How To Avoid Houston Homes With Flooding History

Understand the Houston real estate market post Harvey and post Imelda, and compare Houston home prices after Harvey and Imelda for neighborhoods that flooded and did not flood.

For anyone who watches the news, it should be no surprise that parts of Houston are very prone to flooding.

Here are a few of Houston's recent major flooding events:

-

Tropical Storm Allison (2001)

-

Major southeast flooding (2006)

-

Hurricane Ike (2008)

-

Memorial Day Floods (2015)

-

Tax Day Floods (2016)

As a real estate broker, I'm baffled by the number of Houstonians who buy a home that has flooded two or more times from the events above.

Some buyers of flooded homes know of the risks. However, far too many Houston home buyers didn't do their correct due diligence before making a purchase. Read more about our Houston Real Estate Predictions for 2023.

Here's an example of a common problem.

If the property flooded, but the structure didn’t flood, the listing agent too often markets the property in big bold letters "DID NOT FLOOD."

However, while this is technically true, it is not accurate . . . and it happens all the time.

Furthermore, the listing agent also often doesn't make it easy for Houston homebuyers to get the survey, details, and any prior inspection reports so you really know what you’re buying.

That's why you need an expert on your side to help you navigate the pitfalls of buying in or around Houston's flood-prone areas.

Politicians may promise "new and improved drainage" or "new building restrictions" to "fix the problem." However, it's difficult to overcome fundamental topography when Houston adds more residents per year than the entire population of Pittsburg.

After every major storm, the Houston Properties Team researches the neighborhoods and high-rise condos that did and did not flood.

Below, you'll see a list of some of the neighborhoods that fared well during the most recent major flooding event in Houston (in this case, Harvey). We'll also share with you those neighborhoods that didn't do so well.

We also did the research on home prices and the state of the real estate market in Houston post-Harvey to give you an idea of the trends in the area after a major disaster, plus some tips on how to do your homework to make sure that you (1) won't make the mistake of unknowingly buying a flooded home and (2) will price appropriately.

If you're looking to buy a home in Houston that is at lower risk of flooding, we can definitely help you. We've done the research into the areas that did and did not flood. Email [email protected] for recommendations.

Table of Contents

- What Parts of Houston Are Not Flooded (Examples From Central Houston)

- Flooded Neighborhoods in Houston (Examples From Central Houston)

- Resale Trends (Comparing Areas That Did Well vs Flood Prone Areas 2 Years Post Harvey)

- Hurricane Harvey, Tropical Storm Imelda, and Houston Flood Maps

- Houston Home Prices After Harvey

- Houston Real Estate Market Post Harvey and Imelda

- How to Check for Flooding History When Buying a Home in Houston

- Houston Flood Plain Terminology - Explained

- The Best Houston Realtor to Sell Your Home

What Parts of Houston Are Not Flooded (Examples From Central Houston)

This group of neighborhoods reported very few (or no) flooded homes during the last four major storms based on our post-Harvey and post-Imelda analysis. Contact us for additional recommendations on what areas are not flooded in Houston.

After every major flood, the big question in homebuyers' minds is always, "What parts of Houston are not flooded?"

Based on our research from the last major floods (including the Imelda flooding, the Harvey flooding, the Tax Day Floods, and the Memorial Day Floods), the following Central Houston neighborhoods fared very well:

-

EaDo

-

Garden Oaks

-

Heights / Greater Heights

-

Highland Village / Midlane

-

Midtown

-

Montrose (77006)

-

Northside (77009)

-

Royden / Afton Oaks

-

Oak Forest (East Only)

-

Briargrove

In addition, these three neighborhoods also did well during Tropical Storm Imelda, which, together with Harvey, is now considered one of the worst storms to hit Houston in recent years.

-

River Oaks

-

Southbelt / Ellington

-

The Woodlands

EaDo

Also known as East Downtown, EaDo has some of the most competitively-priced properties in the Inner Loop, offering housing options such as single-family homes, townhomes, and condos for attractive prices.

Eastwood is an affordable subdivision to consider within EaDo, while Herrin Lofts and Stanford Lofts are just some of its most notable condo projects that you can take a look at if condo living is what you’re after.

Located only a few minutes from the Medical Center, Greenway Plaza, and Houston Ship Channel, this neighborhood is one of Houston’s most accessible neighborhoods, where top-rated gyms, restaurants, bars, and breweries are all just a stone’s throw away from each other.

It’s also home to some of the National Blue Ribbon and multi-award-winning schools like Baylor College of Medicine Biotech Academy, Project Chrysalis Middle School, and Houston Gateway Academy—one of the most beautiful campuses in Houston.

Garden Oaks

Garden Oaks is a tree-lined community with towering oaks (hence the name), lofty pine trees, and scenic magnolias dotting its rustic landscape.

The lots in this Central Houston neighborhood can go more than 17,000 square feet and feature vintage home options that appreciate well, such as plantation-style homes, quaint patio homes, bungalows, ranch-style homes, and townhomes.

And even though it retains a lot of its small-town vibe, Garden Oaks is just 7 miles away from downtown Houston and is easily accessible from job centers like the Medical Center and the Galleria.

Also, since it’s zoned to the largest school district in the state (Houston Independent School District), you can have your pick from several notable public and private schools you can send your children to.

Heights / Greater Heights

A historic district and one of Houston’s most accessible neighborhoods, The Heights (or more accurately, The Greater Heights) is one of the best-performing neighborhoods in Houston in terms of real estate appreciation.

It offers single-family homes, townhomes, and condo options for those looking to move into this area.

While single-family homes are the most common housing option here, townhomes are also gaining more and more popularity. Condos are a bit more limited, considering the neighborhood’s deed restrictions and preference for Victorian-style homes.

The Greater Heights offers a great commute to downtown, Medical Center, Galleria, and other accessible neighborhoods. It also boasts fun, outdoor activities like Heights Hike and Bike Trail, White Oak Bayou Trail, and Lights in the Heights, a well-attended event that is planned annually by its very active community.

Highland Village / Midlane

Highland Village is a pocket neighborhood located just south of the Highland Village Shopping Center, a popular upscale retail destination.

Housing options in this area include updated ranch-style homes and larger and newer custom-built homes, all of which can go for as high as $3,000,000. Limited townhomes and condos are available in Highland Village though because of its strict deed restrictions.

This neighborhood is included in the best land value appreciation in Houston, and this is mainly due to Highland Village’s proximity to retail, business, and employment hubs like the Galleria/Uptown Houston and Upper Kirby/Greenway Plaza.

Another factor in its rising land values is the International Baccalaureate World Schools serving Highland Village homes, like School At St. George Place Elementary, Lanier Middle, and Lamar High School.

Midtown

Midtown is almost synonymous with luxury loft living, with upscale condos and lofts being a popular housing option for residents and homebuyers in this area.

The Edge, Rise Lofts, Vistas at Midtown, and 2016 Main are just some of the notable condos in this neighborhood, and they come with luxurious amenities like rooftop decks with views of the downtown skyline, swimming pools, fitness centers, and reserved parking for residents.

One of the most accessible neighborhoods in Houston, Midtown has location as its best asset. It has excellent public transportation facilities and easy access to major freeways, restaurants, bars, lounges, coffee shops, boutiques, and retail stores.

It also boasts excellent private and public schools zoned to the Houston Independent School District.

Montrose (77006)

Montrose is one of Houston’s cultural centers and is known for its distinctly bohemian vibe with its art museums, festivals, 1920s mansions, and quirky townhomes.

However, it is also seeing a rise in upscale condominiums and old-style and new construction single-family homes due to a boom in property development projects in the area.

Although it is a mostly residential neighborhood, retail and entertainment spots are still easily accessible within the Montrose area, and commuting to and from downtown, Galleria, and the Medical Center is relatively easy.

The neighborhood is also home to several International Baccalaureate World Schools, and, of course, to the High School for the Performing and Visual Arts (HSPVA), a highly sought-after Fine Arts magnet school.

Northside (77009)

Northside is one of Houston’s oldest neighborhoods and offers fairly affordable homes that start for as low as $100,000 and average around $275,000.

Housing options include single-family homes and townhomes, and while there are no condos in this neighborhood, you can easily find plenty of condo options in the downtown area which is easily accessible from Northside.

A quiet community atmosphere, proximity to downtown, METRORail access, and an excellent selection of public and private schools, many of which are International Baccalaureate (IB) World schools, make Northside a promising neighborhood for homebuyers.

Royden / Afton Oaks

Royden Oaks and Afton Oaks are two of Houston’s most expensive neighborhoods—the median sales price of single-family homes in Royden Oaks is $2,600,000 while the median sales price for homes in Afton Oaks is over $1,700,000.

Both neighborhoods offer single-family homes as housing options, with Afton Oaks offering gorgeous 1950s ranch-style homes and recently constructed traditional, Spanish, Mediterranean, and French-style homes.

Both area don’t offer condo buildings, although Afton Oaks have townhomes that are steadily becoming a popular option for many homebuyers. Royden Oaks, on the other hand, has no townhomes.

Both areas have excellent access to shopping and business districts. World-class retail, business and employment hubs, parks, numerous entertainment, and dining establishments, and public and private school options are all just minutes away from both neighborhoods.

Oak Forest (East Only)

Oak Forest offers mostly single-family homes on generous lots that go anywhere from 5,800 square feet to more than 20,000 square feet.

Housing options include updated and renovated ranch-style homes from the 1940s and 1950s, as well as new construction homes. And although the lots on Oak Forest are on the larger end, homes in this neighborhood are relatively affordable and appreciated well.

Oak Forest is a popular choice for homebuyers because of its location, its large lots and tree-lined streets, and its top-ranked elementary schools, one of which is Oak Forest Elementary, deemed to be one of the best elementary schools in the state of Texas itself.

Briargrove

Briargrove is a quiet residential neighborhood that offers ranch-style homes, a small-town atmosphere and wooded grounds, well-kept yards, and large lots.

Lots in this area go from 6,000 to as large as 13,000 square feet, while prices for homes range from $500,000 to more than $1,500,000.

Location is one of Briargrove's greatest assets since it's located near Uptown, a main employment and retail district in Houston that houses The Galleria shopping center. Aside from The Galleria, you can also avail of more retail and dining options in the Briargrove Plaza found just south of the neighborhood.

River Oaks

River Oaks contains some of the most expensive homes in Houston. It has over 200 luxury homes, and each one of those can range from $1M to $6M. The most expensive ones can even go for as high as $20M.

River Oaks is located within the Inner Loop, which means that it provides great access to downtown, the Galleria, the Medical Center, and other entertainment and retail hubs.

Southbelt / Ellington

A historic neighborhood, Southbelt / Ellington offers diverse real estate options. It has homes designed in the traditional architectural way but it also has contemporary and modern styles.

What's great about Southbelt / Ellington is it has both master-planned communities and established subdivisions such as Gulf Palms, Bridgegate, Reserve at Clear Lake, and Kirkwood.

Located 15 miles southeast of downtown Houston, this neighborhood provides excellent access to many retail establishments and outdoor activities such as Almeda Mall and El Franco Lee Park. It's also zoned to top-ranked schools such as Frazier Elementary School, Beverly Hills Intermediate, and Dr. Kirk Lewis Career And Technical High School.

The Woodlands

A popular suburb for homebuyers, The Woodlands offers traditional single-family homes, townhomes, grand estates, and lakefront homes priced between $150,000 to more than $15,000,000. All of these are located in gated communities, greenbelt, and lake areas, and within golf courses.

Located along the North Freeway, homes in this suburb have great access to nearby Houston neighborhoods, schools (many of which are National Blue Ribbon schools), retail centers, restaurants, and entertainment hotspots.

In addition to these central neighborhoods, other Houston suburbs did not flood during previous major flooding events. Some of these areas even benefited from Harvey because of an increase in demand for Houston neighborhoods that did not flood.

Additional areas that did well include: Royal Oaks, Champions, Katy - Old Towne, and Friendswood. Contact us for a full list.

Flooded Neighborhoods in Houston (Examples From Central Houston)

This group of neighborhoods reported a higher percentage than average of flooded homes (flooded homes divided by the total number of homesites in each area) during the last four major storms based upon our post-Harvey and post-Imelda analysis. Contact us for recommendations & additional neighborhoods that suffered heavy flooding.

Many homebuyers are concerned about buying a house that flooded during Harvey, and rightfully so. If you asked how many homes are flooded in Houston after Harvey, you'll be shocked to know that the number is more than 150,000.

With Imelda, on the other hand, data from the Texas Division of Emergency a week after the storm hit showed that nearly 900 homes in Harris County were affected. Seventy-six of those suffered major damages.

Those homes will most likely encounter many of the pressing problems associated with flooded houses, like mold and mildew. Insect infestation and deterioration of wall coverings are other likely issues that will crop up, even for homes that have been renovated after a flood.

After the major past few Houston floods (including the Imelda flooding, the Harvey flooding, Tax Day Floods, and Memorial Day Floods), we noticed that plenty of the inquiries we were receiving from homebuyers were variations of these questions:

-

Which parts of Houston are flooded?

-

Do you have a map of flooded neighborhoods in Houston? Or specifically a map of areas flooded by Harvey? Or a map of areas flooded by Imelda?

-

What were the beautiful neighborhoods flooded in Houston?

-

Are the wealthy neighborhoods in Houston flooded?

-

Can you give me a list of neighborhoods that flooded during Harvey? Also, can you give me a list of neighborhoods that flooded during Imelda?

-

What are the best places to live in Houston after Harvey?

-

What are the best places to live in Houston after Imelda?

So to help answer their questions and allow them to make a more informed decision, we went ahead and analyzed flood data from:

-

Reported property sales from the HAR MLS

-

Property Seller Disclosure Notices

-

Reported insurance claims

-

Contacting building managers at over 75 of Houston's condo buildings

-

Contacting over 200 clients

We then built a model of areas that experienced above-average reported floods (flooded homes divided by the total number of homesites in each area).

Based on the flood data and the model that we built, we found out that the following Central Houston neighborhoods experienced above-average flooding:

-

Bellaire

-

Braeswood Place

-

Briargrove Park / Walnutbend

-

Downtown (77002 | Flooded Buildings Located Near Buffalo Bayou)

-

Eldridge North (77041)

-

Knollwood / Woodside

-

Memorial West (77079)

-

Meyerland

This isn't to say that the entire community in the area flooded, but that many streets and areas within each area experienced an above-average of reported flooded homes. We are also aware of streets within every listed community that fared very well. Contact us for specifics.

For Imelda, we were so far only able to collect images and videos from clients or other third-party individuals around Houston. Based on those images and videos, it seems that some parts of the following areas didn't fare very well during Tropical Storm Imelda:

-

Downtown

-

Cottage Grove

-

Maplewood South

-

Meyerland

-

Bellaire

-

Alief

-

Willow Meadows

-

Independence Heights

-

Spring Branch

-

Garden Oaks

-

Crosstimbers

-

Kingwood

-

Braeswood Place

We have similar neighborhood lists for other parts of Houston that use real estate data and not just videos and images from third parties. Contact us for recommendations or advice.

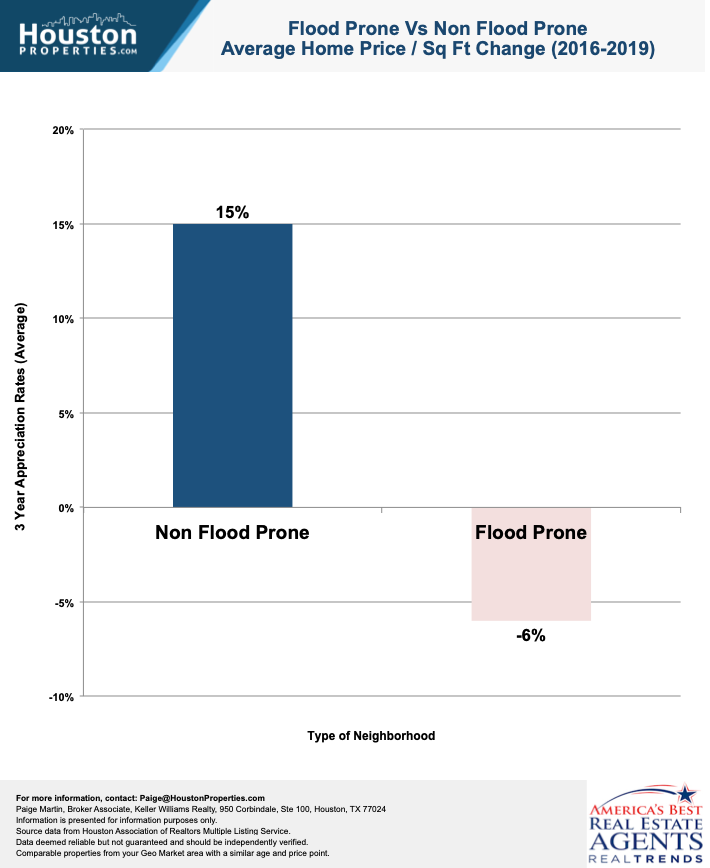

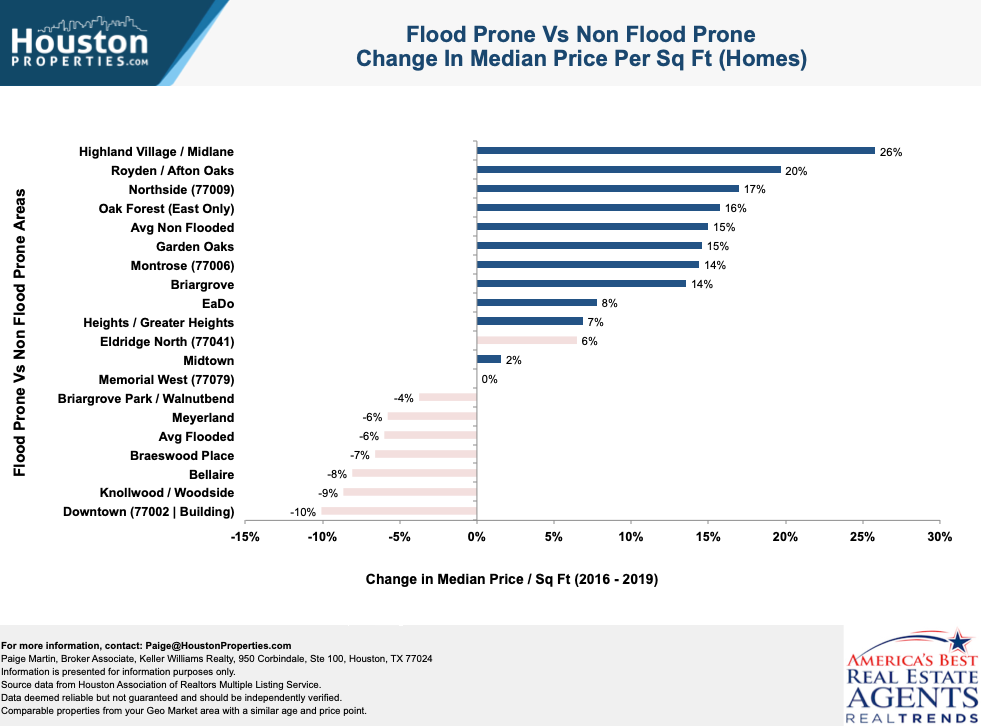

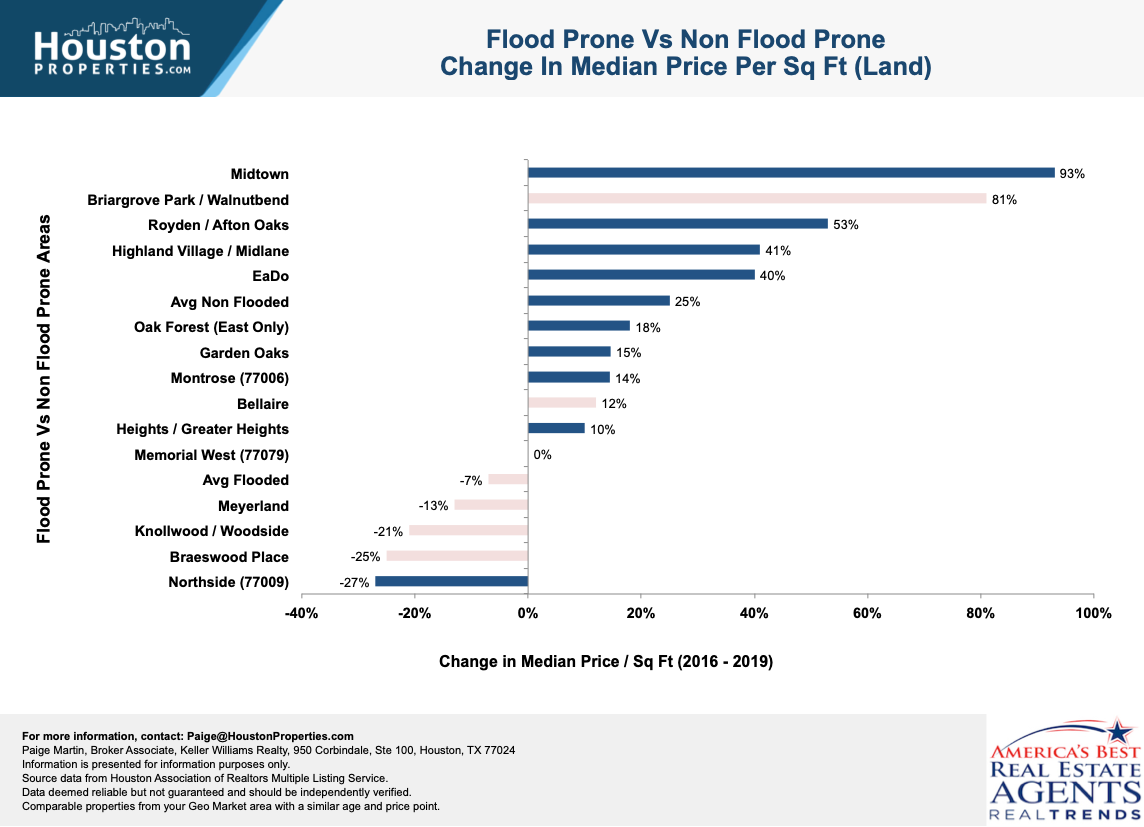

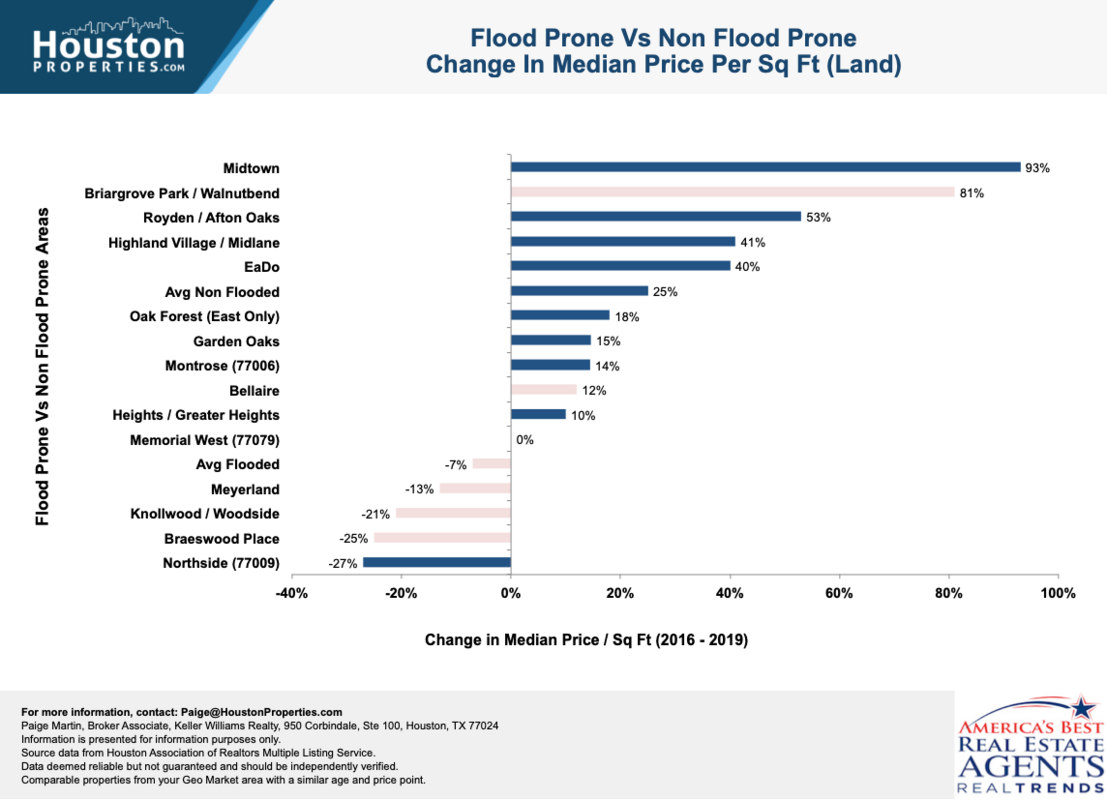

Resale Trends (Comparing Areas That Did Well vs Flood Prone Areas 2 Years Post Harvey)

Even two years after Harvey, home values and land prices in flood-prone areas are materially impacted by the floods. Since Houston has just experienced another major storm in the form of Imelda, it's critical for home buyers to be aware of Houston's flood-prone areas or not and plan appropriately.

Resale value is an important consideration for home buyers, many of whom see their house as an investment that they expect to appreciate over time. In fact, a whopping 84% of homebuyers report that they view a home purchase as a good financial investment, while 42% say that owning a home is better than owning stock.

A big question this year for homebuyers who are looking at the housing market in Houston TX and are concerned about their home's resale value is, "Should I buy a house that flooded in Harvey?"

To answer this, we completed a study of over 500,000 Houston home sales since 2000, with the goal of determining the factors that hurt a home’s resale value.

One of the key findings from our study is that there are nine factors that materially impact a home's resale value.

This article just focuses on one of the nine (contact us for the full list)—a significant factor that becomes even more critical in light of all the recent major flooding events that have hit Houston in the past couple of years.

The important factor that materially hurts a home’s resale value? Buying a flooded home or buying in a flood plain.

To highlight this, we analyzed two sample groups:

-

Group A (Central Houston areas that did not experience any/much flooding from Harvey)

-

Group B (Central Houston areas that reported an above-average percentage of flooded homes during Harvey)

We analyzed the area's pricing from 2016 (the year before Harvey) through 2019 (two years post-Harvey) and compared the following:

-

Median home price

-

Median home price per square foot

-

Median land value

-

Median land value per square foot

Based on our analysis, we found out that homes in the areas that did very well during Harvey grew their median price per square foot by 15% between 2016 and 2019.

On the other hand, homes that were located in the regions that flooded declined their value by 6%.

As you can see in the image above comparing home prices in flood-prone neighborhoods to areas that are not flood-prone, a homebuyer can be 20% worse off if they buy a home from the areas that flooded, based on our analysis.

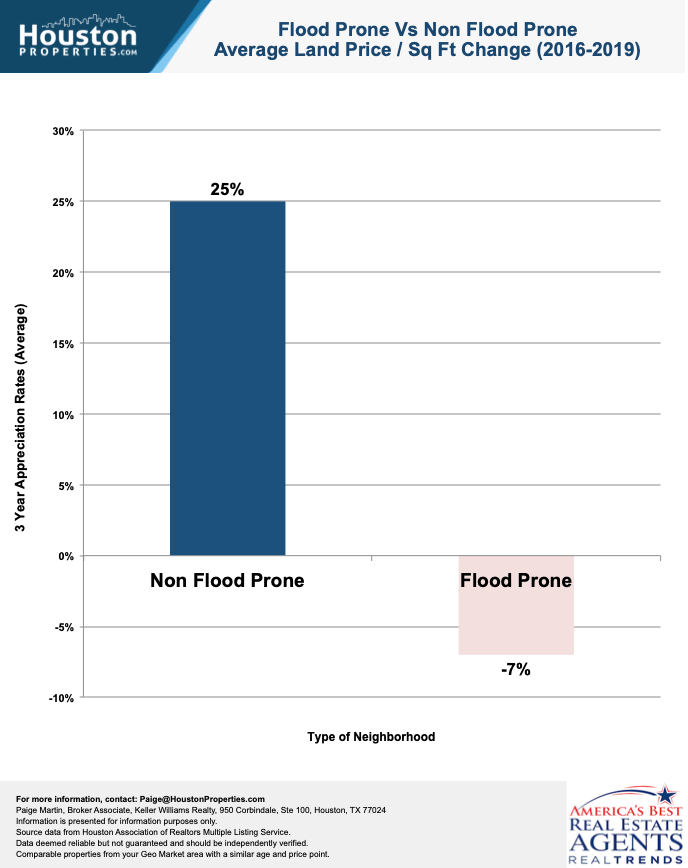

We also looked at land value, since it’s a better indicator of property value. Our findings show that the average land value of areas that did well during the flooding in Harvey appreciated by 25% from 2016 to 2019.

On the other hand, the average land value of areas that flooded declined by 7%.

That’s a nearly one-third performance difference!

What does this mean?

This means that, if you compare flood-prone neighborhoods to areas that are not flood-prone in Houston, there was a 32% difference in appreciation rates over the prior three years, based on our analysis.

As you can see, even two years after Harvey, the impact of flooding has materially impacted average resale values within the neighborhoods that experienced heavy flooding, creating a huge, almost one-third difference between flooded and non-flooded areas.

If you want to know the eight other factors that materially impact a home's resale value, or if you are concerned about buying in a flooded area (especially after Imelda) and are worried about your home’s resale value, contact us so we can give you recommendations.

Hurricane Harvey, Tropical Storm Imelda, and Houston Flood Maps

Harvey damaged 204,000 homes. Over 75% of these properties were outside of the 100-year flood plain (defined as the region with a 1% annual chance of flooding). Many of these homeowners did not have flood insurance. As home buyers, you should understand the risks of buying in a flooded plain so you can determine if those are appropriate risks your family is willing to take on.

Houston is no stranger to major flooding events, but Harvey was so unprecedented in its intensity and scale that Houstonians simply were taken aback.

One of the costliest tropical cyclones in the United States, Harvey—considered a 1,000-year flood event—inflicted $125 billion in damages and dumped more than 51 inches of rain onto a city unprepared for a disaster of that magnitude.

After Harvey hit, the Federal Emergency Management Agency paid out $378 million to 738,000 people and delivered 80 tractor-trailers full of food and emergency supplies to thousands of people who had to be rescued from flooded homes and moved to shelters and temporary housing.

Weeks later, almost 4,000 homes still had no power, 27% of schools had to be closed due to flood damage, and 50 water systems and wastewater systems had to remain down.

It is estimated that the hurricane damaged 204,000 homes, ruined 1 million vehicles, affected 13 million people, and killed 88.

Imelda's flooding, on the other hand, is considered less significant than Harvey's. However, it still managed to inundate Houston with 41 inches of rain, making it another 1,000-year flood event.

Concerningly enough, 20% of new homes were built in Houston one year after Harvey is in a flood plain. Another 260 plats that were being developed are in flood zones, posing a big risk to homebuyers.

The risks of buying Houston flooded homes are so big that many homebuyers are choosing to avoid Houston’s flooded zones altogether and are turning to tools like FEMA flood maps to check for areas that flooded during Harvey and Imelda.

When homebuyers enter the house’s address or the neighborhood where the house is located, FEMA’s interactive flood zone map will display flood hazard information and show if the house they’re planning to buy is located in a flood-prone area.

You can check the FEMA Flood Map Service Center for yourself, or you can contact the best realtor in Houston to help you avoid buying a home in an area that flooded during Harvey and Imelda.

Houston Home Prices After Harvey

Homeowners in flooded neighborhoods saw their home prices and land values drop after Harvey. We're anticipating that the same could happen after Imelda. Get the advice of an expert Realtor to guide your home-buying experience - avoid future tragedies!

Immediately after Harvey, many of our clients came to us and asked, "Will Houston home prices drop after Harvey?"

We tell them that, technically, the answer is yes.

We saw that the Houston housing market after Harvey did take a beating. 2018 was a down year for areas hit hard by flooding. Things have stabilized in many neighborhoods, but their sales data stayed down 2 to 3 years after Harvey.

For instance, in 2019, homes in Meyerland sat on the market for over five months before going under contract. The Meyerland market saw double-digit (-11%) price declines both for home and land values.

Other areas that experienced flooding like Energy Corridor (-6%), Bellaire (-7%), and Memorial West (-10%) are also struggling and saw material price declines.

Cypress numbers are more positive. Jan-Jun 2019 single-family home sales in Cypress are up 3% even if the median land value (a better indicator of property value) is down 19%.

At first glance, the Cypress home sale numbers seem to be in line with the general trend that points to sales percentages going up. Even the areas above that experienced flooding are recording positive growth in terms of sales this year.

However, the increase in Houston home prices after Harvey is mostly due to two things:

-

The numbers for those areas are being stacked against the already-low percentages from the year before.

-

Houston’s real estate is hyper-local.

When you look at the general trend of sales percentages going up, you also have to take into account the local data used to measure against it.

Let’s take a deeper look into this.

Take, for example, the fact that Houston gained 11,223 residents last year. More people means higher demand for houses.

Houston’s economy should also add 71,000 new jobs. Oil and gas exports are growing at an exponential rate, with the Gulf Coast being the primary beneficiary for decades to come.

Around $5B worth of healthcare-related projects are currently underway in the area, and healthcare jobs are projected to double within the next decade. The Medical Center is already the world’s largest medical complex with more than 60 institutions, 106,000 employees, and 10 million patients each year.

Looking back at the general trend of increased sales percentages, we can speculate that the number may only be up because the data from the year before is far worse. Or if the trend is for an entire area, the number may only be up because one section is boosting the numbers for the entire region.

Another factor that may be causing the increase in sales percentages is the price cuts that are being implemented in an attempt to sell or lease more homes.

It’s a problem that we’ve been seeing a lot, and we believe it’s two-fold:

-

First is that Houston’s city council passed onerous regulations for any new permits in flood-prone areas. Many builders and major remodelers we’ve talked with expect their costs to increase by 15-25% in these areas.

-

The second issue is that we expect a large number of Harvey-flooded-and-then-renovated homes to start hitting the market over the next 6 months.

Some of these will be done by reputable builders, but many won’t have remediation certificates, quality construction, or strong warranties.

This will make determining fair value difficult between non-flooded homes, flooded-and-well-renovated, and flooded-and-poorly renovated homes.

In addition, many builders in these areas have set their list pricing based on their cost plus the “amount of money they need to make.”

This means a lot of homes that go on the market are overpriced to begin with—these properties tend to stay on the market longer. The longer a property sits on the market, the harder it becomes to sell.

Houston Real Estate Market Post Harvey and Imelda

Contact us for data on people, companies, and investors who are buying homes in flooded zones, fixing them up, and reselling them. In general, families should be sure to perform proper due diligence on any "rehabbed" properties (and we have comprehensive due diligence checklists for no flood zone in Houston).

While it’s true that home prices and land values have declined in neighborhoods affected by the Houston flooding, it’s also true that forecasts for the Houston real estate market post-Harvey are starting to look promising again.

And while we still don't have enough data to make an accurate assessment of the Houston real estate market post-Imelda, we expect that the trend will be quite similar to Harvey's, and this is due to several factors:

More demand for rental properties

A lot of homeowners have been renting out their houses that were damaged by Harvey, while we expect that owners of homes flooded by Imelda will turn to renting in an effort to find temporary living accommodations.

Investors, on the other hand, are taking advantage of the rental market to earn from homes they don’t plan to live in.

All of these are contributing to an 83.6% increase in leases for single-family homes over 365 days, and as much as a 92.2% increase in leases for townhomes and condos year-over-year.

The average rent has also increased to 7.9% for single-family homes and 5.4% percent for townhomes and condos year-over-year.

Increase in condo sales

New home buyers who are moving to Houston for the first time are choosing to live in a protected building - like a condo - instead of in a single-family home. On the other hand, Houston residents who already know what it’s like to be flooded don’t want to have the same experience, so they’re choosing to buy a condo that’s away from bayous or flooded areas.

This behavior has caused the condo market to go up by 5.8%, with 543 units selling during October alone. We expect the same trend of condo sales to increase after Imelda.

A preference towards updated homes

We looked at 86,557 single-family homes that sold in the past 10 years with the words “updated,” “upgraded” and “renovated” in their property descriptions.

The sales data cover Close In Houston (areas 4, 9, 16, 17, 22, 23, 24) and main suburbs (Cypress, The Woodlands, Sugar Land, Katy, Friends, Pearland, League City, Richmond, Spring, Humble, Kingwood, Clear Lake, and Stafford):

Close-In Houston

Median Land Value/Sqft

10-Year Appreciation: 36%

5-Year Appreciation: -3%

Total # Of Homes Sold:

2018 (full-year): 2,135

2019 (Jan-Jun): 1,190

Main Suburbs

Median Land Value/Sqft

10-Year Appreciation: 7%

5-Year Appreciation: 135%

Total # Of Homes Sold:

2018 (full-year): 10,340

2019 (Jan-Jun): 5,285

Based on the numbers, properties defined to have been “upgraded," “renovated,” and “updated” have overall positive year-over-year and long-term growth.

Renewed interest in homes and neighborhoods that didn’t flood

With the memory of Harvey and Imelda still fresh on everyone’s mind, buyers are generally warier and more informed about the risks of buying properties in flood-prone areas.

They are now using flood plain maps and are specifically searching for neighborhoods that didn’t flood, making those areas a prime spot for people looking to buy a new home in Houston.

However, as we consistently tell our clients, one of the few reliable trends in Houston real estate is that there will always be a flight to quality.

Homes in good locations (close to major job centers, zoned to top-ranked schools, outside primary flood zones, not adjacent to railroads or major roadways) have proven to perform well (and will continue to do well).

In contrast, we believe homes in disadvantaged locations will struggle as builders keep adding inventory to awkward lots, and as continued development of the city makes Houston more prone to flooding and traffic congestion.

Smart buyers know that even if an area has a history of flooding, there are pockets of neighborhoods and subdivisions that remain relatively flood-free. There are good deals to be found in these locations as the general trends affect how much the seller/builder can price the home.

In fact, these locations are even seeing a surprising number of people who are specifically looking to snap up flooded homes for sale in Houston TX.

An increasing number of investors are buying damaged homes at low prices, getting some of them off their owners' hands for as low as 61% off the value that they had before they got inundated by Harvey.

Homeowners who are stuck with a house they can’t live in while still paying for a mortgage and for taxes and utilities in a neighborhood that looks increasingly like a ghost town will especially find this arrangement appealing. The choice, for them, is either this or be stuck with a lemon while seeing their finances go down the drain.

A better deal for buyers of single-family homes

Buyers will see that it will be to their benefit to purchase single-family homes in the coming months because there are always fewer buyers in the market after a weather catastrophe like Imelda.

However, it might be a slow process because homeowners of single-family homes will most likely choose to repair their properties first before putting them up on the market to be sold.

The positive forecast for the housing market in Houston shows that now is a good time to buy homes. Add to that the fact that there are fewer buyers in the market today because they are either affected by the flooding and can’t carry two mortgages, are unwilling to relocate, or are paralyzed by uncertainty.

How to Check for Flooding History When Buying a Home in Houston

Insurance rates on homes in floodways, flood pools, and 100-year flood plains are usually higher. Contact us for recommendations on great insurance agents to help you navigate the best insurance for your family.

The Houston real estate market post-Harvey and post-Imelda holds a lot of potential for homebuyers and investors alike, making home purchases an attractive option despite all the flooding events that the city has experienced in recent years.

But with several areas of Houston being designated as flood-prone areas, how do you avoid Houston flooded zones? How do you make sure that you don’t buy a home that has been flooded?

The Houston Properties Team has compiled a list of tips that can help you do your due diligence on flooding history before buying a home in Houston.

1. Check FEMA flood maps to see whether the neighborhood you're considering is a flood-risk zone or not

The Federal Emergency Management Agency has an online Flood Map Service Center where you can enter the address of the home you’re eyeing and it will show you if the neighborhood is a flood-prone area or not.

Flood maps, however, change over time, which is something that you should keep in mind if you rely on a Houston flood map alone as your source of flooding information. As FEMA itself says on its website,

“FEMA flood maps are continually updated through a variety of processes. Effective information that you download or print from this site may change or become superseded by new maps over time.”

Some Houston neighborhoods might not register as flood-prone areas on the maps today, but that can change over a few months or years. A home that was originally in a “low-risk” area might not meet the standards that were set for the new flood zone, and the home might suddenly be designated as being in a “high-risk” area.

Also, keep in mind that the flood maps from FEMA are based on a general study of a large area and may not be totally accurate for individual properties.

The proximity of dams or reservoirs to your chosen home will be a major factor as well. A particular home may not have flooded during Harvey, but the presence of dams or reservoirs nearby may actually cause it to become flooded in case another tropical cyclone comes along—and the cyclone may not even need to be as strong as Harvey to cause a high amount of damage to that home.

2. Get a survey

Hire a qualified and licensed surveyor to conduct an elevation and flood survey that will determine if the property has been accurately designated to a flood zone. Remember, flood maps continually change and are not always accurate for individual properties.

A survey will also have the added benefit of producing a Flood Elevation Certificate that can help you with flood insurance. If it shows that the structure of the home is located above the base flood elevation, you can use the certificate to request for the removal of the property from the designated flood zone and relieve you of the need to pay for flood insurance.

If, however, the certificate shows that all or part of the structure falls below the base flood elevation, you can use the data on it to help flood insurance companies accurately determine the amount of your premiums.

3. Consider getting a flood insurance policy

FEMA’s Flood Map Service Center has this to say about flood insurance:

"Whether you are in a high-risk zone or not, you may need flood insurance because most homeowners insurance doesn't cover flood damage. If you live in an area with low or moderate flood risk, you are 5 times more likely to experience a flood than a fire in your home over the next 30 years. For many, a National Flood Insurance Program's flood insurance policy could cost less than $400 per year.”

As with any type of insurance, flood insurance policies are those you hope you’ll never get a chance to use, but once your house gets flooded, you’ll realize that you’re glad you had them in the first place.

However, it’s always good practice to read the policy carefully, since flood insurance doesn’t cover everything. Temporary housing isn’t covered. So is damage stemming from mold, moisture, or mildew and damage to currency, stock certificates, precious metals, and belongings outside the home.

And keep in mind that Houston flood-prone areas will generally result in higher insurance premiums and lower resale value, which is why it’s generally advisable to get a home in a low-risk area instead.

4. Research water levels and flood stages in the bodies of water near the home

According to the National Weather Service (NWS), a flood stage is:

”An established gauge height for a given location above which a rise in water surface level begins to create a hazard to lives, property, or commerce.”

The NWS website provides a color-coded map where you can see the current river levels or flood stages for more than 9,000 gages in the entire country. Some sites on the map even show water level forecasts for the next several days.

You can use this information to determine the likelihood of flooding that will be caused by those bodies of water near the home you’re looking at and can make decisions based on that.

5. Ask your future neighbors about the neighborhood’s, or the home’s, flood history

As I mentioned previously, one common problem that homebuyers face is listing agents who don’t always tell the truth about the property they’re selling, choosing to market the property as DID NOT FLOOD even though it’s not totally accurate.

Oftentimes, the best people who can tell you about a home’s flooding history are those who live beside it. Ask your potential neighbors if the claims your listing agent is making are real, and if the house indeed flooded, ask them how high the water was.

Ask them as well if they’ve seen any renovation or rehabilitation work being done on the house, which is another good indication of the extent of the flooding that the house has experienced.

People who’ve lived in the area long enough can also oftentimes be more knowledgeable than listing agents about the area’s propensity for flooding. An entire neighborhood, or a particular property, may not have flooded during the most recent hurricane but received a beating from the one before that.

“Old-timers” will usually possess this knowledge, and it will be to your advantage to politely interview them about it.

6. Talk to an expert real estate broker

An expert real estate professional who knows Houston neighborhoods like the back of their hand can help you avoid buying in a flooded area by providing you with details that may not have come up in your research.

For example, a good indicator of whether a property is located in a flood-prone area or not is home prices and land value. Homes in areas that didn’t flood usually appreciate in value compared to homes in areas that did flood.

A reliable broker can provide you with data on home prices and land appreciation rates in the area, and whether they have been increasing or decreasing. This will allow you to see the trends in a given neighborhood and help you deduce if flooding has been a contributing factor to those trends.

Your broker can also advise you on zoning and environmental regulations, some of which may have contributed, and might continue to contribute, to flooding problems.

Houston Flood Plain Terminology - Explained

The updated Texas Seller's Disclosure and associated TXR 1414 Form (effective as of September 2019) has a new section with nine detailed questions. This breakout provides excellent insight into a home's water penetration/flood history. While it is mandatory, not all sellers/listing agents are properly completing the data. Get the advice of the best realtor in Houston to help guide you on disclosure forms.

When buying a home, especially in areas with a history of flooding, it's always good practice to review disclosure forms to ensure that you are well informed about any issues with owning the home.

The updated Seller's Disclosure Statement requires that sellers complete the following questions about their home:

Are you (Seller) aware of any of the following conditions?*

(Mark Yes (Y) if you are aware and check wholly or partly as applicable. Mark No (N) if you are not aware.)

-

Present flood insurance coverage (if yes, attach TXR 1414).

-

Previous flooding due to a failure or breach of a reservoir or a controlled or emergency release of water from a reservoir.

-

Previous flooding due to a natural flood event (if yes, attach TXR 1414).

-

Previous water penetration into a structure on the Property due to a natural flood event (if yes, attach TXR 1414).

-

Located ( ) wholly ( ) partly in a 100-year floodplain (Special Flood Hazard Area-Zone A, V, A99, AE, AO, AH, VE, or AR) (if yes, attach TXR 1414).

-

Located ( ) wholly ( ) partly in a 500-year floodplain (Moderate Flood Hazard Area-Zone X (shaded)).

-

Located ( ) wholly ( ) partly in a floodway (if yes, attach TXR 1414).

-

Located ( ) wholly ( ) partly in a flood pool.

-

Located ( ) wholly ( ) partly in a reservoir.

If the answer to any of the above is yes, explain (attach additional sheets as necessary).

Terms used and their meanings:

"100-year floodplain" means any area of land that:

(A) is identified on the flood insurance rate map as a special flood hazard area, which is designated as Zone A, V, A99, AE, AO, AH, VE, or AR on the map;

(B) has a one percent annual chance of flooding, which is considered to be a high risk of flooding; and

(C) may include a regulatory floodway, flood pool, or reservoir.

"500-year floodplain" means any area of land that:

(A) is identified on the flood insurance rate map as a moderate flood hazard area, which is designated on the map as Zone X (shaded); and

(B) has a two-tenths of one percent annual chance of flooding, which is considered to be a moderate risk of flooding.

"Flood pool" means the area adjacent to a reservoir that lies above the normal maximum operating level of the reservoir and that is subject to controlled inundation under the management of the United States Army Corps of Engineers.

"Flood insurance rate map" means the most recent flood hazard map published by the Federal Emergency Management Agency under the National Flood Insurance Act of 1968 (42 U.S.C. Section 4001 et seq.).

"Floodway" means an area that is identified on the flood insurance rate map as a regulatory floodway, which includes the channel of a river or other watercourse and the adjacent land areas that must be reserved for the discharge of a base flood, also referred to as a 100-year flood, without cumulatively increasing the water surface elevation more than a designated height.

"Reservoir" means a water impoundment project operated by the United States Army Corps of Engineers that is intended to retain water or delay the runoff of water in a designated surface area of land.

The Best Houston Realtor to Sell Your Home

The Houston Properties Team has a well-defined structure based on the individual strengths of each member. Each member is a specialist in their role – which is why our homes sell faster and for more money than average.

Paige Martin, Broker Associate with Keller Williams Realty, and the Houston Properties Team are ranked among the top residential Realtors in the world.

They have been featured on TV and in dozens of publications including The Wall Street Journal, Fortune Magazine, Reuters, Fox News in the Morning, Money Magazine, Houston Business Journal, Houstonia, and Houston Chronicle.

Paige Martin was just ranked as the #5 agent in the world with Keller Williams, completing over $1 Billion in Houston residential real estate sales.

Recent awards include:

– 2022: #1 Residential Real Estate Team by Sales Volume, Houston Business Journal

– 2021: Best Real Estate Teams in America, RealTrends.com

– 2021: Top 100 Women Leaders in Real Estate of 2021

– 2021: America’s Top 100 Real Estate Agents

– 2021: Top Real Estate Team (Houston Properties Team), Houston Business Journal

– 2021: Best Houston Real Estate Team, Best of Reader’s Choice

– 2021: Top Real Estate Team (Houston Properties Team), Houston Business Journal

– 2021: #1 Real Estate Team, Keller Williams Memorial

– 2020: America’s Best Real Estate Teams, Best of America Trends

– 2020: Best Houston Real Estate Team, Best of Reader’s Choice

– 2020: Top Real Estate Team (Houston Properties Team), Houston Business Journal

– 2020: #6 Individual Agent, Keller Williams, Worldwide

– 2020: #1 Individual Agent, Keller Williams, Texas (Top Keller Williams Realtor)

– 2020: #1 Real Estate Team, Keller Williams Memorial

- 2019: Top Residential Realtors in Houston, Houston Business Journal

- 2019: America’s Best Real Estate Agents, RealTrends.com

- 2019: #5 Individual Agent, KW Worldwide

- 2019: #1 Individual Agent, KW Texas

- 2018: #5 Individual Agent, Keller Williams, Worldwide

- 2018: #1 Individual Agent, Keller Williams, Texas

- 2018: #1 Individual Agent, Keller Williams, Houston

- 2018: America’s Best Real Estate Agents, RealTrends.com

- 2018: Top 25 Residential Realtors in Houston, Houston Business Journal

- 2018: Texas’ Most Influential Realtors

- 2017: #1 Individual Agent, Keller Williams, Texas

- 2017: #1 Individual Agent, Keller Williams, Houston

- 2017: #10 Individual Agent, Keller Williams, Worldwide

- 2017: America’s Best Real Estate Agents, RealTrends.com

- 2017: Top 25 Residential Realtors in Houston, Houston Business Journal

- 2017: Texas’ Most Influential Realtors

- 2016: #1 Individual Agent, Keller Williams, Texas

- 2016: #1 Individual Agent, Keller Williams, Houston

- 2016: #20 Individual Agent, Keller Williams, Worldwide

- 2016: Texas’ Most Influential Realtors

- 2016: Top 25 Residential Realtors in Houston, HBJ

- 2016: Five Star Realtor, Featured in Texas Monthly

- 2016: America’s Best Real Estate Agents, RealTrends.com

- 2015: #9 Individual Agent, Keller Williams, United States

- 2015: #1 Individual Agent, Keller Williams, Texas

- 2015: #1 Individual Agent, Keller Williams, Houston

- 2015: America’s Best Real Estate Agents, RealTrends.com

- 2015: Top 25 Residential Realtors in Houston, HBJ

- 2015: Five Star Realtor, Texas Monthly Magazine

- 2014: America’s Best Real Estate Agents, RealTrends.com

- 2014: #1 Individual Agent, Keller Williams Memorial

...in addition to over 318 additional awards.

Paige also serves a variety of non-profits, and civic and community boards. She was appointed by the mayor of Houston to be on the downtown TIRZ board.

Benefits Of Working With The Houston Properties Team

Our team, composed of distinguished and competent Houston luxury realtors, has a well-defined structure based on the individual strengths of each member.

We find the team approach as the most effective way to sell homes. We have dedicated people doing staging, marketing, social media, open houses, and showings. Each Houston Properties Team member is a specialist in their role—which is why our homes sell faster and for more money than average.

The benefits of working with a team include:

- the ability to be in two or three places at one time; a member can handle showings, while another answer calls

- collective time and experience of members

- targeted advice and marketing of agent expert in your area

- competitive advantage by simply having more resources, more ideas, and more perspectives

- a “checks and balances” system; selling and buying a home in Houston is an intensely complex process

- more people addressing field calls and questions from buyers and agents to facilitate a faster, successful sale

- efficient multi-tasking; one agent takes care of inspections and repair work, while another agent focuses on administrative details

- multiple marketing channels using members’ networks

- constant attention: guaranteed focus on your home and your transaction

- lower risk for mistakes. Multiple moving parts increase oversights. A team approach handles these “parts” separately

- flexibility in negotiation and marketing

- better management of document flow

- increased foot traffic through more timely and effective showing schedule coordination; and

- increased sphere of influence and exposure to more potential buyers.

To meet all the award-winning members of the Houston Properties Team, please go here.