2024 Houston Real Estate Trends: The Top 6 Predictions You Need to Know

With a 68% Accuracy Rate: Discover Our Top Houston Real Estate Predictions for the Upcoming Year

2023 witnessed a dynamic shift in Houston's real estate market, with rising prices and interest rates shaping the landscape.

Despite these factors, the market largely favored sellers throughout most of Houston.

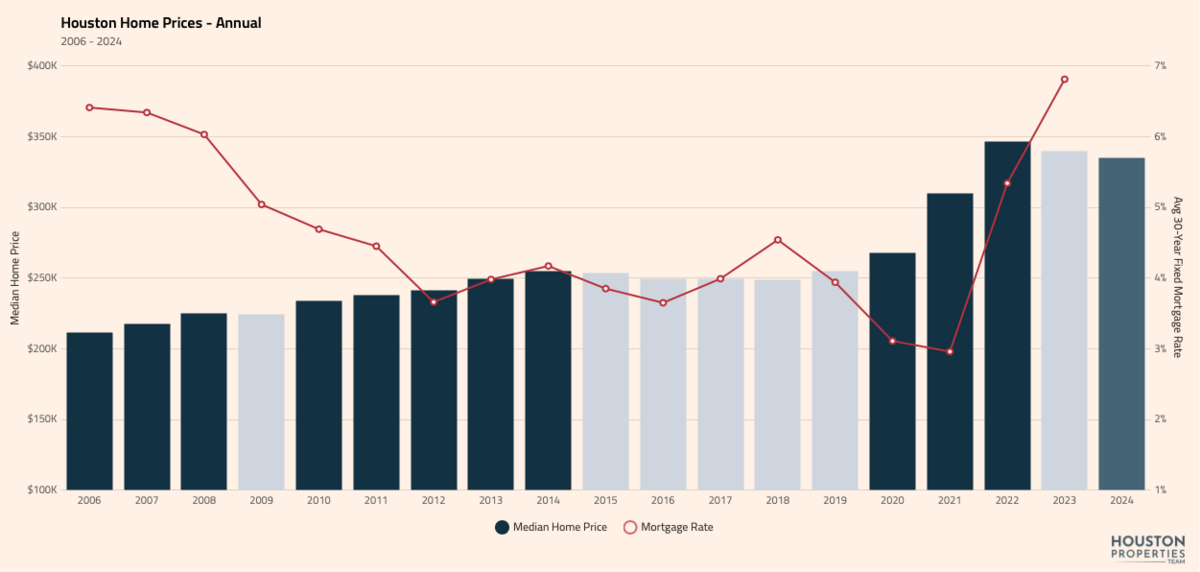

Last year's home sales paralleled 2019's figures, with average home prices at $335,000, slightly below those of 2022 at $340,000.

As 2024 begins, Houston's real estate scene offers a blend of challenges and opportunities.

This article explores what lies ahead for buyers and sellers, drawing on expert insights and data.

Table of Contents

- Houston Will End 2024 With Its 3-5th Best Real Estate Market In History

- Houston Will Outperform The Nation Due To Local Job Growth

- Anticipated Election Season May Temporarily Decelerate Real Estate Sales

- Mortgage Interest Rates Decline But Remain Around 6%

- Housing Inventory Will Remain Low & We Will Technically Remain In A Sellers Market

- Home Prices Rise Slightly And Are Consistent With 2022-2023 Pricing

- Disclaimers, Sources & Methodology

Houston Will End 2024 With Its 3-5th Best Real Estate Market In History

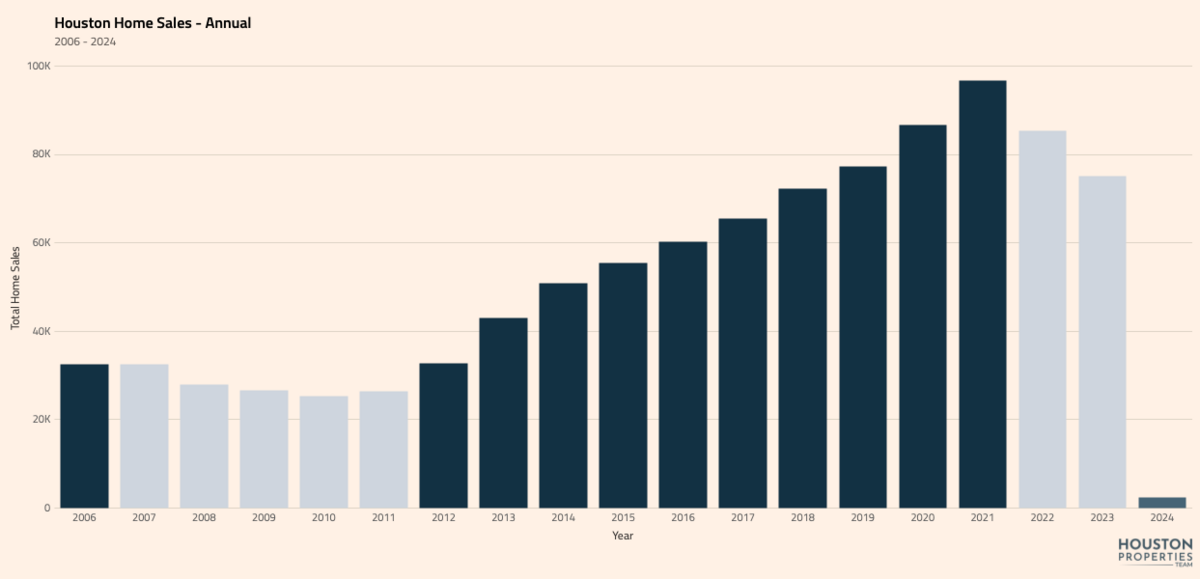

Ranking Houston's top real estate years by sales volumes, we see a dynamic market:

- #1: 2021 (96.9k)

- #2: 2020 (86.9k)

- #3: 2022 (85.6k)

- #4: 2019 (77.4k)

- #5: 2023 (75.1k)

Given the pent-up demand and anticipated marginally lower mortgage rates, our projections suggest that Houston's sales volumes in the upcoming period will surpass those of 2023, aligning closely with the figures from 2019.

Click here for Real Time Houston Market Data.

Houston Will Outperform The Nation Due To Local Job Growth

Based on the Greater Houston Partnership's report, the Houston region saw significant job growth:

- From May 2020 to October 2023, the region added a remarkable 557,000 jobs.

- In 2024, it's expected to add another 57,600 jobs.

Job growth is a key factor in real estate trends. It often predicts how real estate prices and sales volumes will move.

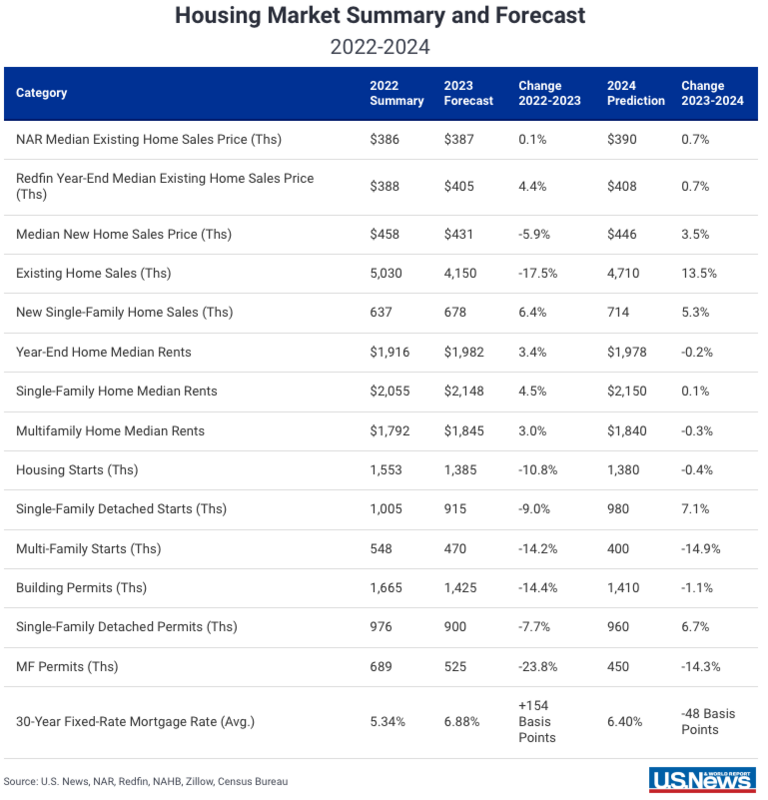

The table above shows a range of forecasts for the national housing market in 2024. Predictions for national housing trends range widely, from a 14.9% decrease to a 13.5% increase.

However, our analysis suggests a different trend for Houston. Based on our past predictions and their outcomes, we believe Houston's real estate market will outperform the national average. Specifically, we expect the market, as measured by sales volume, to surpass the national trends.

Anticipated Election Season May Temporarily Decelerate Real Estate Sales

Recent data from an AP poll indicates that 62% of Americans are concerned that the upcoming 2024 presidential election might endanger U.S. democracy. Additionally, 22% of Americans are experiencing significant stress because of the continuous news and election cycles. (1 & 2)

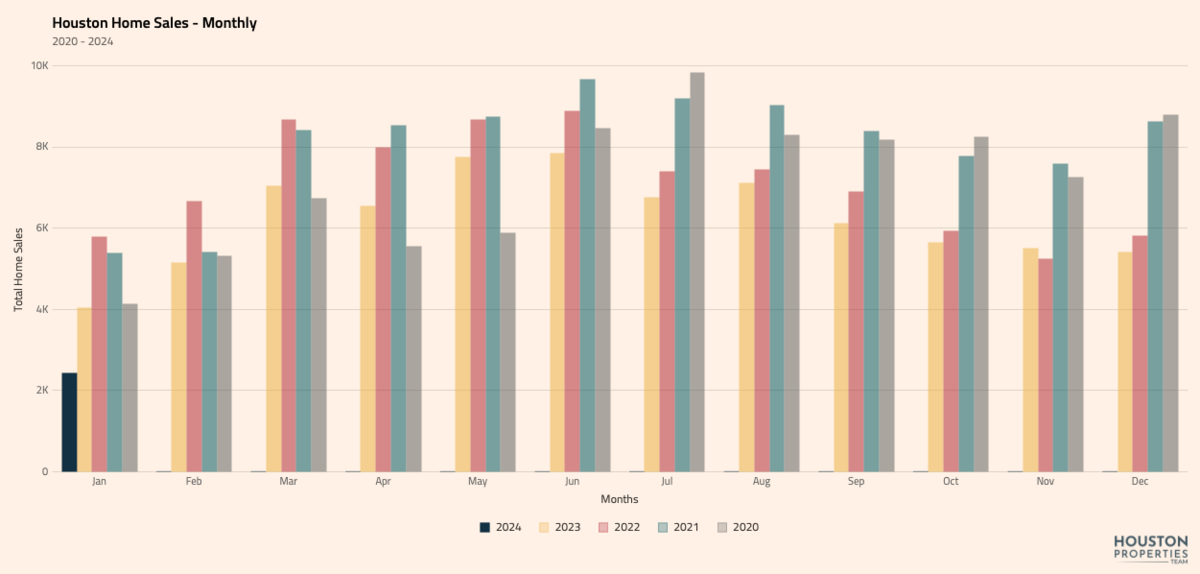

The Houston real estate market has also felt the impact of broader economic events, as shown by the monthly sales graph:

- In 2020, April and May saw lower sales due to the initial COVID-19 impact.

- Sales surged in June 2020 as the initial COVID shock lessened.

- The market in 2021 was buoyed by COVID stimulus checks and historically low-interest rates.

- By April 2022, the influence of climbing interest rates began to significantly affect sales.

- Sales dampened further in July 2022 as interest rates continued to rise.

- A softening in interest rates in October 2023 led to an uptick in sales compared to the previous year.

Echoing the patterns seen in the last presidential election cycle, we anticipate some buyers and sellers may opt to wait out the period preceding the election. This could result in lower sales from September to November compared to typical years.

For those considering selling, our advice is to act quickly and list your property soon. For expert guidance on how to sell your Houston home swiftly and for top dollar, visit our page: How to sell your houston Houston fast for the most money.

Mortgage Interest Rates Decline But Remain Around 6%

At the time of this writing in January 2024, the current average 30-year fixed mortgage interest rate is 6.6%, down from a high of 7.8% in October 2023.

Here is how some experts predict market conditions will affect the average 30-year, fixed-rate mortgage in 2024: (3)

- National Association of Realtors chief economist Lawrence Yun. “Mortgage rates look to head towards 7% in a few months and into the 6% range by the spring of 2024.”

- Mortgage Bankers Association (MBA). MBA’s baseline forecast is for mortgage rates to end 2024 at 6.1% and reach 5.5% at the end of 2025 as Treasury rates decline and the spread narrows.

- Fannie Mae Housing Forecast. The 30-year fixed rate mortgage will average 7% in Q1 2024 and slowly decline over the year, landing at a Q4 average of 6.5%.

The Federal Reserve is likely to remain vigilant against inflation. If the first quarter trends are stable, we believe they will lower rates 2-4 times before the election.

We believe mortgage rates will be in the mid to lower 6% range for most of 2024.

We do not expect any return to the ultra low 2-4% mortgage rates in the foreseeable future.

Housing Inventory Will Remain Low & We Will Technically Remain In A Sellers Market

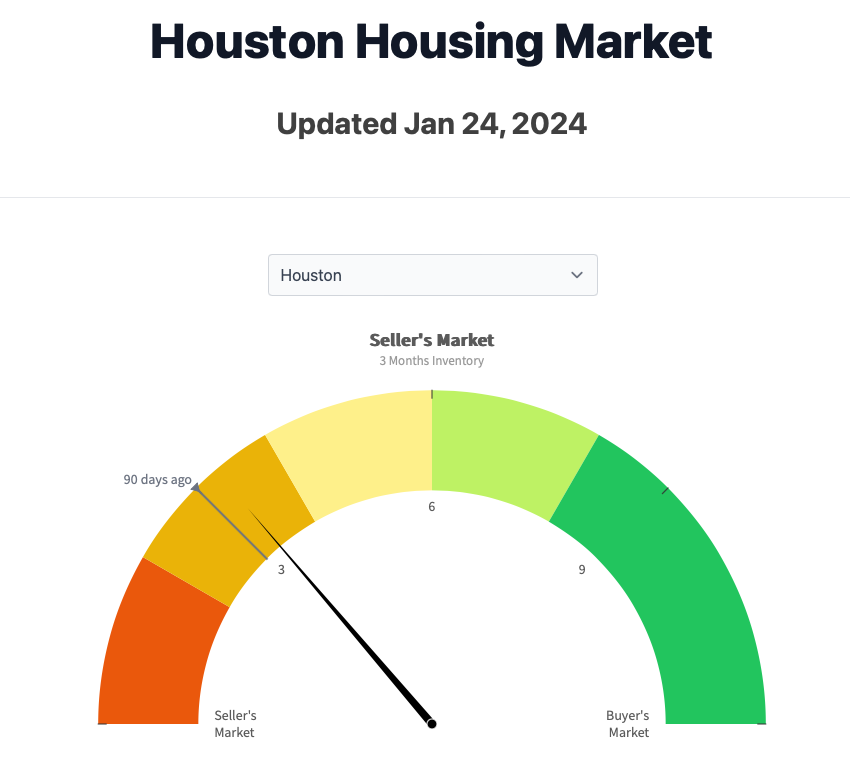

A balanced real estate market has 5-7 months of inventory.

- Sellers Market: less than 5 months

- Buyers Market: more than 7 months

2020 and 2021 saw the greatest seller's markets in history.

Here's data on Houston's inventory for the last 7 years from each December:

- 2023: 3.3 months

- 2022: 2.6 months

- 2021: 1.4 months

- 2020: 1.8 months

- 2019: 3.5 months

- 2018: 3.4 months

- 2017: 3.2 months

We believe that 2024 will also bring constrained inventory levels given that over 80% of homeowners pay mortgage rates below 5%.

We believe higher rates in 2024 will keep home sales slow due to the "lock-in effect," where people delay moving until rates drop below 5% or prices adjust.

Our team expects to end 2024 with 3.0 - 4.5 months of inventory.

Home Prices Rise Slightly And Are Consistent With 2022-2023 Pricing

NAR Chief Economist Lawrence Yun forecasts the US median home price will an increase of 0.9% in 2024.

His predictions are based on the US GDP growing by 1.5%, avoiding a recession, and the 30-year fixed mortgage rate to average 6.3% for the year. (4)

We concur with this economic model and extend it with our own forecast. Considering Houston's anticipated job growth surpassing national figures, we predict the median home price in Houston to rise between 2-4%, keeping pace with inflation.

However, it's crucial to remember that the "median house" is not representative of every home.

In 2023, among the 124 Houston regions we monitor, all with over 50 publicly reported sales, the real estate landscape was varied:

- In 17 regions, the median sales price saw a decrease of 5% or more.

- Conversely, 28 regions witnessed a median sales price increase of 5% or more.

For a deeper insight into Houston's real estate market, particularly the neighborhoods boasting the best five-year appreciation rates, visit our detailed guide on Houston's neighborhoods with the best 5 year appreciation rates

For information about any specific neighborhood, feel free to reach out to us at PMartin@HoustonProperties.com .

Disclaimers, Sources & Methodology

We don’t have a crystal ball. All predictions are our educated guesses.

All Houston home value information was sourced from the HAR MLS database.

Data is deemed accurate but is not guaranteed. Information is provided for informational purposes only.

Our market data is from https://www.houstonproperties.com/housing-market

The data is for Houston (Data from the HAR MLS for purchases of single family homes over $125,000, not at lot value, in MLS Areas 1, 2, 3, 4, 5, 6, 7, 8, 9, 10, 11, 12, 13, 14, 15, 16, 17, 18, 19, 20, 21, 22, 23, 24, 25, 26, 28, 29, 30, 31, 32, 33, 34, 35, 36, 37, 38, 39, 40, 55 & 57).

The average days on market is calculated using the average of the trailing 4 weeks of data from the Days on Market graph.

The median sale price is from the most recent month on the Home Prices - Monthly graph, comparing the value to the same month one year ago.

The number of homes sold is from the most recent month on the Home Sales - Monthly graph, comparing the value to the same month one year ago.

Pending sales values are calculated by summing the number of new “Pending” listings from the trailing four weeks for the past two years and then expressing the differences in a percentage value.

Number of properties with price reductions are calculated by summing the number of new properties with a price change and comparing it with same time periods over the last two years.

Pending Sales graph displays the weekly count of new “Pending” listings in the HAR MLS. It does not include “Option Pending” or “Pending Continuing To Show” status fields so contracts are not double or triple counted.

The Days on Market graph displays the average of the Cumulative Days on Market field for sold properties from the HAR MLS field for the past 13 weeks, as compared to the same data over the past three years.

This product uses the FRED® API but is not endorsed or certified by the Federal Reserve Bank of St. Louis.

1) https://apnorc.org/projects/widespread-feeling-that-the-2024-presidential-election-carries-serious-stakes-for-the-country/

2) https://www.psychiatry.org/news-room/apa-blogs/address-your-feelings-during-this-election-cycle

3) https://www.forbes.com/advisor/mortgages/mortgage-interest-rates-forecast/#:~:text=“Our%20best%20guess%20is%20that,a%20Q4%20average%20of%206.5%25.

4) https://www.nar.realtor/newsroom/nar-forecasts-4-71-million-existing-home-sales-improved-outlook-for-home-buyers-in-2024