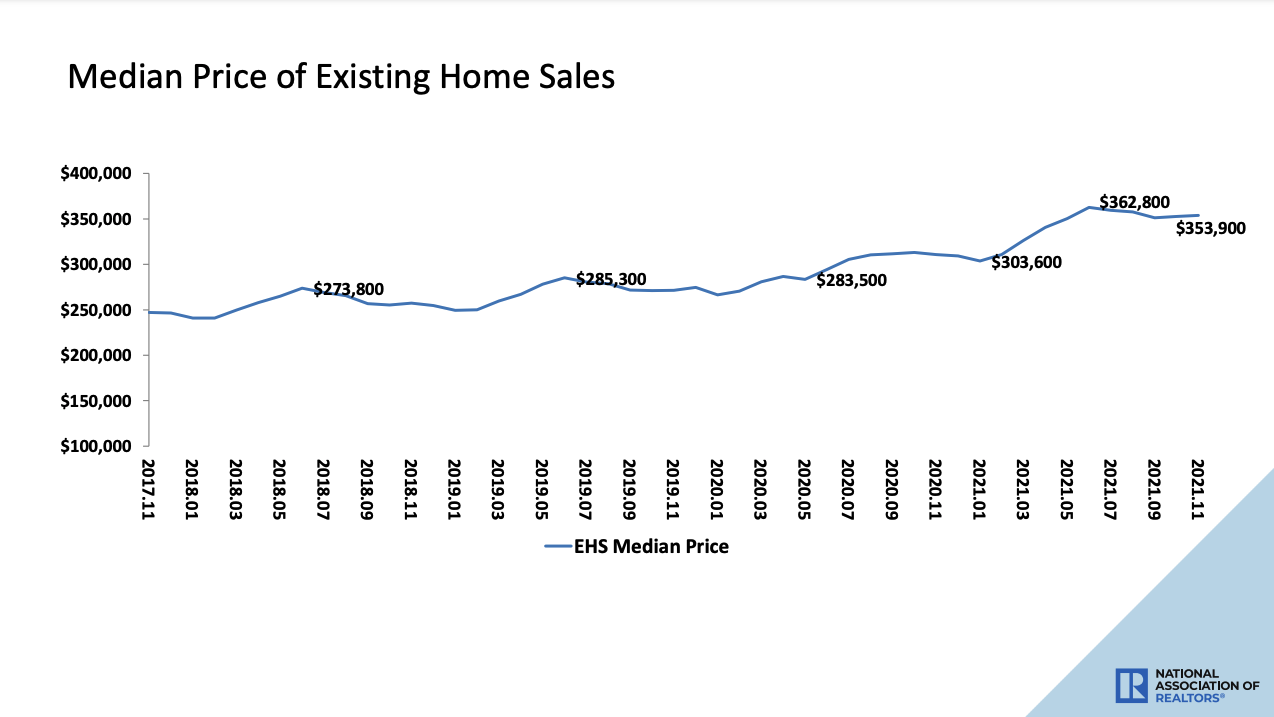

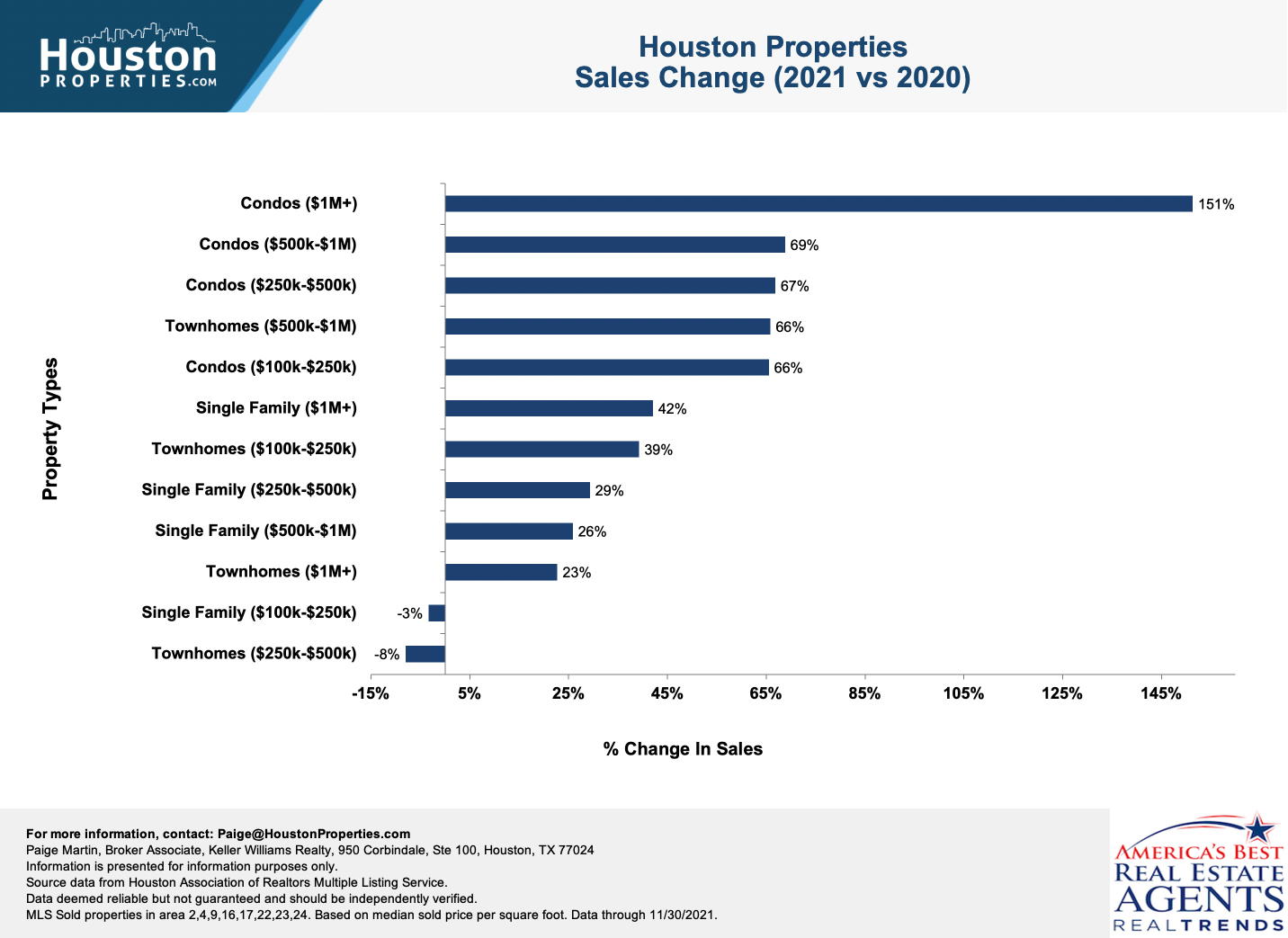

Recent Real Estate Growth

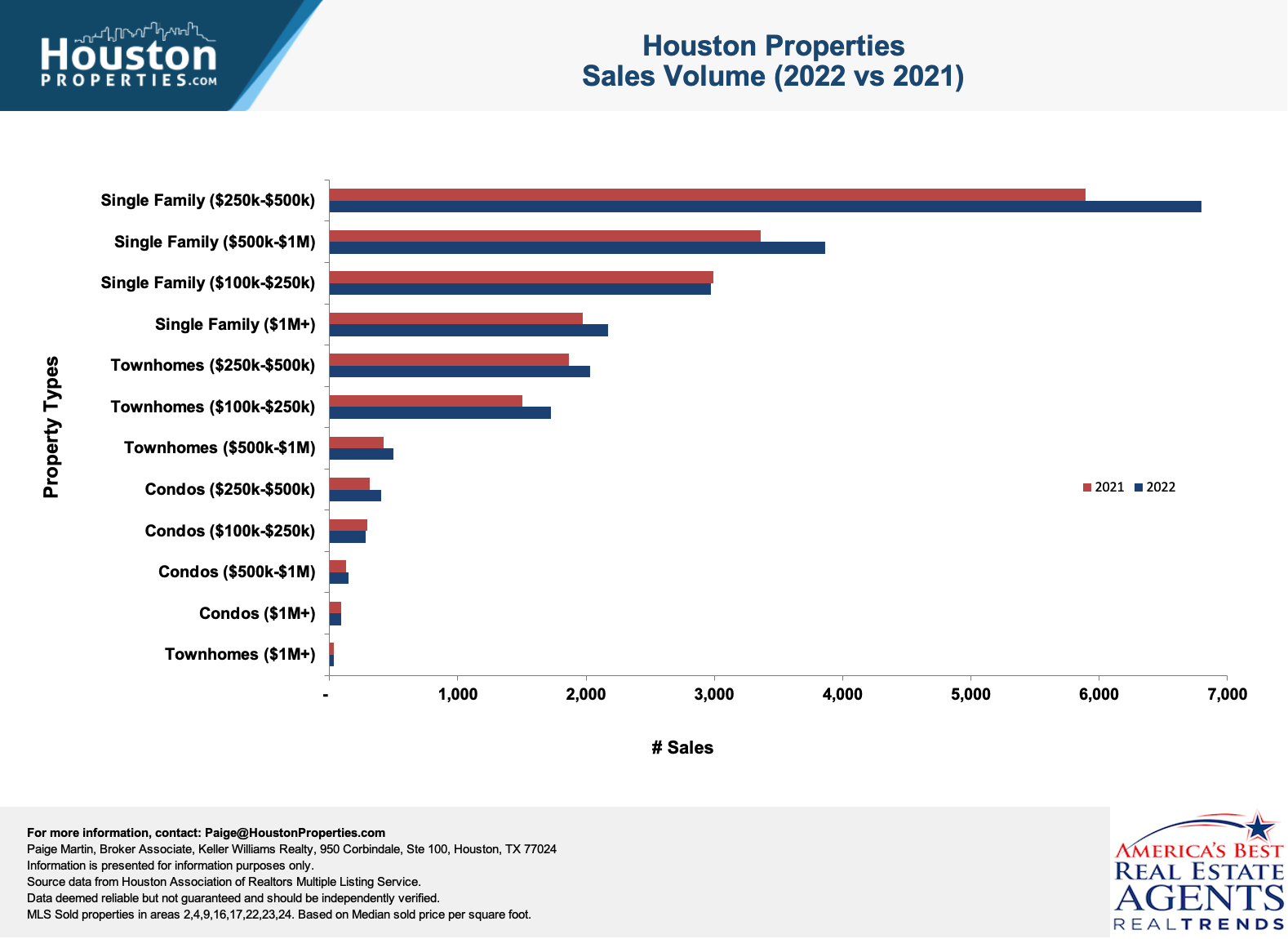

2021 is one of Houston’s best years in terms of real estate growth. On a year-to-date basis, Houston home sales are 13% ahead of 2020’s record pace. Total dollar volume is also up 28% to a record-breaking $40 billion.

To summarize:

- 10.3% increase in single-family home sales

- 13% jump on all property types

- $500k-$999k homes are up the most at 41% (sales volume)

- Median price increased by 17.2%

- 1.4 months of supply

- BUT December was down 4.5%

Inflation's Impact On Real Estate

| Neighborhood | Median Home Price | Home Price / Sq Ft | 10-Yr Apprec. % |

|---|---|---|---|

| River Oaks Area | $2,962,500 | $578 | 34% |

| Piney Point | $3,250,000 | $613 | 31% |

| Hunters Creek | $2,725,000 | $567 | 38% |

| The Woodlands: Carlton Woods | $0 | $0 | |

| Crestwood | $2,662,500 | $515 | 69% |

| Memorial Close In | $2,514,000 | $405 | 1% |

| Southside Place | $2,239,590 | $432 | 49% |

| Bunker Hill | $2,650,000 | $526 | 66% |

| Memorial Villages | $2,433,150 | $496 | 73% |

| Tanglewood Area | $1,670,000 | $366 | 0% |

| Hedwig Village | $3,790,000 | $549 | 111% |

| Memorial Park | $1,300,000 | $383 | 14% |

| West University/Southside Area | $1,816,000 | $512 | 44% |

| Southampton | $1,680,000 | $535 | 26% |

| Boulevard Oaks | $1,485,000 | $474 | 48% |

| Highland Village / Midlane | $1,300,000 | $418 | 74% |

| Rice / Museum District | $1,165,000 | $404 | 37% |

| The Woodlands: East Shore | $1,082,000 | $419 | 45% |

| Braeswood Place | $1,300,000 | $357 | 57% |

| Bellaire Area | $1,270,000 | $332 | 27% |

| Briargrove | $1,350,000 | $450 | 61% |

| River Oaks Shopping Area | $927,000 | $298 | 40% |

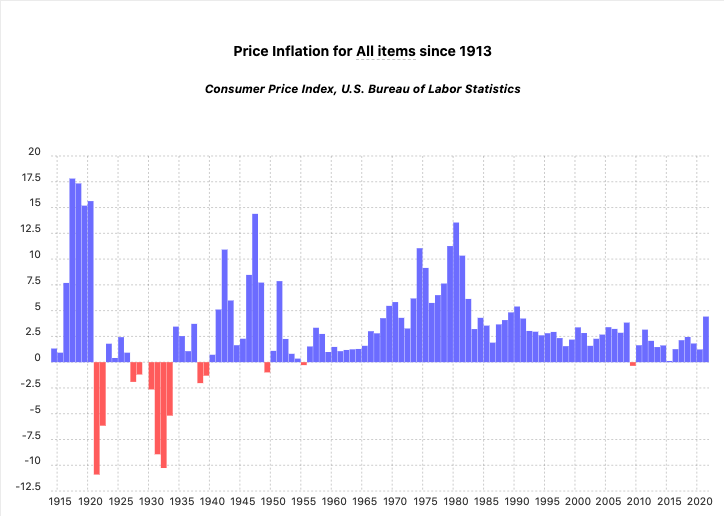

We've all seen the headlines: "Inflation at its highest since 2000", "Historic highs on inflation rates", "Inflation is the highest it's been in over a decade", and more.

The pandemic, the federal economic stimulus plan, our weakened spending habits (Americans are sitting on $2 trillion in savings since the onset of Covid-19), and now our fast-paced return to normal life are big factors contributing to the inflation spike.

What can we do to protect our assets then? Here are three reasons why real estate is a good hedge against inflation:

Inflation has a "deflating effect" on debt. As home prices increase over time, it lowers the loan value of any mortgage debt. This acts as a buffer to price inflation (like a natural discount). So in a sense, mortgages are paid in "cheaper dollars". Specially if you're buying in areas with historically good land value appreciation as the equity on the house rises, but your fixed-rate mortgage payments remain the same.

Inflation benefits real estate investors who are earning money from rental properties. With higher home values come higher rental rates. Those who have invested money in rental properties can see increased revenue from higher leases. We constantly see investors inquiring about multi-family properties or rental-type houses with this in their mind. We expect 2022 to bring more of the same.

Good properties (those with long-term value) will always be good protection against inflation because it will continue to appreciate in value. Real estate keeps up with or exceeds the rate of inflation. Add in the fact that long-term mortgages "cost less" because they're paid back in "future, less valuable dollars." Real estate does well, mainly because leverage attached to it gets melted away from inflation.

How Is My Neighborhood Doing?

High-quality homes sell in nearly every market. Disadvantaged homes sell more slowly or at larger discounts. The Houston real estate market is hyper-local — contact The Houston Properties Team for tips on how to navigate it.

“Which Houston neighborhoods are still hit hard by COVID-19? Which ones are recovering?”

“Which areas in The Bayou City thrived because of the buying frenzy post-pandemic?”

“How is my neighborhood doing? Should we expect sales to go up or down this year?”

Clients ask us these questions every day. Our answer: It will always depend on your goals and situation. Houston real estate is hyper-local, and our reports, data, and analyses depend on the clients’ specific area. It’s a case-to-case basis.

Overall, right now properties are still actively going under contract. We are still seeing listings receive multiple offers.

Last year’s number of homes that have gone under contract is still consistent with figures prior to the pandemic and the oil price crash.

Our greatest concern is that last year’s buying frenzy led to some really risky deals that violated the 9 Kisses of Death - the 20-year research study of what NOT to buy in Houston.

The limited inventory, low interest rates, and increased buying power of the average American household created a lot of unusual situations and deals. It’s not immediately apparent now, but we predict that this will create a lot of buyers’ remorse down the road.

This is specially true for some parts of Houston. Some housing segments also displayed erratic behavior and unsustainable growth.

I’m A Buyer. Should I Panic?

With over $1 Billion Houston residential home sales, the Houston Properties team can help you find the best property for you and your family. Contact us for a custom report on the Houston real estate outlook for this year.

Not at all, but tread with caution. 2021 closed at such a high note for sellers. Fed is also forecasting 2-4 interest rate hikes this year.

We’ll still see early- to mid-2022 favor sellers, and paying high for low quality and compromised properties during a boom, can lead to devastating results (see case studies above).

The biggest challenge right now is the low inventory. With less than 1.6 months of home inventory (a balanced market has 5 to 7 months), buyers are more likely to go into bidding wars and will be usually pressed for time. This can lead to rushed decisions, specially when you're not getting good Realtor advice.

Stilll, buyers should still be in a good position to get great deals if they know where to look and are getting good guidance. Buyers still have two things going for them:

- Current interest rates are still at an all-time low (although Fed projects 2-4 rate hikes in 2022)

- You’re going to start seeing great deals in good locations in the next 3-6 months

However, we also expect to see a lot of fake deals. There will be plenty of buyers who will think they got a good deal, only to find out it’s a disaster later.

The market will see an influx of price drops and hikes due to low inventory and high demand. On the other hand, properties that have been sitting on the market for a while will be slashing prices left and right.

Buyers should be wary of “seemingly good deals on paper”. We typically guide our clients to watch out for the 9 Kisses Of Death For Resale when shopping for a home.

From our studies of over 400,000 Houston home sales, here are the major success themes to make a good investment:

- Located in quality neighborhoods that have good proximity to major job centers;

- Large lots (the primary value is the land value);

- Not located on a busy thoroughfare, near a highway or near a railroad;

- A street location with some kind of premier feature (by a cul-de-sac, on a street with a tree-filled median, etc.);

- With a home that is liveable and can be rented. Typically, new construction homes come with a higher purchase premium and “true fixer-uppers” require too much investment.

Regardless of the economic and political climate, our approach has been the same: Every situation is unique. We use data to create custom solutions for our clients, present this to them, and have candid conversations on what they should do given the situation.

I May Need To Sell. What Should I Do?

The Houston Properties Team ran a study of past shocks (Hurricane Harvey, 2008 Crash, 2015 Oil Crash) and how it reshaped the market. For a copy of this research plus current trends in your neighborhood, email [email protected].

2021 ended heavily favoring sellers. We saw historically low home inventory buoyed by low-interest rates.

This year should start following the same trends, but we expect the market to slow down considerably during the latter part of the year. Early sales data project that the switch may start as early as the first quarter of 2022.

The market should be soon flooded with sellers and builders looking to take advantage of last year’s trends.

Our advice for those who need to sell: Sell now and move fast, before the market turns.

This is because people who got on the market first, reset the comps lower.

Buyers are getting warier of the overly hot nature of the market. The most forward-looking buyers will always be focused on a flight to quality. This is mostly the advice we give to clients who have no reason to rush. We review data with them almost on a weekly basis.

They want to ensure that they buy a good house that fits within the main long-term investment themes and they are trying to ensure they don’t overpay.

Historically, homes in good areas, zoned to good schools, and is built on its own land have bounced back from the bottom of any market (Hurricane Harvey, 2015 Oil & Gas Crash or 2008 Great Recession) in about 12-20 months.

We’re advocating that for sellers who want to sell within the next 12-18 months that they price attractively now to get ahead of what may or may not be coming so they can move on with their goals. This also puts you in a position to receive multiple offers which can lead to selling above listing price.

Ultimately the answers will depend largely on the individual goals of each buyer and seller. If you’re a seller who needs to sell fast, you need to get ahead of the curve (before prices go way down and the market becomes really competitive) and move now.

The typical real estate purchase process takes about 4-6 months (including being under contract for ~30-45 days). Any data showing any market impact won’t begin to show up for at least 3 months.

Historically, it has taken 18 months before there is a material impact on the real estate market (e.g. after the 2008 crash, average home prices still increased for ~12 months).

This means home sellers who can get on the market early have a distinct advantage over those who will opt to wait. Homeowners who absolutely need to sell, NEED TO GET OUT EARLY.

Third Party Predictions

If you're looking for a personal recommendation on your situation (buying or selling a home in Houston) and how it could impact your goals, please contact Paige Martin at [email protected].

The Houston real estate market grew 13% in 2021.

Here are the forecasted Houston 2022 sales growth (% year over year) from major publications:

- Corelogic: +2.2%

- Freddie Mac: +5.3%

- Goldman Sachs: +9.5%

- Realtor.com: +2.6%

- Redfin: +3%

- Zillow Home Value Forecast: +11%

The summary predictions from major real estate outlets is that Houston’s market will grow on average about 4-6%.

HOWEVER, the problem with statistics from national publications is that a Houstonian can’t live in the “average house.” You get to live in one.

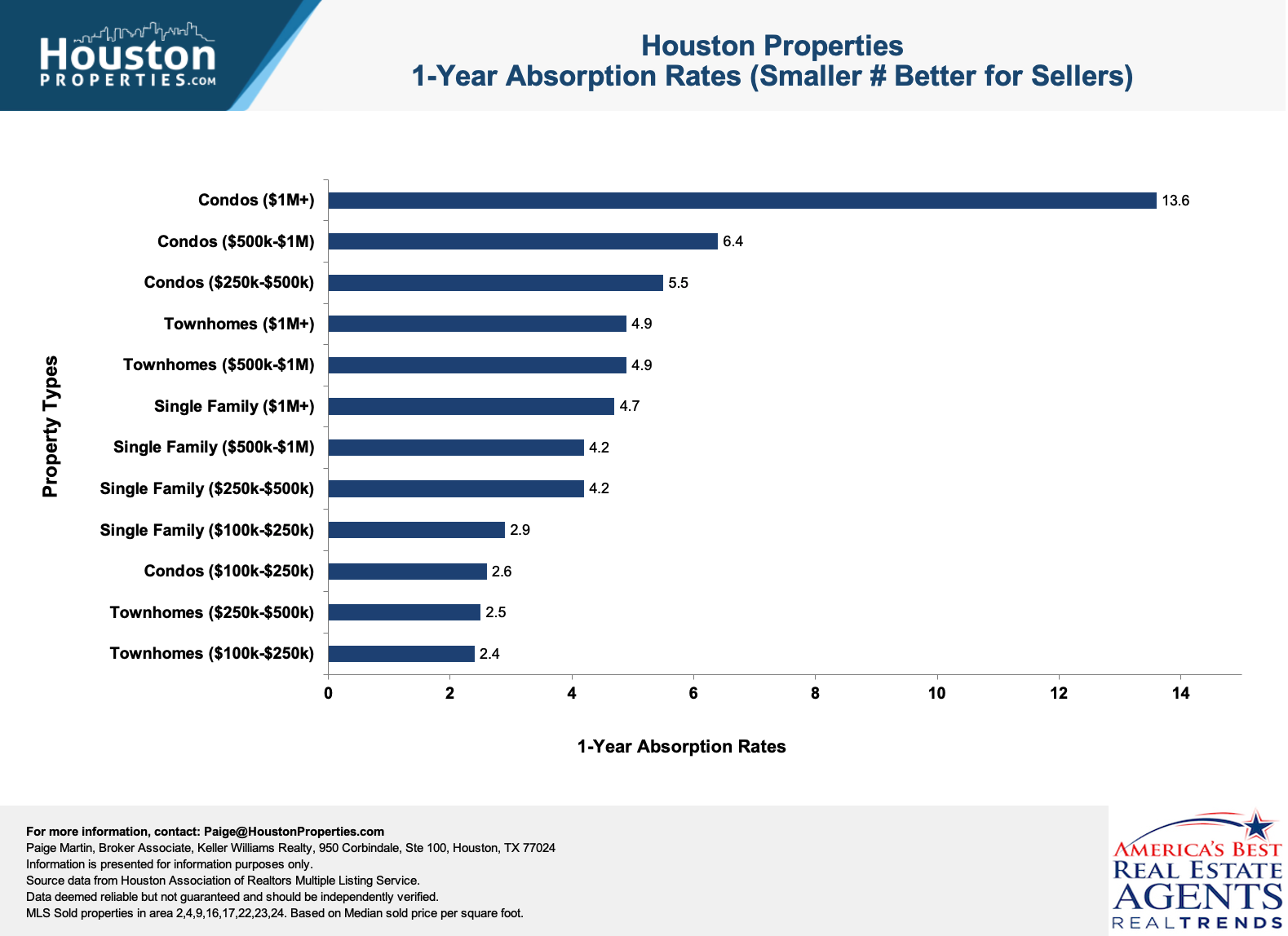

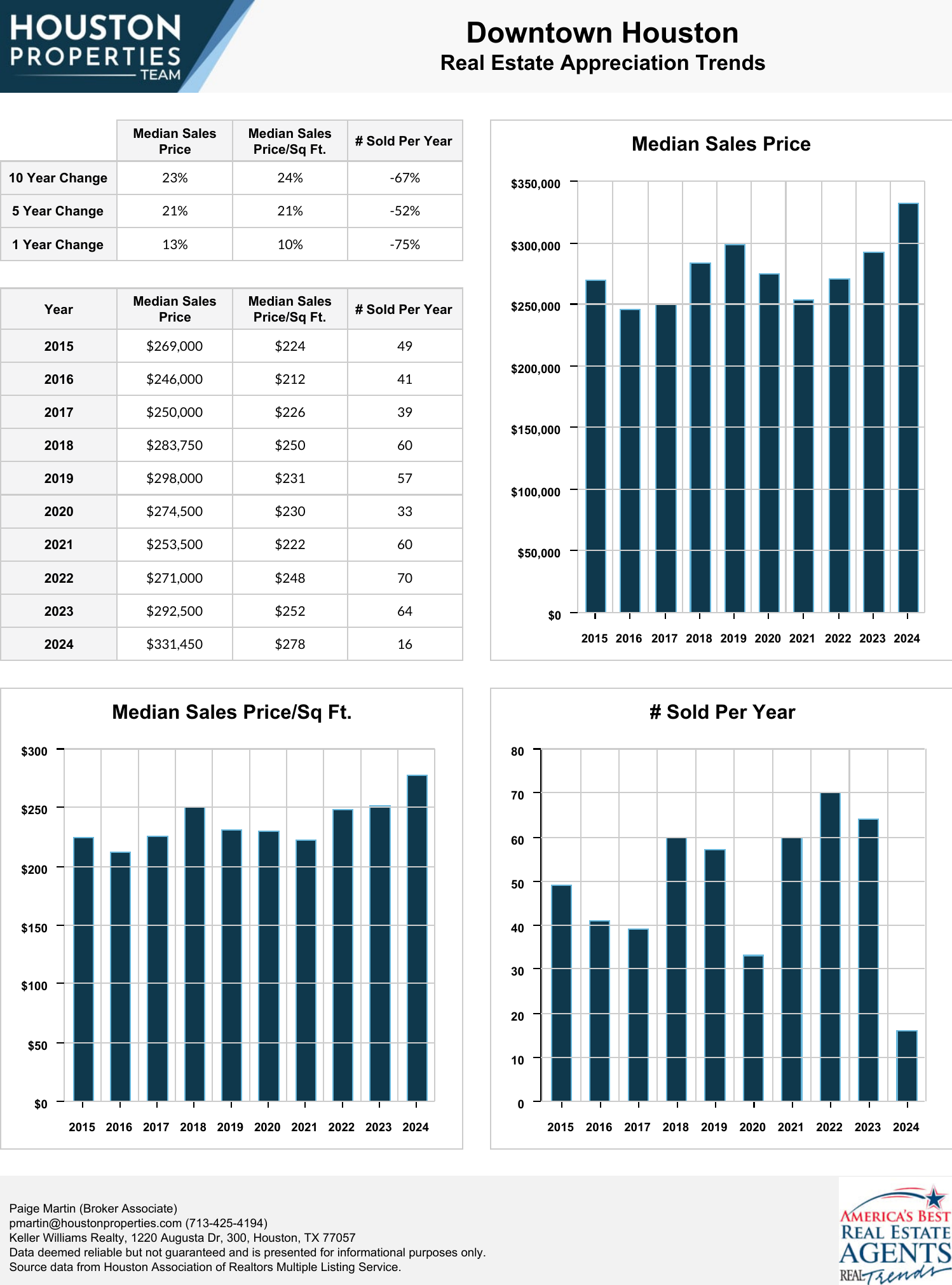

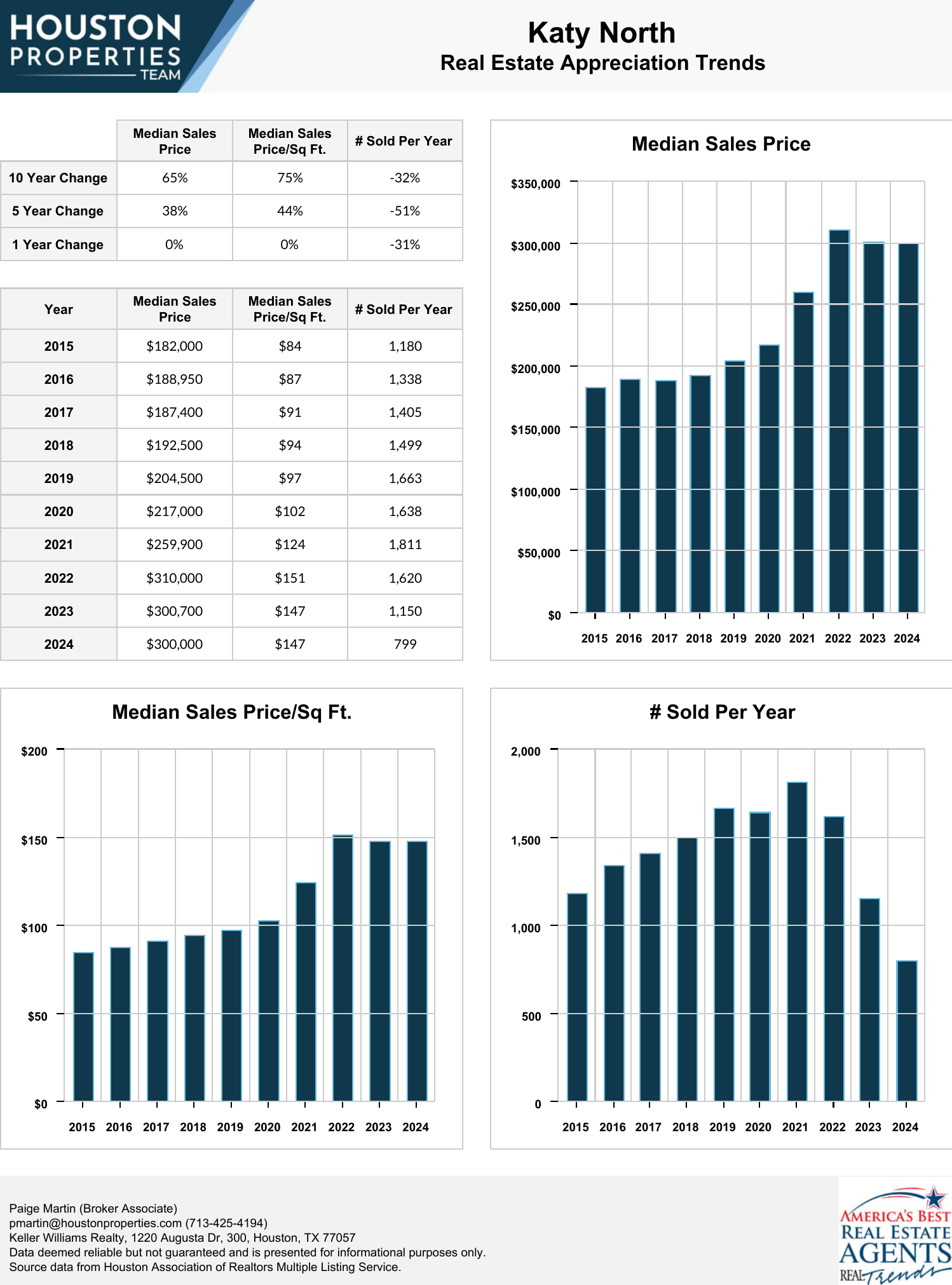

As Houston is over 600 square miles, neighborhoods and property types perform very differently. 2021 Examples:

- Katy Single Family Homes +19%

- Downtown Condos -8%

- Northern Suburbs Acreage +33%

Sources, Methodology & Disclosures

Houston real estate is hyper-local. For advice on the 2020 Houston housing market forecast, contact Paige Martin, the #1 Keller Williams Realtor in Houston and #1 Realtor in the state of Texas.

- All Houston home value information was sourced by the HAR MLS database.

- National Association of Houston Realtors Research Group

- 2022 Market Forecast by Ted C. Jones, PhD

- Greater Houston Partnership

- Bureau of Economic Analysis

- Data is deemed accurate but is not guaranteed. Information is provided for informational purposes only.

- We don’t have a crystal ball. All predictions are our educated guesses. Caveat emptor.

Best Houston Realtors: Paige Martin & The Houston Properties Team

The Houston Properties Team has a well-defined structure based on the individual strengths of each member. Each member is a specialist in their role – which is why our homes sell faster and for more money than average.

Paige Martin, Broker Associate with Keller Williams Realty, and the Houston Properties Team are ranked amongst the top residential Realtors in the world.

They have been featured on TV and in dozens of publications including: The Wall Street Journal, Fortune Magazine, Reuters, Fox News in the Morning, Money Magazine, Houston Business Journal, Houstonia, and Houston Chronicle.

Paige Martin was just ranked as the #5 agent in the world with Keller Williams, and has completed over $1 Billion in Houston residential real estate sales.

Recent awards include:

– 2022: #1 Residential Real Estate Team by Sales Volume, Houston Business Journal

– 2021: Best Real Estate Teams in America, RealTrends.com

– 2021: Top 100 Women Leaders in Real Estate of 2021

– 2021: America’s Top 100 Real Estate Agents

– 2021: Top Real Estate Team (Houston Properties Team), Houston Business Journal

– 2021: Best Houston Real Estate Team, Best of Reader’s Choice

– 2021: Top Real Estate Team (Houston Properties Team), Houston Business Journal

– 2021: #1 Real Estate Team, Keller Williams Memorial

– 2020: America’s Best Real Estate Teams, Best of America Trends

– 2020: Best Houston Real Estate Team, Best of Reader’s Choice

– 2020: Top Real Estate Team (Houston Properties Team), Houston Business Journal

– 2020: #6 Individual Agent, Keller Williams, Worldwide

– 2020: #1 Individual Agent, Keller Williams, Texas (Top Keller Williams Realtor)

– 2020: #1 Real Estate Team, Keller Williams Memorial

- 2019: Top Residential Realtors in Houston, Houston Business Journal

- 2019: America’s Best Real Estate Agents, RealTrends.com

- 2019: #5 Individual Agent, KW Worldwide

- 2019: #1 Individual Agent, KW Texas

- 2018: #5 Individual Agent, Keller Williams, Worldwide

- 2018: #1 Individual Agent, Keller Williams, Texas

- 2018: #1 Individual Agent, Keller Williams, Houston

- 2018: America’s Best Real Estate Agents, RealTrends.com

- 2018: Top 25 Residential Realtor in Houston, Houston Business Journal

- 2018: Texas’ Most Influential Realtors

- 2017: #1 Individual Agent, Keller Williams, Texas

- 2017: #1 Individual Agent, Keller Williams, Houston

- 2017: #10 Individual Agent, Keller Williams, Worldwide

- 2017: America’s Best Real Estate Agents, RealTrends.com

- 2017: Top 25 Residential Realtor in Houston, Houston Business Journal

- 2017: Texas’ Most Influential Realtors

- 2016: #1 Individual Agent, Keller Williams, Texas

- 2016: #1 Individual Agent, Keller Williams, Houston

- 2016: #20 Individual Agent, Keller Williams, Worldwide

- 2016: Texas’ Most Influential Realtors

- 2016: Top 25 Residential Realtor in Houston, HBJ

- 2016: Five Star Realtor, Featured in Texas Monthly

- 2016: America’s Best Real Estate Agents, RealTrends.com

- 2015: #9 Individual Agent, Keller Williams, United States

- 2015: #1 Individual Agent, Keller Williams, Texas

- 2015: #1 Individual Agent, Keller Williams, Houston

- 2015: America’s Best Real Estate Agents, RealTrends.com

- 2015: Top 25 Residential Realtor in Houston, HBJ

- 2015: Five Star Realtor, Texas Monthly Magazine

- 2014: America’s Best Real Estate Agents, RealTrends.com

- 2014: #1 Individual Agent, Keller Williams Memorial

. . . in addition to over 318 additional awards.

Paige also serves a variety of non-profits, civic and community boards and was appointed by Houston’s Mayor to be on the downtown TIRZ board.

Benefits Of Working With The Houston Properties Team

Our Team, composed of distinguished and competent Houston luxury realtors, has a well-defined structure based on the individual strengths of each member.

We find team approach as the most effective way to sell homes. We have dedicated people doing staging, marketing, social media, open houses and showings. Each Houston Properties Team member is a specialist in their role – which is why our homes sell faster and for more money than average.

The benefits of working with a team include:

- ability to be in two or three places at one time: a member can handle showings, while another answer calls

- collective time and experience of members

- targeted advise and marketing of agent expert in your area

- competitive advantage by simply having more resources, ideas, and more perspectives

- a “Checks and Balances” system. Selling and buying a home in Houston is an intensely complex process

- more people addressing field calls and questions from buyers and agents to facilitate a faster successful sale

- efficient multi-tasking: One agent takes care of inspections and/or repair work, while another agent is focused on administrative details

- multiple marketing channels using members’ networks

- constant attention: guaranteed focus on your home and your transaction

- lower risk for mistakes. Multiple moving parts increase oversights. A team approach handles these “parts” separately

- flexibility in negotiation and marketing

- better management of document flow

- increased foot traffic through more timely and effective showing schedule coordination; and

- increased Sphere of Influence and exposure to more potential buyers.

To meet all the award-winning members of The Houston Properties Team, please go here.