Worried About The Impact Of Oil Price Crash On Houston Home Values?

We reviewed key trends from the 2015 oil crash and 2008 Great Recession to see how the recent oil price crash will impact the Houston housing market.

Oil prices have dropped to a 25-year low. Since Houston holds 29% of the nation’s jobs in oil & gas, the Bayou City is more exposed to oil prices than most.

While there are no signs of a slowdown so far, we’ve compiled an analysis of what may happen from a continued and prolonged drop in oil prices on Houston real estate.

We based our research on current market data, Houston’s economic makeup, and the impact of the 2008 financial crisis.

EXECUTIVE SUMMARY

There was an 18-month lag between the 2007/2008 financial crisis and a dip in Houston real estate prices.

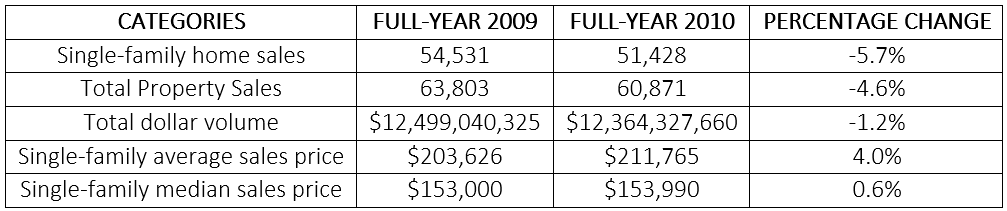

Houston’s single-family home prices fell 2.2% in 2009 and returned to “pre-crisis” levels within 24 months.

Homeowners who bought at the peak of the pre-crisis market (including transaction costs) were able to recoup their investment within 4-5 years.

Buyers from the peak of the pre-2008-crisis recouped their investment (including transaction costs) within 4-5 years on average.

In any downturn, there is a flight to quality. “In demand” neighborhoods outperformed.

Homes with good floorplans, not immediately located next to railways, highways or thoroughfares continued to hold value.

Certain areas of Houston are more exposed to energy jobs than others. It is likely that properties located near major centers (The Medical Center – Healthcare, Downtown – General Industry, The Galleria – Retail, etc.) could outperform.

Real estate is hyper-local. The quality of your neighborhood and home matters.

Any downturn (from oil prices or other negative events) creates a “flight to quality.” The value of a Top Houston Realtor is candid feedback on which areas and properties are most likely to hold value over time.

KEY RESOURCES:

Study Of How Previous Pandemics Affected The Real Estate Market

How The Houston Real Estate Market Is Trending (Updated Bi-Weekly)

Support Local: How The Houston Properties Team Is Helping Out Small Businesses

Buyers from the peak of the pre-2008-crisis recouped their investment (including transaction costs) within 4-5 years on average.

Table of Contents

- Not surprisingly, Houston is exposed to the energy industry.

- Houston’s energy exposure is down 70% since the 1980’s – thanks to growth in other sectors.

- Houston’s real estate market is so strong now, that 20-35% dip would create a “balanced market.”

- Global Financial Crisis Lesson #1: 18-Month Lag.

- Global Financial Crisis Lesson #2: Different Neighborhoods Trend Differently.

- Global Financial Crisis Lesson #3: Flight To Quality.

- Global Financial Crisis Lesson #4: Financing Terms Matter.

- Sources, Methodology & Disclosures

- The Best Houston Realtor to Sell Your Home

Not surprisingly, Houston is exposed to the energy industry.

Not surprisingly, Houston is exposed to the energy industry.

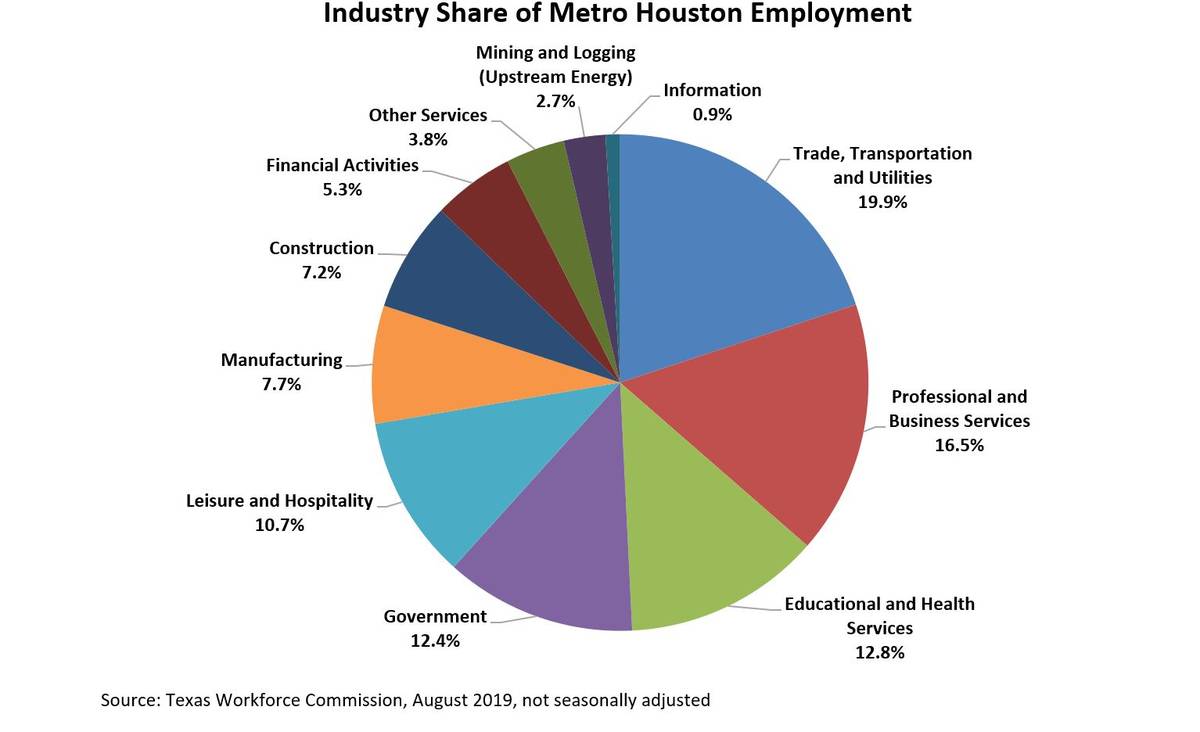

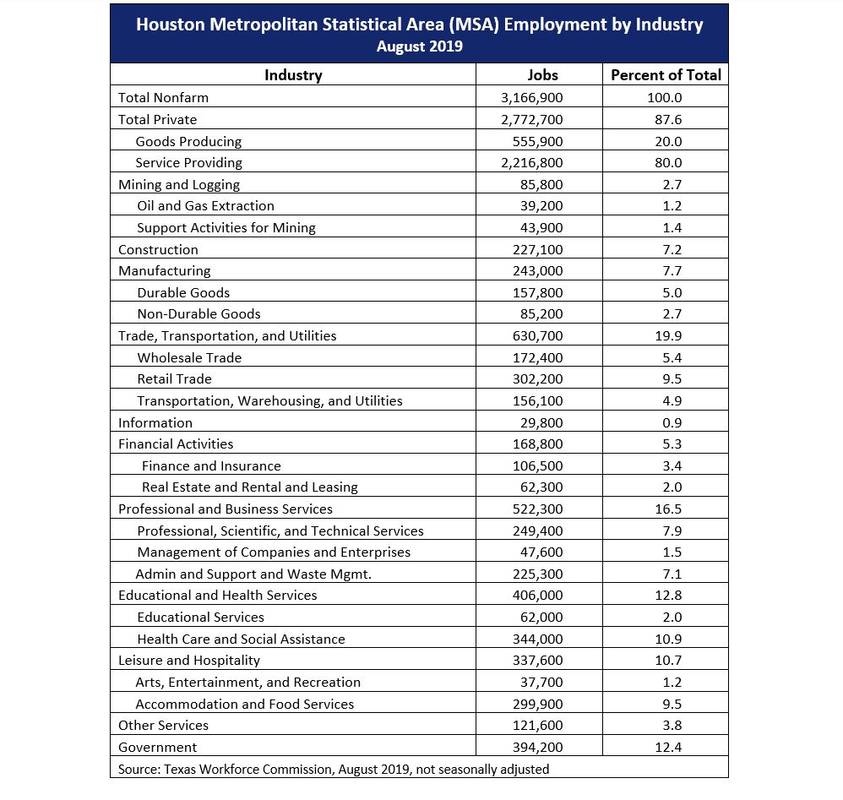

Houston is currently more exposed to the energy industry than most US cities as nearly 45% of our employment is directly or indirectly tied to the sector (for comparison, New York City has approximately 10% exposure.

Houston’s energy exposure is down 70% since the 1980’s – thanks to growth in other sectors.

"Paige Martin and her team are the finest group of professionals in the business" - Jason (Google review)

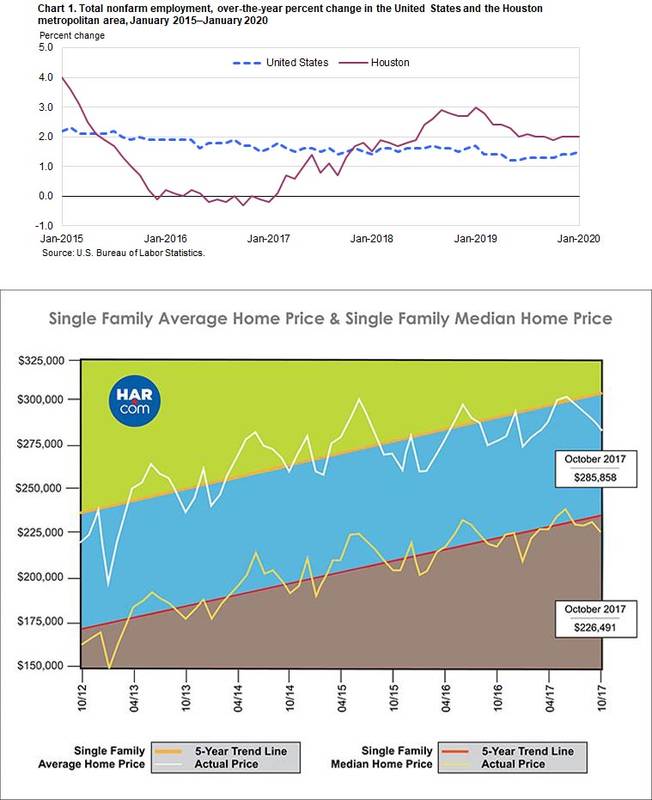

Houston’s energy exposure is dramatically lower than it was in the past. 85% of Houston’s employed in 1985 was directly or indirectly exposed to the energy sector.

Houston’s primary other industries include: Trade, Transpo, and Utilities (19.9%), Educational and Health Services (12.8%), Government (12.4%). Recreation and Entertainment, Real Estate, Finance, Information and Other Services combine to make 14%.

The Health care industry alone accounts for one in every 10 jobs in the region, 9.5 percent of local payroll ($15.9 billion in ’13), and more than 48,000 jobs created since the end of the Great Recession.

Houston’s real estate market is so strong now, that 20-35% dip would create a “balanced market.”

"The Houston Properties Team is the #1 boutique real estate team in Houston for good reason. Paige, Lisa & Shannon are incredibly candid and professional and they go the extra mile. Their analytics system is 2nd to none, their Success Team is exceptional and on the ball, and they have vendors for everything you'll need." - Infinite Ridge (Google review)

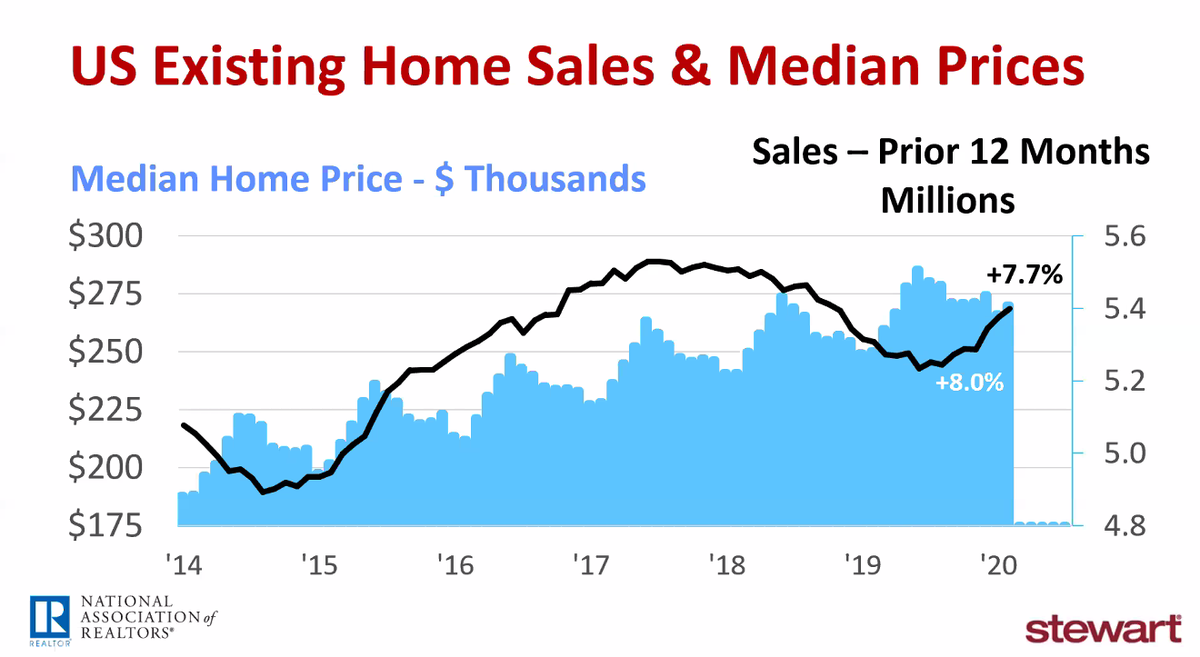

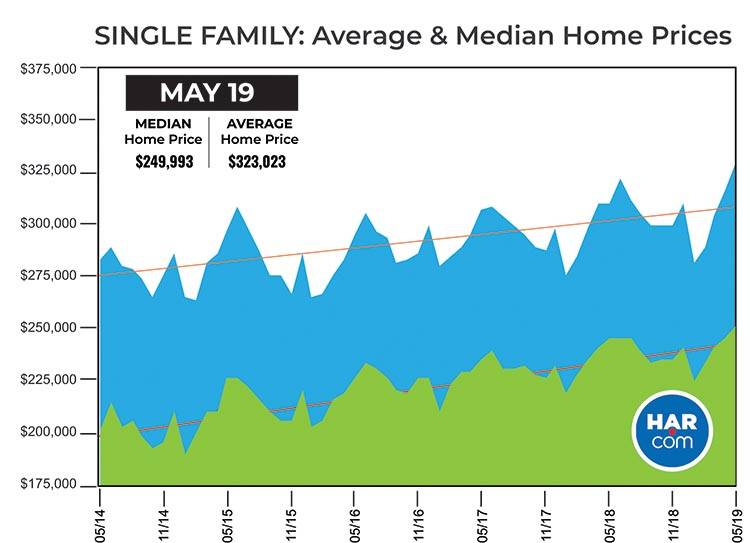

Houston is currently in a very strong seller’s market (2.7 months of inventory, compared to 5.1 months nationwide and 5-8 months being a balanced market).

A 20-35% drop (either based on a drop in demand or an increase in supply from new homes on the market) would bring us to a balanced market.

Historically, Houston’s “balanced market” appreciates at a rate between 3-5% per annum.

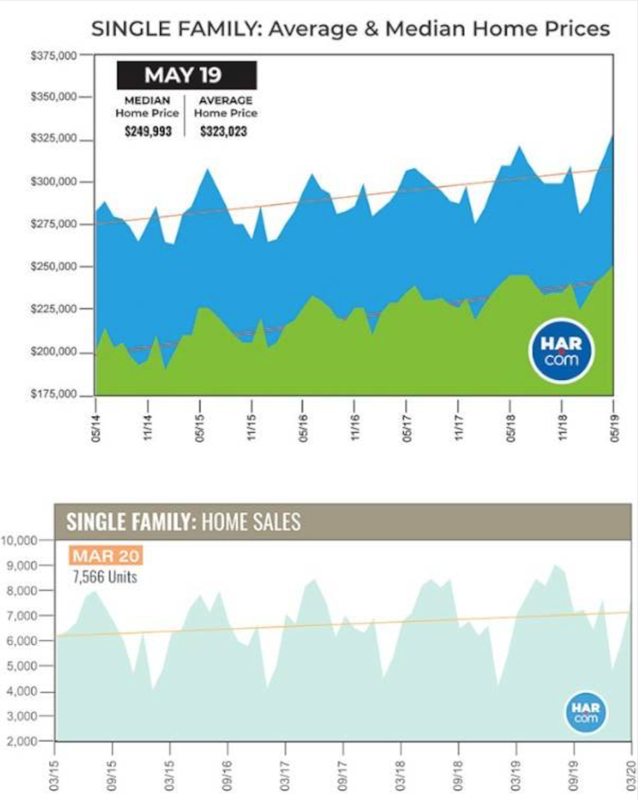

Based on the market report, we are still seeing a robust housing market. We recorded notable growth in total property sales (6.9%), total dollar volume (11%), and single-family home sales (8.2%).

We expect things to slow down considerably in the 2nd quarter (and possibly moving forward).

Global Financial Crisis Lesson #1: 18-Month Lag.

Paige Martin has been recognized as the #1 individual agent in Texas and the #5 individual realtor in the world with the Keller Williams group. We really enjoyed meeting her and appreciated her professional, diligence and follow up. - Calli Ricker (Google Review)

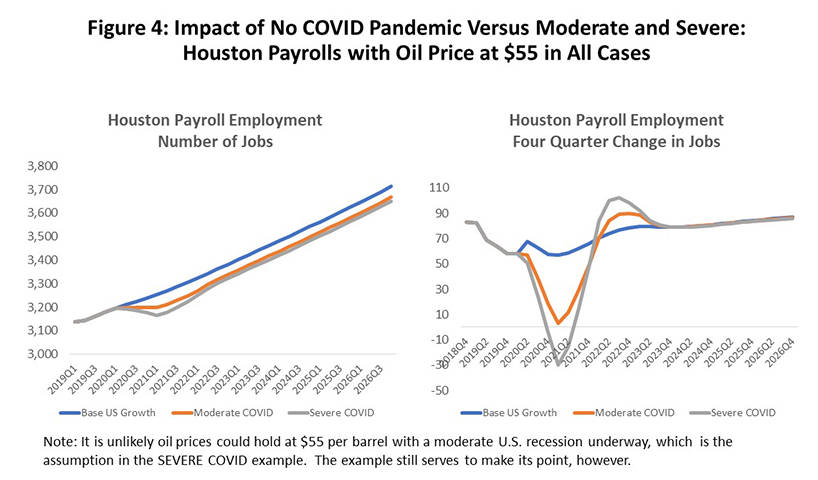

While no one knows the direction or magnitude of future oil prices, we could extrapolate what a continued drop in oil prices may look like by evaluating the impact of the 2007/2008 financial crisis.

In August 2007, the interbank market froze completely, and major banks started looking for emergency funding.

Lehman Brothers collapsed in September 2008.

The average sales price per square foot of single-family home price of Houston's close-in neighborhoods increased in both 2007 and 2008.

In September 2009, the average price of single-family homes was 1.6% lower than the previous year.

Houston’s single-family home prices were up 4% by 2010 and returned to “pre-crisis” levels within 24 months.

The main trend that Houston real estate experienced was a drop in total VOLUME but not a massive decrease in the average or median sale price per square foot, like other parts of the country experienced.

Global Financial Crisis Lesson #2: Different Neighborhoods Trend Differently.

"The Houston Properties Team under the leadership of Paige Martin, is one of the most successful real estate teams in Texas. Paige and her team takes the pain out of the real estate experience through hard work, proprietary systems and processes, and a deep understanding of the hyper local Houston real estate market. She's ranked #5 in Keller Williams worldwide and #1 in Houston with good reason. Paige is the best!" - Sandy (Google review)

Neighborhoods trend differently, as real estate is local (and in most cases hyper-local).

Certain areas, subdivisions, and condo buildings had an extremely muted impact (compared to Houston, Texas, or the nation) as these areas were (and are) consistently in high demand.

These areas benefited from two main factors:

Most sellers who lived there didn’t have to sell (they could either rent out their property or had the luxury of having financial resources to keep their home).

The areas were (and in nearly all cases “are”) in such high demand that they had a continual interest from new buyers (buyers “moving up,” buyers wanting to be close to their jobs, relocation buyers, investors, etc.)

Notable neighborhoods that fit these criteria include: West University, River Oaks, Bellaire, Timbergrove / Lazybrook,, Museum District, Houston Heights, Southampton, Rice Military, Afton Oaks, etc

As in most crises, real estate experiences a “flight to quality.” (If you want a collection of neighborhoods in consistently high demand in your price point, email me.)

Assuming a “bad case scenario” for oil prices, it’s likely that neighborhoods with close proximity to major job centers of other industries will trend better (e.g. Medical Center – Healthcare, Galleria – Retail, Downtown – General industrial).

Likewise, neighborhoods with a higher proportion of energy jobs than average, or neighborhoods located in further proximity to the major job centers could trend worse.

Global Financial Crisis Lesson #3: Flight To Quality.

"Three years after purchasing our home, Paige Martin continues to provide excellent service! After experiencing electrical problems a recently, she was able to immediately put us in touch with her top inspector who walked us through the issue over the phone. Something that could have cost us hundreds of dollars, ended up being an easy fix for free! With Paige and her team, you know you will have help and support whenever you need it, even long after you have purchased your home. That kind of help is invaluable!!" - April Coker (Google review)

High quality homes sell in nearly every market.

Disadvantaged homes sell more slowly or at larger discounts.

In the aftermath of the 2007/2008 financial crisis, we saw a flight to quality in nearly every asset class – including Houston real estate.

Several of the key factors that influenced the price and speed that homes sold in the downturn include:

Railways. Homes in close proximity to railroads tended to sell at larger discounts.

Highways. Homes in close proximity to highways tended to sell at larger discounts.

On major thoroughfares. Homes located on a major thoroughfare tended to sell at larger discounts.

Floorplan. Homes built with a bad or awkward floor plan tended to sell slower or at larger discounts.

Quality of construction. While this can be subjective (or determined by a good inspector during the option period) homes built by “known problematic builders” are sold at material discounts.

The primary value of a top Houston realtor is to provide candid advice on the resaleability of a home in a downturn. Not all homes are created equal.

Global Financial Crisis Lesson #4: Financing Terms Matter.

"We had the pleasure of meeting Paige Martin. She was recently presented with the following awards: - #1 Keller Williams Realtor in Houston - #1 Keller Williams Realtor in Texas - #5 Keller Williams Realtor in the World Our short time with her showed us why she's so successful: she's smart, patient, and very professional!" - Kristin Bond (Google review)

Mortgage financing terms are of critical importance. The primary drop in real estate sales from the 2008 crisis did not stem from a lack of demand – it came from the lack of ability to get financing.

Two notable items have the ability to mitigate a drop in oil prices:

We are seeing 90% / 100% financing returning to the market for certain professionals (doctors, lawyers, engineers, etc.). The impact of this is enormous as it shifts the demand curve up and could counterbalance a fall in demand due to fewer energy jobs.

Together Fannie and Freddie own or guarantee about half of all U.S. mortgages, worth about $5 trillion. Along with other federal agencies, they back roughly 90 percent of new home loans.

What the Fed decides to do about interest rates is anyone’s guess, but it will impact the real estate market.

If the Fed acts more “dovish” due to a drop in the energy industry, the impact of a drop in oil prices will be muted.

Any downturn (from oil prices or anything else) creates a “flight to quality.” The value of a Top Houston Realtor is candid feedback on which areas and properties are most likely to hold value over time.

CONSIDERING SELLING? Get a custom home valuation guide.

BUYERS: Get a custom recommendation on areas that may be the best fit for you.

Sources, Methodology & Disclosures

With all the available information out there about Houston's top areas, it can be confusing when finally making a decision on which neighborhood to choose. Get the advice of the best Houston Realtors and remove the guesswork when looking for one of the best homes in Houston to live in.

Houston Economic Highlights

Median home sale prices were calculated by HAR MLS Geo Market area, HAR MLS Master Planned Community --Designation, or HAR MLS subdivision.

All median Houston home value information was sourced by the HAR MLS database.

Default median housing price values are from single-family homes, except in these neighborhoods (where condos, townhomes, and single-family homes are considered due to the fact that there’s an above-average of condos/townhomes in these market areas.)

These exception neighborhoods include Braeswood Place, Rice/Museum District, Memorial West, Midtown, Downtown, EaDo, Memorial Close In, and Medical Center.

For “can comfortably afford” salary assumptions, we used that 28% of gross income could be used toward monthly PITI costs.

Data is deemed accurate but is not guaranteed. Information is provided for informational purposes only.

The Best Houston Realtor to Sell Your Home

The Houston Properties Team has a well-defined structure based on the individual strengths of each member. Each member is a specialist in their role – which is why our homes sell faster and for more money than average.

Paige Martin, Broker Associate with Keller Williams Realty, and the Houston Properties Team are ranked among the top residential Realtors in the world.

They have been featured on TV and in dozens of publications including The Wall Street Journal, Fortune Magazine, Reuters, Fox News in the Morning, Money Magazine, Houston Business Journal, Houstonia, and Houston Chronicle.

Paige Martin was just ranked as the #5 agent in the world with Keller Williams, completing over $1 Billion in Houston residential real estate sales.

Recent awards include:

– 2022: #1 Residential Real Estate Team by Sales Volume, Houston Business Journal

– 2021: Best Real Estate Teams in America, RealTrends.com

– 2021: Top 100 Women Leaders in Real Estate of 2021

– 2021: America’s Top 100 Real Estate Agents

– 2021: Top Real Estate Team (Houston Properties Team), Houston Business Journal

– 2021: Best Houston Real Estate Team, Best of Reader’s Choice

– 2021: Top Real Estate Team (Houston Properties Team), Houston Business Journal

– 2021: #1 Real Estate Team, Keller Williams Memorial

– 2020: America’s Best Real Estate Teams, Best of America Trends

– 2020: Best Houston Real Estate Team, Best of Reader’s Choice

– 2020: Top Real Estate Team (Houston Properties Team), Houston Business Journal

– 2020: #6 Individual Agent, Keller Williams, Worldwide

– 2020: #1 Individual Agent, Keller Williams, Texas (Top Keller Williams Realtor)

– 2020: #1 Real Estate Team, Keller Williams Memorial

- 2019: Top Residential Realtors in Houston, Houston Business Journal

- 2019: America’s Best Real Estate Agents, RealTrends.com

- 2019: #5 Individual Agent, KW Worldwide

- 2019: #1 Individual Agent, KW Texas

- 2018: #5 Individual Agent, Keller Williams, Worldwide

- 2018: #1 Individual Agent, Keller Williams, Texas

- 2018: #1 Individual Agent, Keller Williams, Houston

- 2018: America’s Best Real Estate Agents, RealTrends.com

- 2018: Top 25 Residential Realtors in Houston, Houston Business Journal

- 2018: Texas’ Most Influential Realtors

- 2017: #1 Individual Agent, Keller Williams, Texas

- 2017: #1 Individual Agent, Keller Williams, Houston

- 2017: #10 Individual Agent, Keller Williams, Worldwide

- 2017: America’s Best Real Estate Agents, RealTrends.com

- 2017: Top 25 Residential Realtors in Houston, Houston Business Journal

- 2017: Texas’ Most Influential Realtors

- 2016: #1 Individual Agent, Keller Williams, Texas

- 2016: #1 Individual Agent, Keller Williams, Houston

- 2016: #20 Individual Agent, Keller Williams, Worldwide

- 2016: Texas’ Most Influential Realtors

- 2016: Top 25 Residential Realtors in Houston, HBJ

- 2016: Five Star Realtor, Featured in Texas Monthly

- 2016: America’s Best Real Estate Agents, RealTrends.com

- 2015: #9 Individual Agent, Keller Williams, United States

- 2015: #1 Individual Agent, Keller Williams, Texas

- 2015: #1 Individual Agent, Keller Williams, Houston

- 2015: America’s Best Real Estate Agents, RealTrends.com

- 2015: Top 25 Residential Realtors in Houston, HBJ

- 2015: Five Star Realtor, Texas Monthly Magazine

- 2014: America’s Best Real Estate Agents, RealTrends.com

- 2014: #1 Individual Agent, Keller Williams Memorial

...in addition to over 318 additional awards.

Paige also serves a variety of non-profits, and civic and community boards. She was appointed by the mayor of Houston to be on the downtown TIRZ board.

Benefits Of Working With The Houston Properties Team

Our team, composed of distinguished and competent Houston luxury realtors, has a well-defined structure based on the individual strengths of each member.

We find the team approach as the most effective way to sell homes. We have dedicated people doing staging, marketing, social media, open houses, and showings. Each Houston Properties Team member is a specialist in their role—which is why our homes sell faster and for more money than average.

The benefits of working with a team include:

- the ability to be in two or three places at one time; a member can handle showings, while another answer calls

- collective time and experience of members

- targeted advice and marketing of agent expert in your area

- competitive advantage by simply having more resources, more ideas, and more perspectives

- a “checks and balances” system; selling and buying a home in Houston is an intensely complex process

- more people addressing field calls and questions from buyers and agents to facilitate a faster, successful sale

- efficient multi-tasking; one agent takes care of inspections and repair work, while another agent focuses on administrative details

- multiple marketing channels using members’ networks

- constant attention: guaranteed focus on your home and your transaction

- lower risk for mistakes. Multiple moving parts increase oversights. A team approach handles these “parts” separately

- flexibility in negotiation and marketing

- better management of document flow

- increased foot traffic through more timely and effective showing schedule coordination; and

- increased sphere of influence and exposure to more potential buyers.

To meet all the award-winning members of the Houston Properties Team, please go here.